Key takeaways

-

- Before you build a P2P payment app, know the competitors who dominate the market. Companies like PayPal and Cash App set trends, develop users’ habits, and determine the technologies present in peer-to-peer solutions.

- There are 4 most popular types of peer-to-peer apps on the market: standalone, bank-centric, social media-centric and mobile OS-focused systems.

- The best way to test a P2P app idea at low cost and gather user feedback on a product, is to start with an MVP.

What is a peer-to-peer payment app

Peer-to-peer apps allow users to send and receive money directly, without the middleman, such as a traditional bank. Usually these platforms are mobile (like Zelle or Venmo), but some services support a desktop version too — PayPal, for example.

Peer-to-peer apps are ideal for many everyday tasks: from sending cash birthday gifts to splitting the dinner bill and paying rent.

Most people are already familiar with money-transferring functionality: half of all Americans and a third of British people use a peer-to-peer app and there is always demand for innovation within P2P solutions.

How do P2P payment apps work

The user journey in a cash transfering app is simple. Just 5 steps to transfer money:

1️⃣ Users create an account and input their name, email and phone number. Most P2P payment apps ask customers to create a unique username or a tag so others can find the correct person when transferring.

2️⃣ Next, adding a card or linking a bank account. Some platforms, like Revolut or Apple Cash, let users use contactless payment methods (Apple Pay or Google Pay) to add money to their accounts.

3️⃣ Now users can search for a friend or a relative by using a phone number or a username.

4️⃣ Users choose the amount of cash to send and confirm the transaction.

5️⃣ Tah-dah! Now a user can see a confirmation of the transaction, as well as see it in the history.

3 examples of popular P2P payment apps

Before jumping to the P2P payment app development, it is crucial to know which competitors are dominating the market. They set the trends, develop users’ habits and therefore determine what technologies will be present in peer-to-peer solutions.

In short, they lead the way and you can’t ignore it. Here are 3 main P2P payment apps in the world right now.

Revolut

Revolut is a global neobank with P2P functionality. Headquartered in London, the company was founded in 2015 by two entrepreneurs: Nikolay Storonsky and Vlad Yatsenko. It is available in most European countries, in the United States and Japan.

Revolut offers debit cards, virtual cards, savings “vaults,” stock trading, crypto and currency exchanges among other services.

Revenue: €850 million.

Advantages: Personal and business accounts, 24/7 customer support, ATM access, strong APY.

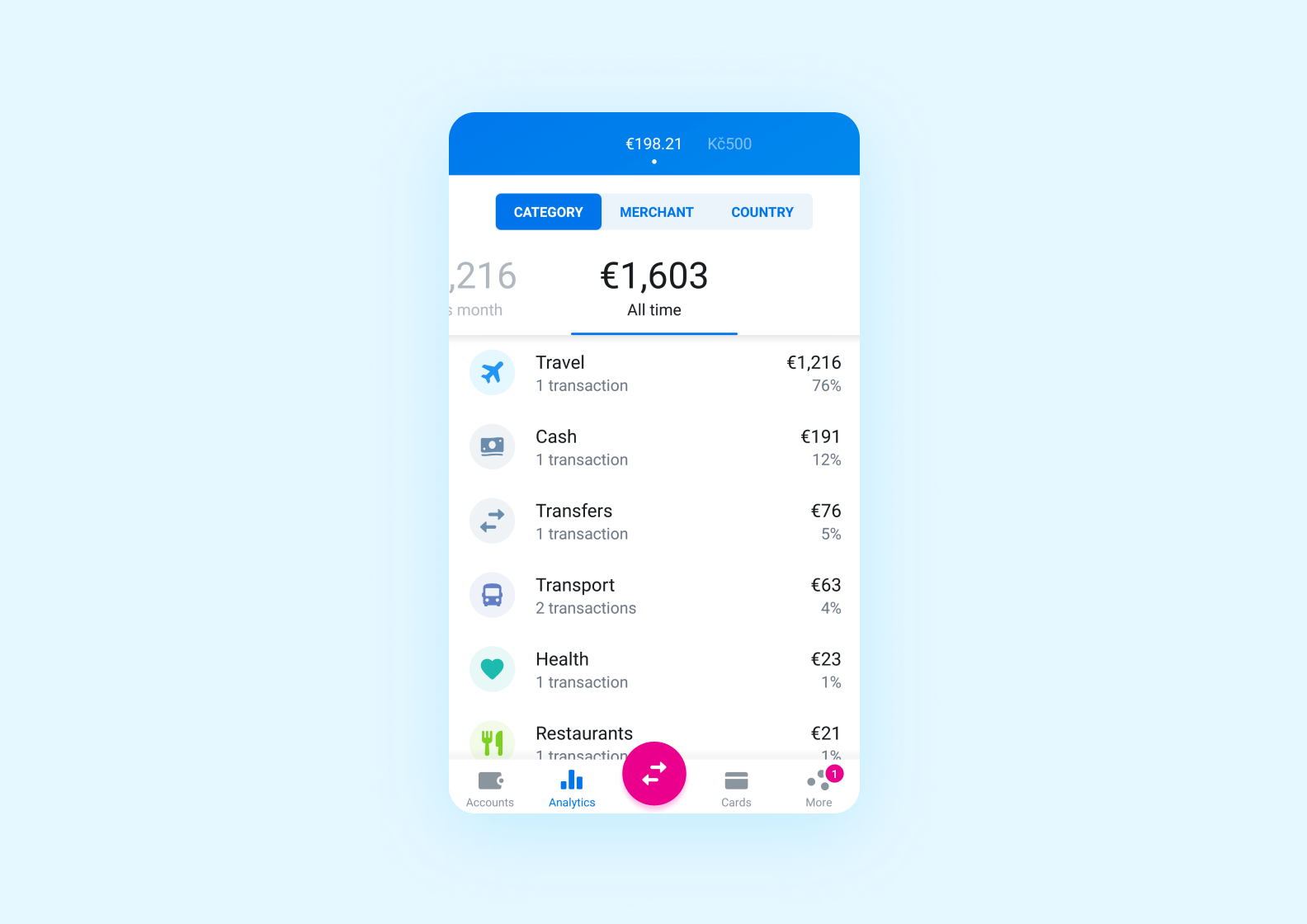

Key app features: dashboard with current balance and history overview; money transfers; widgets, a map with nearby ATMs.

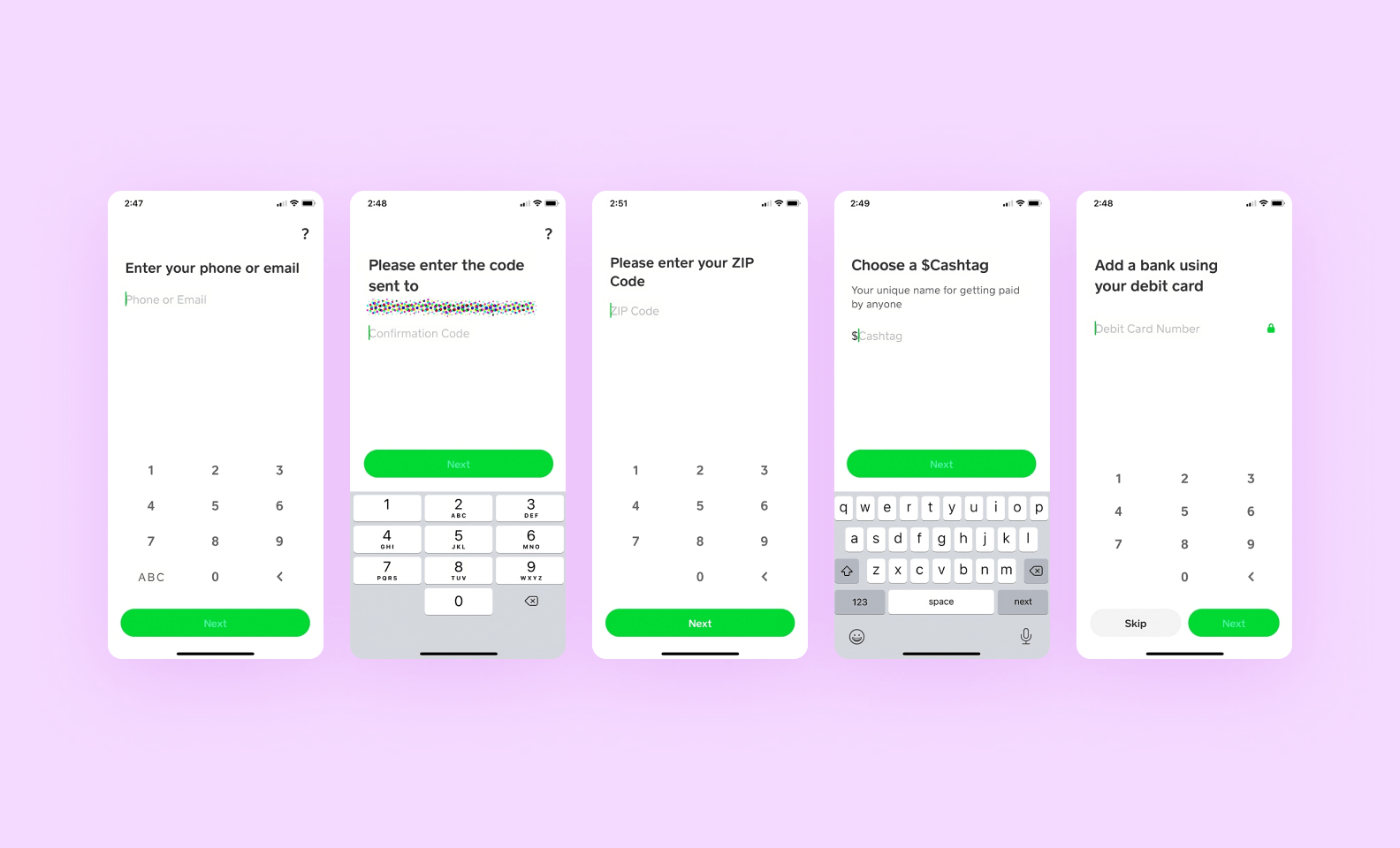

Cash App

Cash App is the top-rated P2P payment app in the finance category. Initially named Square Cash, it was released in 2013 in the US.

Cash App is a classic P2P platform in its pure sense in that it allows individuals, organizations, and business owners to send and receive money. For that, they need to create a unique username known as a $cashtag. Now, the $cashtag has become the most popular method for users to transfer money in the U.S.

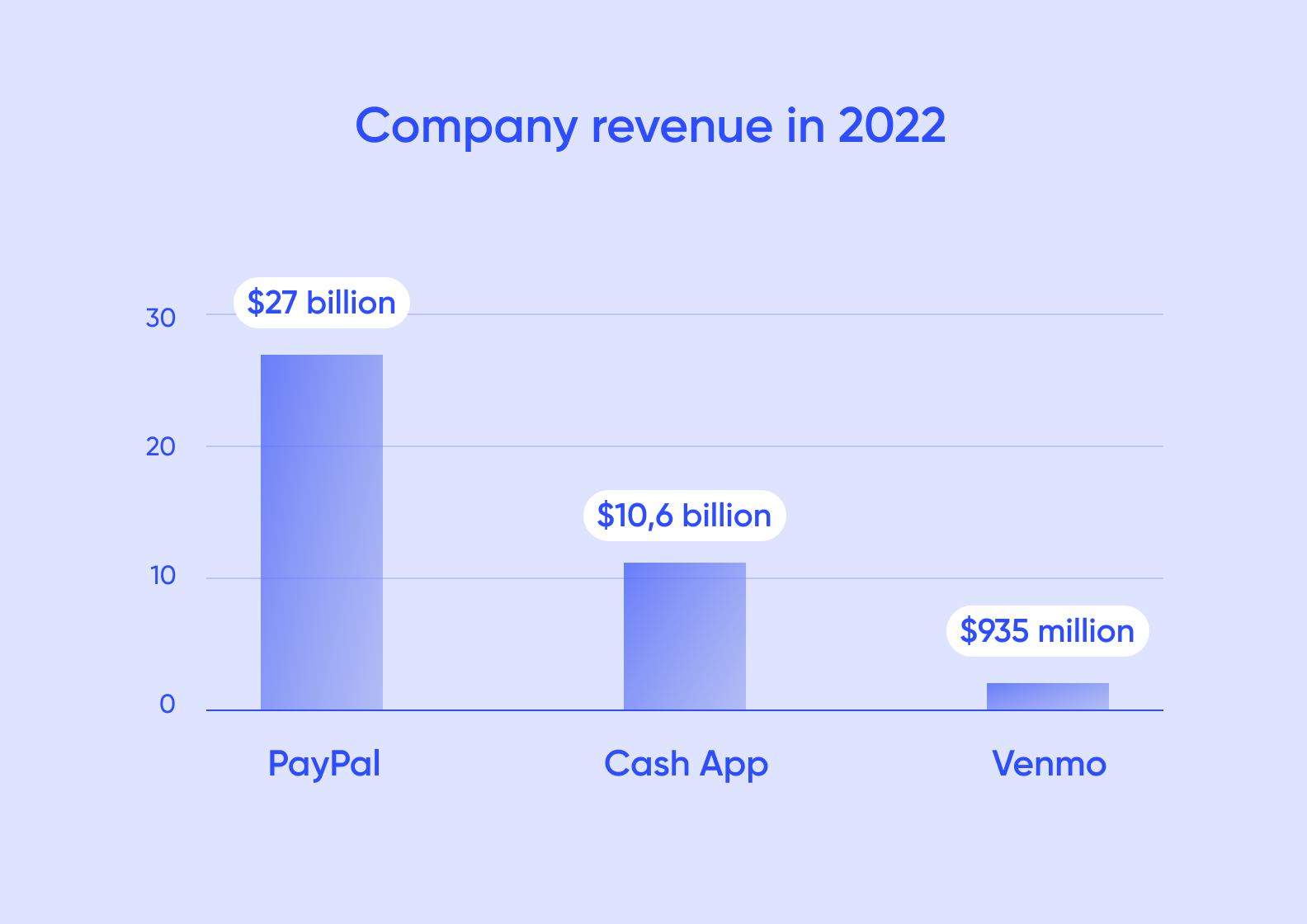

Revenue: $10.6 billion.

Advantages: instant payments between accounts, no account fees, Cash Card debit card, bitcoin support.

Key features: split bill; free in-app tax filing; transfer screen.

PayPal

PayPal is an international online payment system that operates in most countries. It was founded way back in 1998 and had their IPO in 2002, the true pioneer of the industry.

The app and the desktop version support online money transfers and serve as an electronic alternative to traditional paper methods such as checks and money orders.

Revenue: over $27 billion.

Advantages: real-time notifications; money requests; cashback; fraud protection.

Key features: instant transfers; deals and cashback page; buy now, pay later; rewards.

9 must-have features for a peer-to-peer payment application

The global leaders of the money transfer market set the gold standard, features that users are used to having. Without these 9 features, it is going to be tough to build a P2P payment app with high demand and traffic.

1. Registration form

Every good P2P payment app needs a simple and user-friendly registration form to onboard users smoothly. It should ask for all necessary information, but at the same time, not be overly intrusive. Pay attention to user experience by minimizing the number of required fields and offering social media or email signup options to streamline the process.

2. 2FA Authentification

Two-factor authentication (2FA) enhances the security of a P2P payment app by requiring users to provide an additional layer of verification. Users can use this as an extra layer of security on their accounts. Ensure that the 2FA setup is straightforward and well-explained to encourage its use.

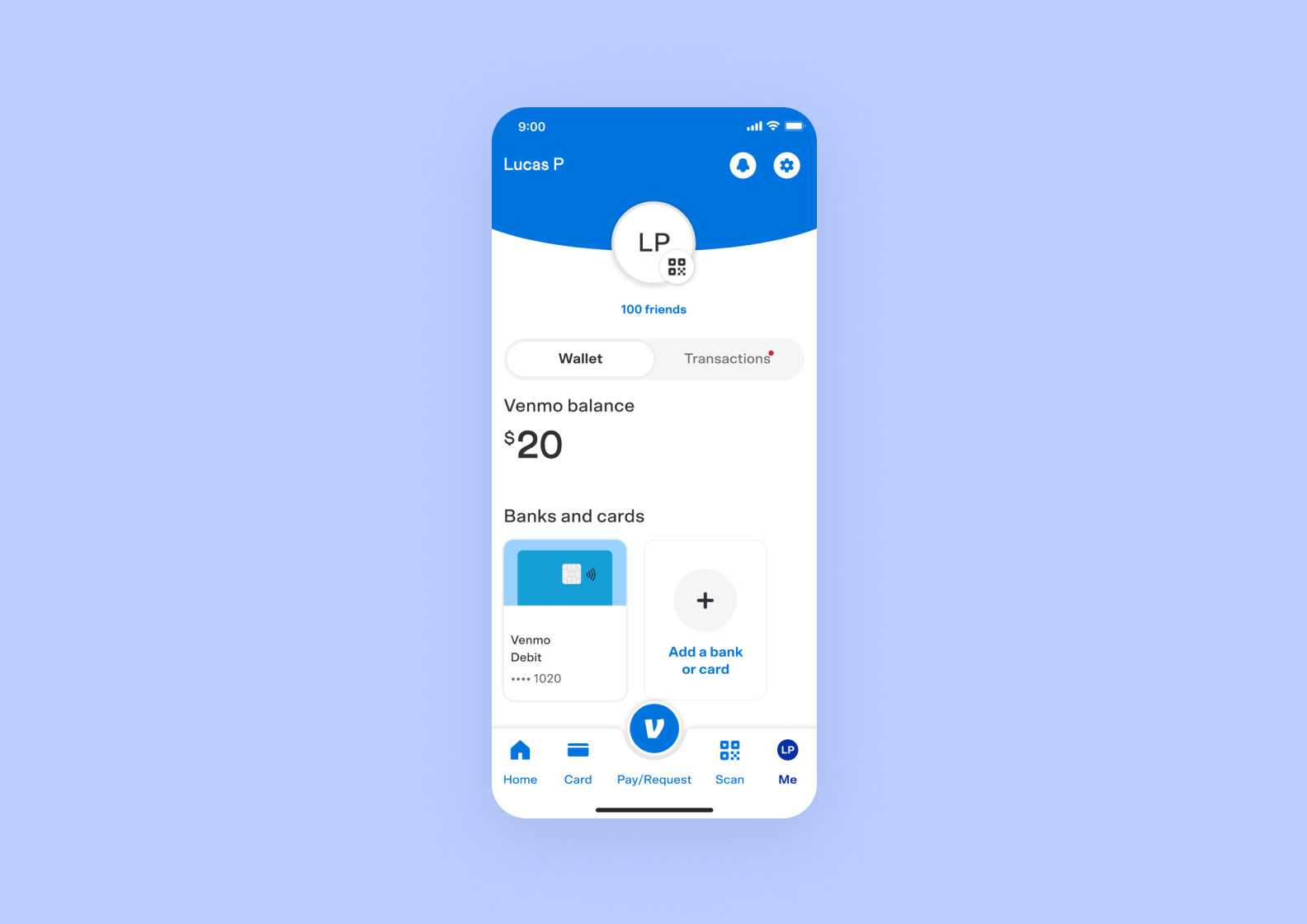

3. Contact access

The easiest way to minimize the risk of a wrong recipient and facilitate peer-to-peer digital transactions is to have access to the user’s contacts. This feature allows easy discovery and connection with friends or contacts using the same app. Emphasize user privacy by obtaining explicit permission for contact access and offering options to import or manually add contacts.

4. Digital wallet

A digital wallet is the core of any mobile payment app, where users store and manage their funds. Focus on robust security measures, user-friendly interfaces, and multiple currency support to make the wallet feature attractive.

5. Notifications

Timely and relevant notifications keep users informed about transactions, account activities, and important updates. Users rely on notifications to track their financial interactions so ensure that notifications are customizable, non-intrusive and provide clear, actionable information.

6. Bank account integration

Integrating bank accounts simplifies fund transfers between the P2P payment app and users’ bank accounts, ensuring seamless transactions. Pay attention to security protocols and ensure that the integration supports a wide range of banks and financial institutions.

7. Customer support

Quick and effective customer support is crucial for resolving issues and building trust. Users need a responsive support system for assistance with payments, account problems or even just general inquiries. Provide various contact channels, such as chat, email, or phone support and establish clear response timeframes.

8. Transaction history

Users require easy access to their transaction history to monitor their financial activities. Offer a detailed and searchable transaction history, complete with filters and export options. Ensure the data is well-protected and easily accessible.

9. Real-time transfers

Real-time transfer capabilities are essential for users who want immediate access to their funds. Implement secure and swift peer-to-peer transfers to enhance user experience. Consider factors like transaction fees, transaction limits, and international transfer options when designing this feature.

Incorporating these nine features into your app will not only meet user expectations but also create a secure, efficient, and user-friendly platform for financial interactions. Prioritizing user experience, privacy, and security will be key to your p2p payment app development.

Main types of P2P payment apps

With these 4 most popular types of P2P payment apps on the market, it’s important to remember that most P2P apps are a combination of different types. They combine versatile features to cater to various user preferences and needs. Whether through standalone services, bank integration, social media connectivity, or mobile OS integration.

Standalone services

Standalones are P2P payment apps designed primarily for facilitating various peer-to-peer transactions, such as payment transfers, splitting bills, or lending money among individuals. They are versatile and can be used for both personal and business transactions. These P2P payment apps offer a wide range of features, often including digital wallets, transaction history, and notifications, making them popular choices for users seeking dedicated peer-to-peer financial solutions.

📲Examples: Venmo, PayPal.

Bank-centric apps

Bank-centric P2P payment apps are integrated within traditional banking apps or offered as additional services by banks. They enable users to send money, pay bills and manage their finances directly from their existing bank accounts. These apps are trusted for their security and seamless bank integration, making them ideal for users who prefer a unified banking experience. Focus on ease of use and accessibility when developing these apps to cater to a wide user base.

📲Examples: Revolut, Zelle.

Social media-centric

They’re called social media-centric apps for a reason. These platforms are typically built into popular social networking platforms, allowing users to send money or make payments within their social networks. These apps leverage the user’s social connections to simplify transactions and create a social payment ecosystem. When developing such apps, focus on privacy and user consent to access contact lists and ensure seamless integration with the social media platform’s interface.

📲Examples: Meta Pay, Snap Cash.

Mobile OS-focused systems

Mobile OS-focused peer-to-peer systems are integrated within the operating systems of smartphones, such as Apple’s iMessage for iOS users. These systems enable users to send money or make payments without leaving their messaging apps. This integration provides a convenient and familiar way to exchange funds, appealing to users who prefer a native, integrated experience. Ensure compatibility with the specific mobile OS’s features and security standards to maximize user trust and adoption.

📲Examples: Cash App, Apple Pay Cash.

7 challenges when developing a P2P app

Users have high hopes and demands when it comes to their finances. No one wants to have their data leaked or discover hidden fees in a credit card statement.

To prevent negative experiences, aspiring entrepreneurs must stay on top of things and consider these 7 challenges during development.

Regulatory сompliance

Money transfers are a domain where everything is heavily regulated. Take a look at the U.S. market, for example. The Electronic Fund Transfer Act (EFTA), the Dodd-Frank Act, and anti-laundering and tax laws — these are just a few regulations to consider when you develop the app.

Security and fraud prevention. Fraud is increasingly common in the P2P world.

Pay attention to encryption protocols, two-factor authentication, and identity verification to protect user data and prevent fraudulent activities.

Regular security audits and updates are essential to stay ahead of emerging threats and vulnerabilities.

User privacy

Nobody wants to air two things: dirty laundry and finances. Both startup owners and developers should prioritize transparent data handling practices, obtain explicit user consent for data usage, and adhere to data protection regulations like GDPR or CCPA. Implementing privacy features, such as anonymizing transaction data, can help build user trust.

Payment infrastructure

Developing and maintaining a reliable payment infrastructure can be complex and costly. Pay attention to third-party payment gateways, ensuring they are secure, compliant and capable of handling high transaction volumes. Building redundancy and failover mechanisms into the infrastructure can mitigate downtime and ensure smooth transactions.

User trust and adoption

To gain user trust and popularize the app is a significant challenge.

Provide clear and concise information about security measures and privacy practices to reassure users.

Incentives such as referral bonuses or low transaction fees can also incentivize users to adopt the app and encourage their friends to do so.

Technical reliability

Ensuring the app’s technical reliability is crucial to prevent downtime or glitches during transactions. Regularly monitor server capacity, and utilize load balancing, and implement disaster recovery plans to minimize disruptions. Thorough testing, including stress testing, can help identify and address potential technical issues before they impact users.

Customer support and dispute resolution

Building an effective customer support system and dispute resolution process is vital for maintaining user satisfaction.

Offer multiple channels for customer support, including chat, email, and phone, and ensure that response times are prompt.

Also, don’t forget about a clear dispute resolution mechanism with a fair and transparent process to address user concerns and disputes on time.

5 advantages of peer-to-peer payment apps

Online payment apps are beneficial for all involved in the process: users, business owners and the market. Here is a brief breakdown of 5 examples of how money transfer platforms are revolutionizing the market and making our lives better.

⚖️Market demands

The level of technologies in the P2P market is highly advanced. Due to demanding and brutal competition, all new apps have to start with higher quality products than in other domains to be able to compete for target users.

💥Revolutionary potential

P2P apps change the industry forever. Do you remember how it was before? Checks and money orders, walking into a bank, waiting in line, all the paperwork and bringing it in person to a recipient. Now it’s a few seconds to send any amount anywhere you like. Can traditional banks keep up or offer a competitive alternative? We shall see.

💰Revenue generation

P2P apps are highly profitable, let’s take a look at some numbers:

We think this image proves the point.

📈Scalability

P2P apps offer many opportunities to scale up and expand the business. New platforms, features, regions — the possibilities are endless.

👩🏻🔬Innovation opportunity

Finance is a dynamic industry with new trends and technologies emerging every month. Digital money solutions have already revolutionized the banking system as we know it, and you can be at the forefront of these innovations.

How to build a P2P payment app

Not sure where to start? We’ve got you covered.

Here is a simplified app development process with 7 important steps to create and launch a robust peer-to-peer application.

1. Create a bulletproof idea

If your app is a house, the idea is the foundation. It should be solid and concrete, yet clear to build upon. At this very stage, try to work out as many details as you can: what product you want to release, who are your target users, what platforms you will be on, and what people will do in your money transfer app.

2. Research the market and competitors

Before you turn your idea into a product, it’s important to take a step back and look at the existing products on the market. The apps you will see around are the ones you will compete with for the user’s attention. As they say, keep your friends close and enemies closer.

Because there are many apps on the P2P market, we recommend choosing the competitors for analysis wisely. For example, you plan to develop a niche solution for a very specific group of users. Let’s say, a cash transferring app for Fantasy Football players, there is little point in comparing yourself with PayPal or Cash App, because it’s too broad and too widespread compared to your niche idea.

| Market research background | More info | Questions to ask |

| Study the market | Here you need to gain a deep understanding of the market you’re entering. | – What problem is your product/service solving?– Who else is solving the same problem?

– Are they small or big? – What do customers say about them? |

| Research competitors | After you get the idea of how the market is structured, dive deeper and look at direct rivals. | – What types of users are they targeting?– What are their strengths and weaknesses?

– Are they going to build new products? – What features do they have that you like? |

| Define your competitive advantage | Focus on your product and compare it with other existing services on the market. | – What do you offer?– Do you price your product fairly?

– Why do you build an app? – What do you do best? |

3. Develop an MVP

MVP, or a minimum viable product, which would in this case be a simplified version of a full money transferring app. It helps entrepreneurs test the waters and validate the hypothesis with only must-have features, instead of investing heavily in an app that won’t be relevant or useful. MVP is usually cheaper than a traditional app as it takes less time to develop, meaning in a matter of months, you can have the first version of a product that you can show to investors and share with the first users.

4. Design and prototype

UI (user interface) and UX (user experience) cover both sides. Minimalistic and user-centric layout helps customers learn how to use the product. Through the same design instruments startup owners can make their product stand out, as well as attract and retain users in the long run. Here are a few tips on how to develop a good-looking and effective UI/UX design for a money transferring app:

Identify user-types. The main approach is to survey current or potential users and categorize them based on demographics, habits and other relevant details. Some designers create a user persona, a semi-fictional character based on a group of ideal customers.

Create a map of a user journey. Brainstorm various scenarios of how users can interact with your product and break it down in steps. After that, think about goals, expectations, and pain points users will face on the way.

Come up with the design. Based on the information you received, come up with the interface layout and design elements that will help users navigate your product. Create wireframes to plan the space on the screen, develop mockups and a UI-kit with branded graphic elements.

5. Test and QA

You don’t want to launch a raw, unfinished product. Imagine users facing a bug when using an app for the first time, will they come back? Quality assurance is a crucial step in the development process, especially for money transferring apps. You want to prevent potential data breaches and fix any possible mistake that can occur before you launch your solution to the public.

6. Release

After you launch an MVP and gather feedback from users, it’s time to improve your app and step up. Add more features if you see demand, improve performance and launch a fully-functioning app.

7. Support and improve

The release is not the end for money transferring apps. After, your product comes to an equally important stage — maintaining performance and data security. You want to make data-driven decisions to improve the product, so gathering feedback from users is important.

Even the strongest criticism from the most harsh reviews can help you identify growth points and improve your app by adding additional features, enhancing user experience, and updating the UI elements.

Best practices in P2P payment app development

To ensure the success of your payment app in a highly competitive market, you need to carefully consider various factors. Let’s talk about the best practices regarding security, interfaces, integrations with other platforms, customer support, and multiple other important things — all of these play a crucial role in making your payment app reliable and trustworthy.

Comprehensive security

Security is paramount in a payment app, as users entrust the platform with sensitive financial data. Implementing end-to-end encryption, secure socket layer (SSL) protocols, and two-factor authentication are fundamental steps in ensuring data privacy. Regular security audits, vulnerability assessments, and compliance with industry standards like Payment Card Industry Data Security Standard (PCI DSS) also help maintain a robust security posture.

Finally, there are some additional layers that can fortify your payment app against potential threats — for example, secure key management, tokenization, and fraud detection mechanisms.

UI personalization

UI personalization enhances the user experience and makes the payment app more appealing. Customizable profiles, themes, and notification preferences enable users to tailor the app to their preferences. In addition to this, intuitive and user-friendly design, with a focus on simplicity, ensures that even users without extensive technical knowledge can navigate the app effortlessly. Personalization can extend to features such as transaction history, allowing users to categorize or annotate transactions for better financial management.

Easy integration with other platforms

Seamless integration with other platforms greatly enhances the app’s versatility. APIs (which is short for application programming interfaces) should be well-documented and easily accessible, enabling third-party developers to integrate the P2P payment functionality into their apps. Integration with popular social media platforms, messaging apps, and banking systems can expand the app’s user base and streamline the user experience. Collaborations with financial institutions and regulatory compliance bodies can also enhance the payment app‘s credibility.

Customer support

Responsive and reliable customer support is critical for reaching a high level of user satisfaction. A multi-channel support system, including in-app chat, email, and a dedicated helpline, ensures that users can seek assistance through their preferred channels. Implementing chatbots with natural language processing capabilities can provide instant responses to common queries, while a human support team should handle more complex issues. Regularly updating the knowledge base with FAQs, tutorials, and troubleshooting guides can empower users to resolve common issues independently.

Regulatory compliance

It’s crucial to adhere to local and international financial regulations. Work closely with legal experts to ensure compliance with data protection laws, anti-money laundering (AML) regulations, and Know Your Customer (KYC) requirements. We also highly recommend that you regularly update the payment app to align with evolving regulatory standards.

Scalability

Design the payment app architecture with scalability in mind to accommodate a growing user base. You can utilize cloud-based solutions and scalable infrastructure to handle increased transaction volumes without compromising performance.

Offline functionality

Ensure that the payment app remains functional even in offline scenarios. It’s always a good idea to implement features such as offline transaction queues and the ability to view transaction history and account details without an internet connection.

Implementing a broad range of offline features enhances user convenience and accessibility.

How much P2P development costs

Final costs of peer-to-peer payment app development always depend on your needs, requirements, the selected tech stack, and the amount of hours it takes to complete the app, here is a general overview of how much it can cost to build an MVP of a P2P app with the Purrweb team.

| Stage | Description | Hours est. | Weeks est. | Cost est. |

| Project estimation | We discuss the idea of your app and estimate the costs and timeframe | 16 hours | 2 days | Free |

| UI/UX design | We analyze user journeys and create design concepts | 130 hours | 5 weeks | $6 500 |

| Development stage | We build the architecture, the user-side interface and connect it to the server | 1263 hours | 15 weeks | $63 150 |

| QA testing | We check the app for any small bugs and fix them | 460 hours | In parallel | $9 200 |

| Project management | We plan the stages and control deadlines | In parallel | In parallel | $10 500 |

At Purweb, an MVP of a peer-to-peer app costs about $89 350. We can provide a personalized cost breakdown and budget estimation after approving all the details of the project.

How to monetize a payment app and return your investment

Most P2P payment apps use these 3 monetization strategies:

-

- Transaction fees,

- Premium subscriptions,

- In-app advertising.

Which one is for you — solely depends on your goals and users. Make sure you consider the preferences of your target audience, as well as competitors’ strategies.

Imagine, you have 5 competitors who all offer a free P2P money transfer. But you decide to charge $10 per month for the app. Why would users pay to you, if they can get these services for free somewhere else?

Unless, you have a strong competitor advantage and offer something that others don’t have. For example, ultra fast payments or advance payments.

How can we help you with P2P payment application development

Purrweb develops and deploys custom financial solutions. We specialize in MVP development, user-oriented UI/UX design, and transparent project management.

With us, your MVP can get published in 4 months, so you could test your ideas at a low price.

Our development team has a lot of experience in fintech, you can see some examples in our portfolio. For example we developed the E-wallet. It’s an e-wallet that allows users to buy, keep, and transfer their cryptocurrency assets, as well as exchange one cryptocurrency for another within one service.

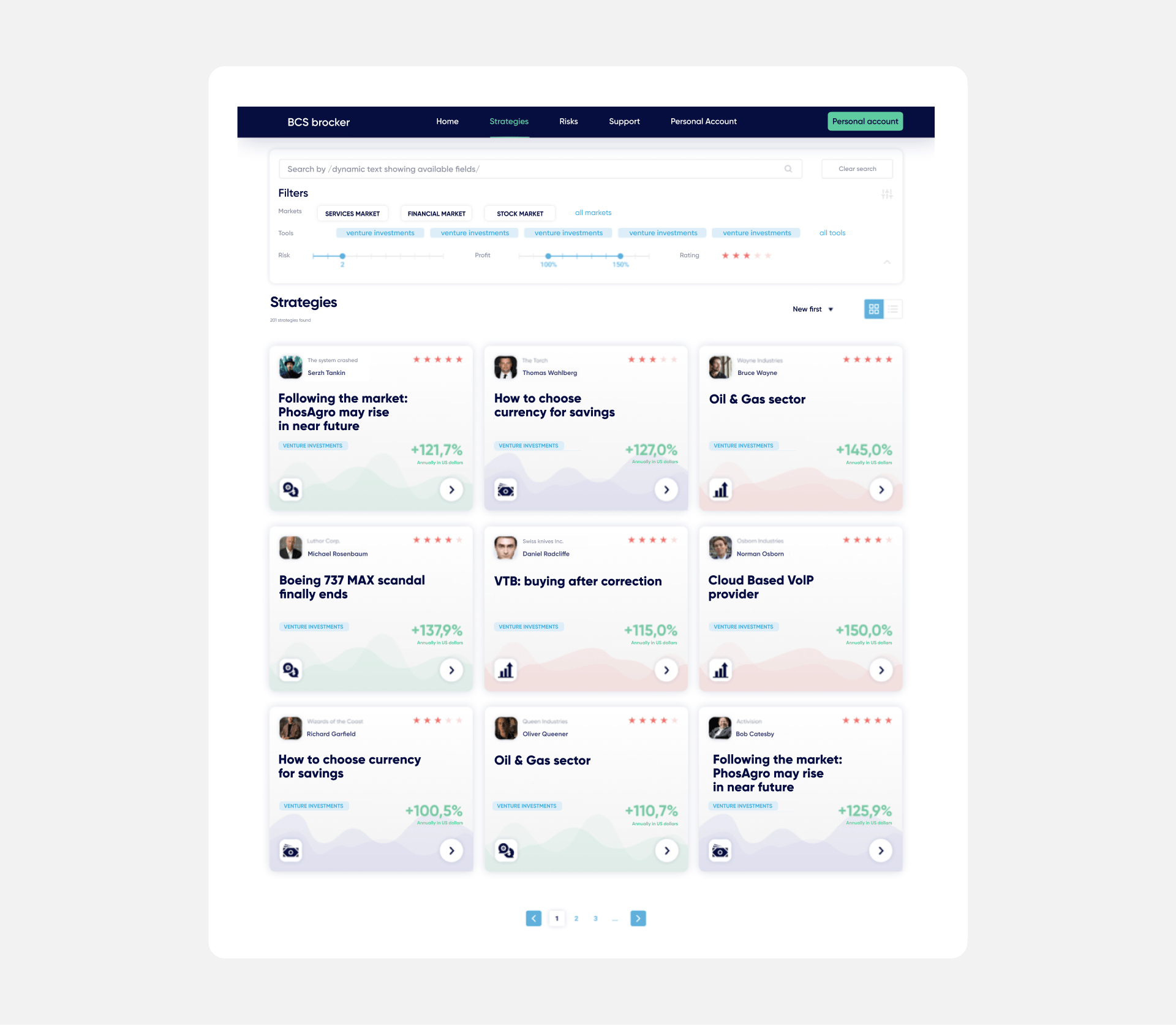

Our experience: Fintarget

Fintarget is a fintech platform offering users pre-made investment strategies. These strategies are submitted by the parent bank’s in-house experts and independent brokers who undergo mandatory verification. Customers can then choose the strategy they like, transfer money to a trust manager and start receiving passive income. The app features an advanced filtering system to help users discover options that suit them most.

The service’s target audience are amateur investors who don’t want to crunch all the numbers by themselves. Obscure graphs, calculations, and endlessly big figures would scare them away, so we knew we needed to make the web design as simple as possible. The financial app looks and feels like a marketplace: there are big & bright product cards, simplified navigation, and convenient data visualization to make all the calculations more approachable.

The app looks and feels like a marketplace: there are big & bright product cards, simplified navigation, and convenient data visualization

Conclusion

Peer-to-peer apps are not an easy market to crack, but the results are rewarding. Pay close attention to the challenges (especially legal regulations), start with MVP, and always ask for feedback — to stay relevant to the target users.