AI + online dating = ❤️🔥?

The North American online dating market is very promising. The demand is high, new services are constantly emerging, and there are different applications for different audience segments. According to Statista, the online dating market is showing steady growth and it is projected to reach $1.39 billion in revenue by 2024, with the number of users reaching 67.2 million by 2029.

On the other hand, various custom GPT chats are gaining huge popularity — users train them on their own materials.

Our client thought it would be great to combine these two trends in one product and create a dating service with built-in AI. But it’s not enough to add trendy features to a product; first and foremost, it must address the pain points of the target audience.

The client assumed that many users face problems with online dating. For example, they get few likes and matches, their first messages go unanswered, or conversations end up going nowhere. You chat with someone, but they don’t go on dates with you and just ghost you. People experience disappointment, self-doubt, and loneliness because of this 💔

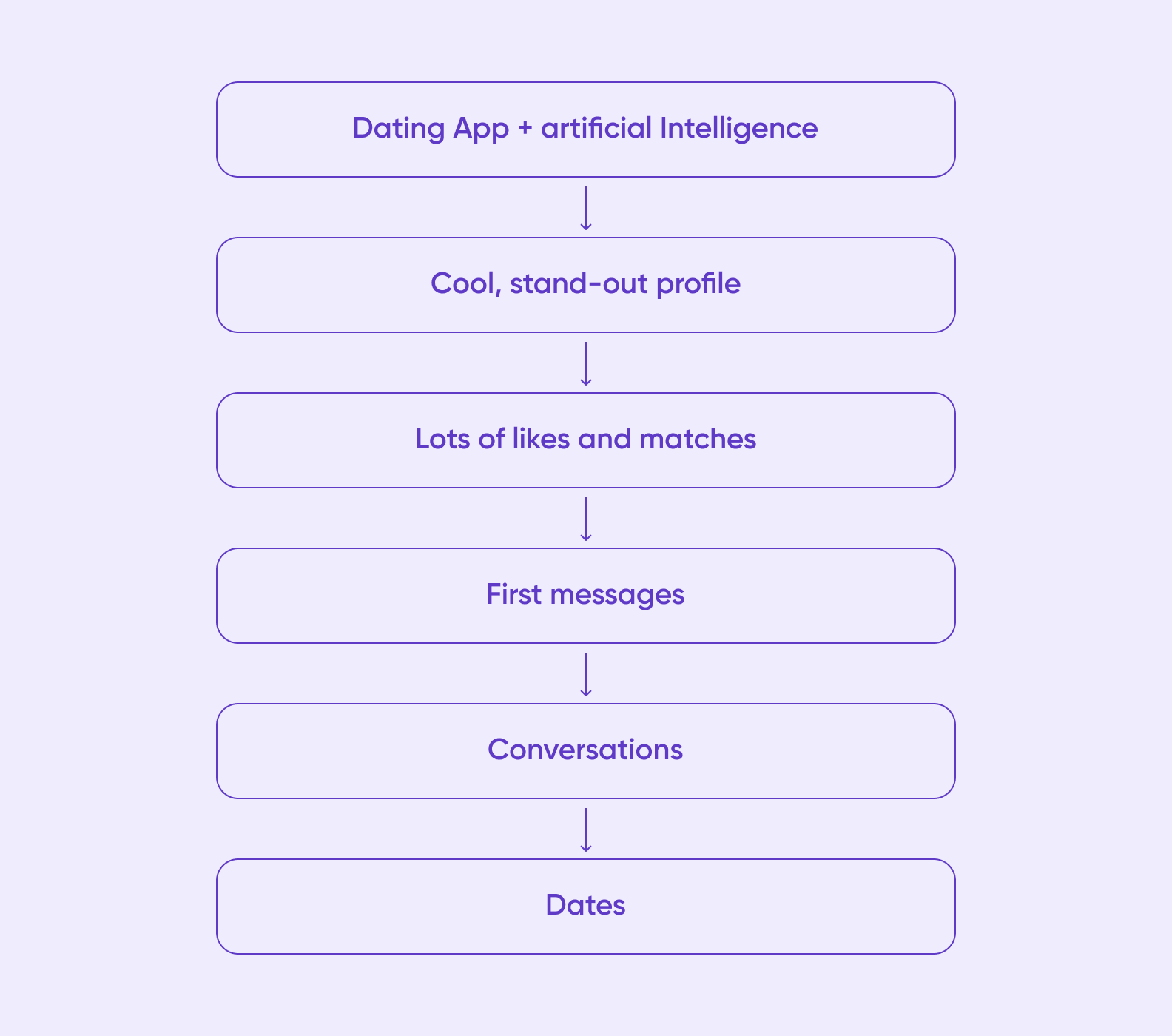

Fortunately, artificial intelligence can come to the rescue here! According to our client’s idea, the neural network in the product would:

-

- Performa profile audit;

- Generate an attractive description that would get many likes and matches;

- Suggest which photos to post on the profile for the same purpose;

- Create a compelling first message;

- Advise on how to continue the dialogue if the conversation stalls.

The product gives the user confidence that their profile will have a high conversion rate into likes and matches. This increases the chances of meeting that special someone.

The client had not communicated with users and built hypotheses based on his understanding of their needs. But to objectively assess the potential of the idea, he came to us for Product Discovery, which involves qualitative and quantitative product research.

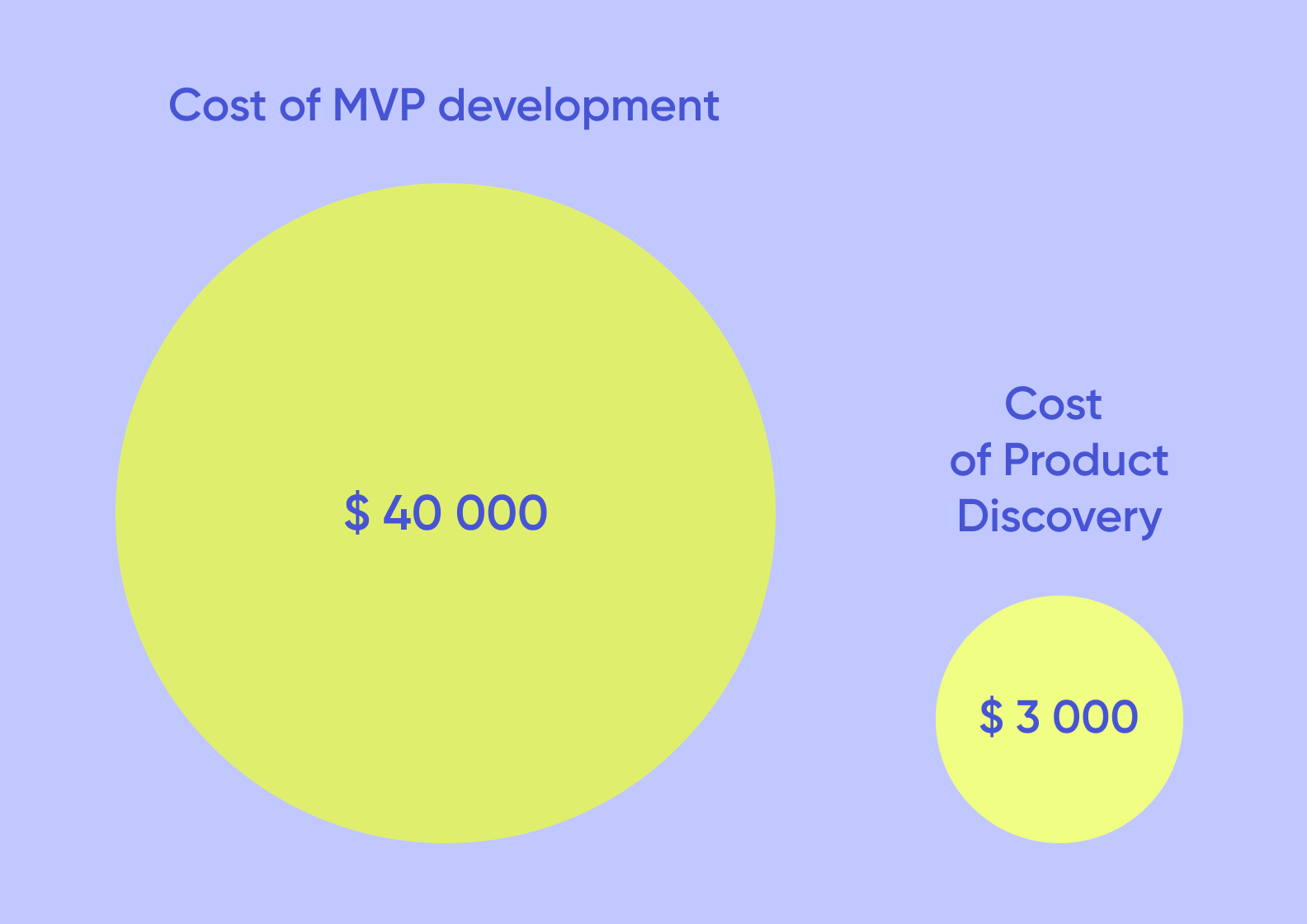

This is a good strategy: it’s not worth starting development without being fully confident that people need your product. Otherwise, there’s a risk of releasing an app that gets zero downloads in stores, wasting time and money.

Compare: creating an MVP from scratch costs almost $40,000, while Product Discovery costs $3,000.

We immediately identified the target audience segment with the client — men from the USA who regularly use dating services and are willing to pay for this app.

Our client was considering who to target with ads and what creatives would best convey the product’s value to the audience. It’s great when the client is involved and thinks about the marketing strategy in advance.

The final step was to determine whether the target audience had a real need for such a product and whether users would be willing to pay for it. If the hypothesis was confirmed, the development of the MVP could begin.

We identified the target audience needs using the Jobs to be Done framework and formulated hypotheses

In the Jobs to be Done analysis, we translate each feature of the future product into a human need. We are not interested in the functions themselves but in their ability to effectively solve the tasks of the target audience. Here’s how it looks in the concept of an AI-powered dating service.

| Feature | What it does | What user needs it meets |

| Profile review + description generator | Analyzes profile and gives recommendations on what to improve, generates a catchy description | Get more likes and matches to feel attractive and wanted |

| Prompt generator | Generates phrases for a great first message that leaves the recipient indifferent | Write a message that sparks a conversation, deal with insecurity and shyness |

| Next line (to continue the dialogue) | Helps find solutions if the conversation stalls | Find interesting topics to continue the conversation and go on a date with the person |

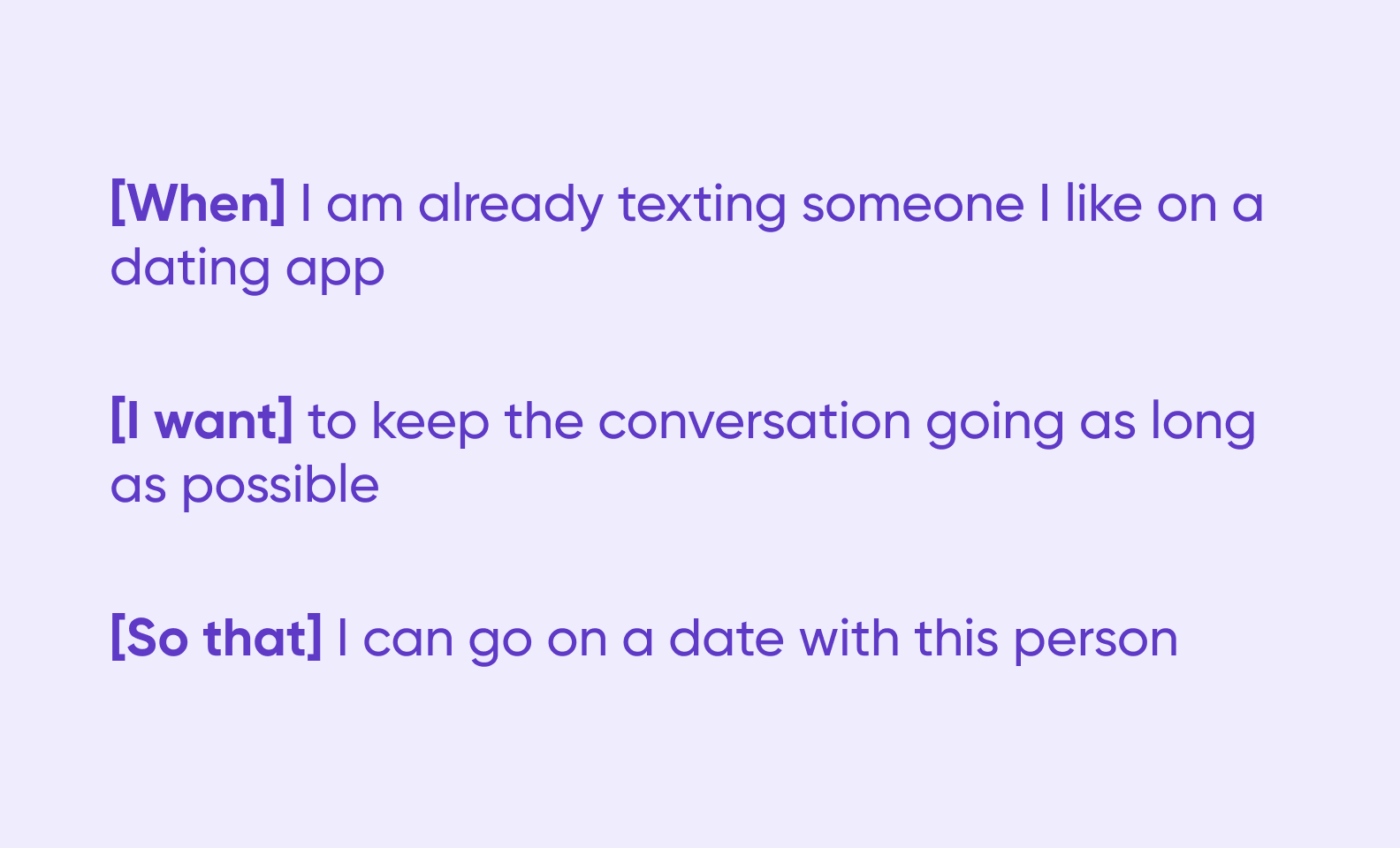

Next, we needed to formulate hypotheses to test during qualitative and quantitative research. We used the Jobs to be Done formula: “When [situation], I want [motivation] so that [expected result].”

It helps to consider the needs of the user’s world and thus better understand how exactly the product will be useful to them.

In the end, we identified three hypotheses:

- Profile hypothesis: Users do not understand how to set up a profile to get many likes and matches every day.

- First message hypothesis: Users don’t know what to write in the first message besides “Hi, how are you,” so girls do not respond to them.

- Dialogue hypothesis: Users don’t know how to continue the conversation so that the person they are talking to doesn’t ghost them and goes on a date instead.

At the beginning of the study, we assumed that users did not know their conversion rate for likes, matches, and responses. So, we thought that providing reports and statistics would be an additional feature to attract users. We were wrong 🙂

We recruited respondents from the USA. Finding people for interviews was not difficult: we had honed this experience in other Product Discovery projects.

We conducted interviews and got insights

We conducted 11 in-depth interviews. We found respondents with different experiences in online dating. Some use several services daily, others — once a week or several times a year.

Their goals also varied from wanting to meet someone in a new city after moving, to finding friends or partners with similar interests. Some were interested in long-term relationships, while others — short romantic adventures 💕

Respondents said they were generally satisfied with the apps and found them convenient. They rarely subscribed, preferring free versions. Many noted that their main goal wasn’t just to chat and flirt (though that’s important, too), but to go on a real offline date.

Of course, there were also insights. And they surprised us a lot 😅

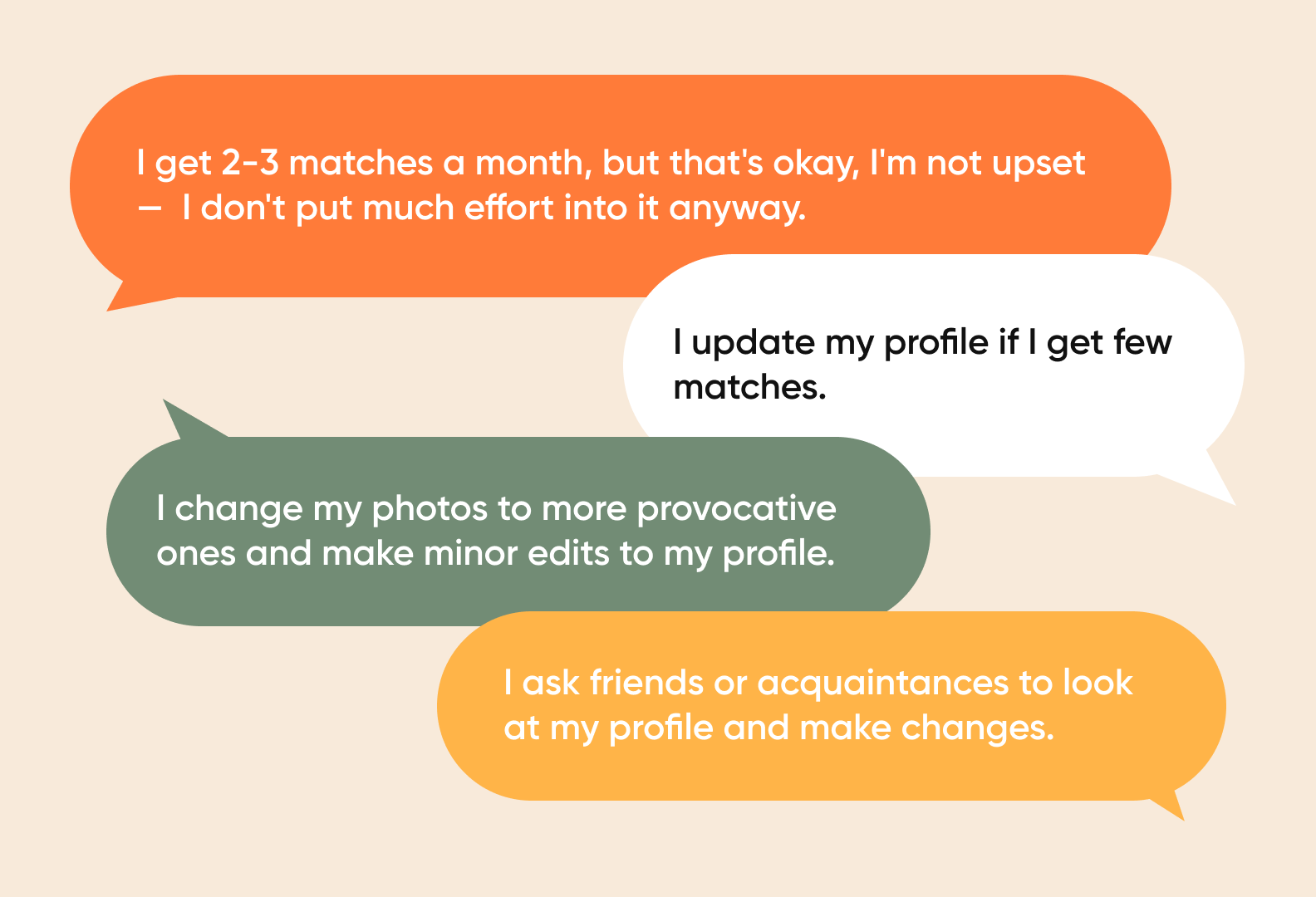

About the connection between the profile and the number of matches

Insight 1: Guys think that if they have few matches, the problem is not with their profile — it’s just how online dating works. As one respondent noted, “It’s normal if I don’t match with someone.”

Insight 2: Some track statistics on all likes, matches, and responses, then calculate the success rate to understand their conversion. If they notice a drop, they update the profile. Others don’t see a small number of likes and matches as a problem.

We learned that users understand how to improve their profiles to get more likes and matches. They also don’t need a tool to calculate conversion as many already know their “success rate.” But most importantly: a small number of likes and matches is not a cause for concern.

We didn’t find a user need for a special solution to enhance profiles — the first hypothesis did not hold true. What about the others?

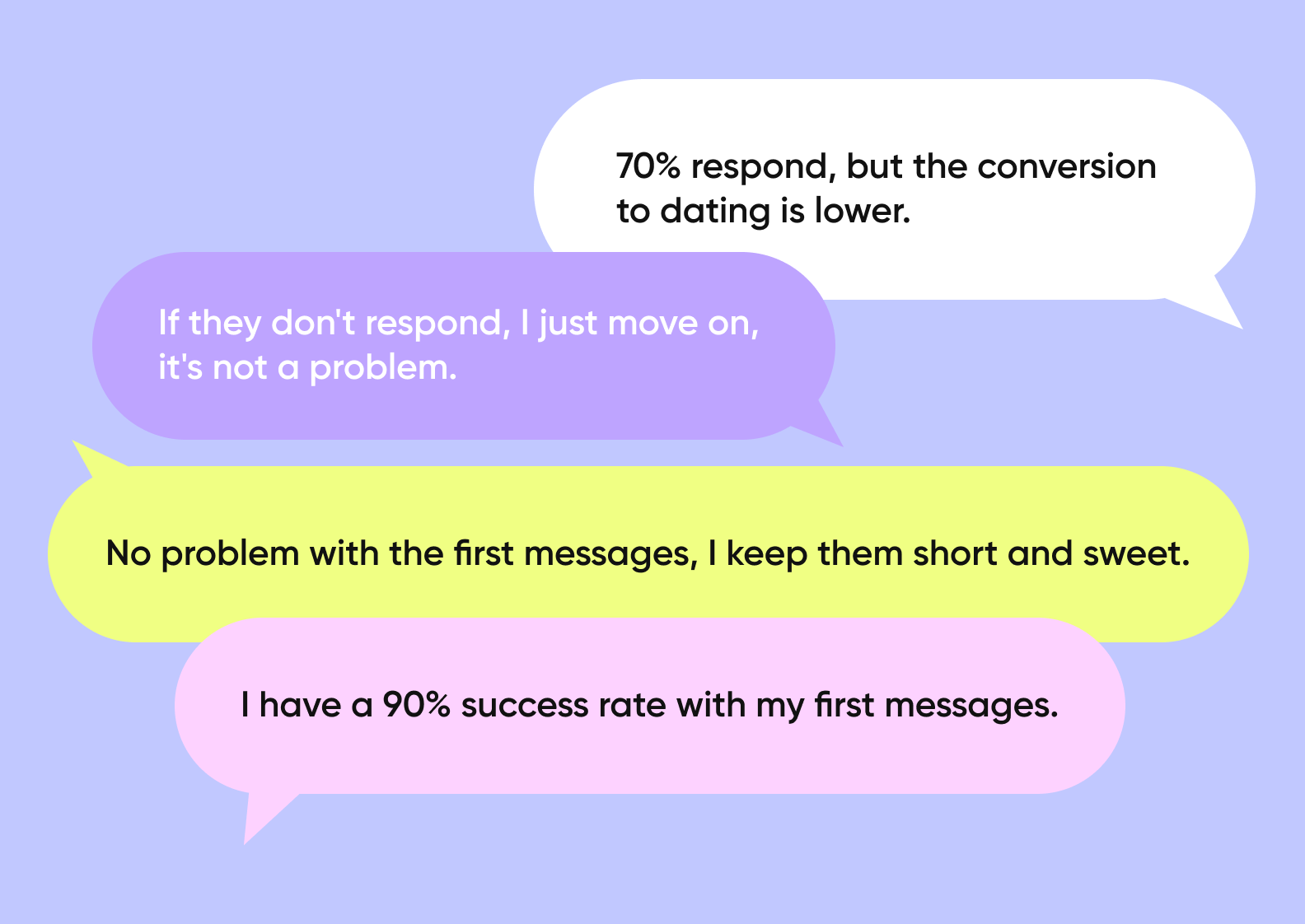

About the first messages

Insight 3: Respondents believe they write great first messages. Everyone has their proven methods of writing to get a response. For example, some compliment, ask about plans, hobbies, or traveling. They are not in a hurry to be overly creative or original, as they think it can come off as weird 🙂

However, some clever techniques were involved. For example, one respondent works as a data scientist and applies his professional skills to dating. He analyzes the percentage of people at each stage of the funnel and monitors how many drop off at each step to stay informed and identify weak points.

Another respondent sent out a mass mailing of a hundred messages. This allowed him to conduct an A/B test: he checked the conversion rate and changed the phrases if they didn’t work. He has his own secret approach that he didn’t want to share — that’s why it’s a secret! He also fully analyzed all profiles to see how people write and built his approach based on the data.

Users are satisfied with their approaches; everyone has their own special “signature phrases.” If they don’t get a response, they just message other people.

Insight 4. Only one person uses ChatGPT to write messages — he is not a native English speaker, and the neural network helps correct mistakes and set the right tone.

The second hypothesis also wasn’t confirmed that users know what the first message should be and get replies. And even if they don’t, they don’t worry and just keep swiping.

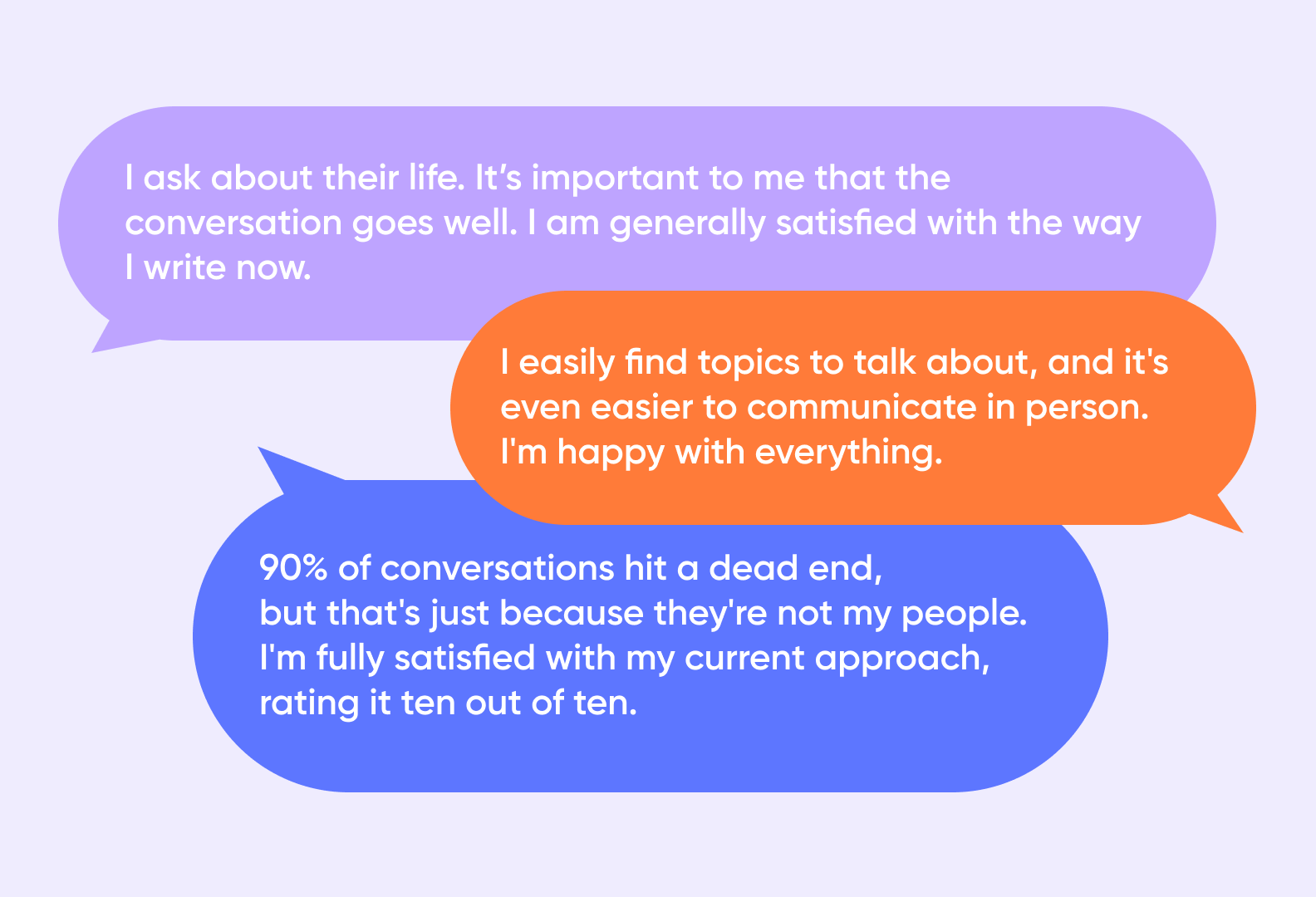

About continuing the dialogue and finding topics for conversation

Insight 5. Respondents look for topics to talk about in the profile of the person they are chatting with or improvise during the conversation. If the conversation hits a dead end, they don’t worry, it means these are “not my people.” The solution? Swipe to the next person.

Some people meet on dating apps and then suggest chatting on social media or calling to make sure the girl isn’t distracted by talking to other guys on the dating app. Plus, chatting in person is much easier.

So, we talked to users and found out that they were confident — they know what to write in the first message and how to continue the dialogue. They try to meet in person or make a call whenever possible.

If something goes wrong, they don’t get upset and just move on to the next person. It turns out they have a very relaxed approach to communicating on dating apps.

We conducted quantitative research

Interviews with users showed that they did not need an online dating assistant. Now, it was necessary to verify these results on a large sample through quantitative research. A little over a hundred people completed our survey. Here’s what we asked the respondents.

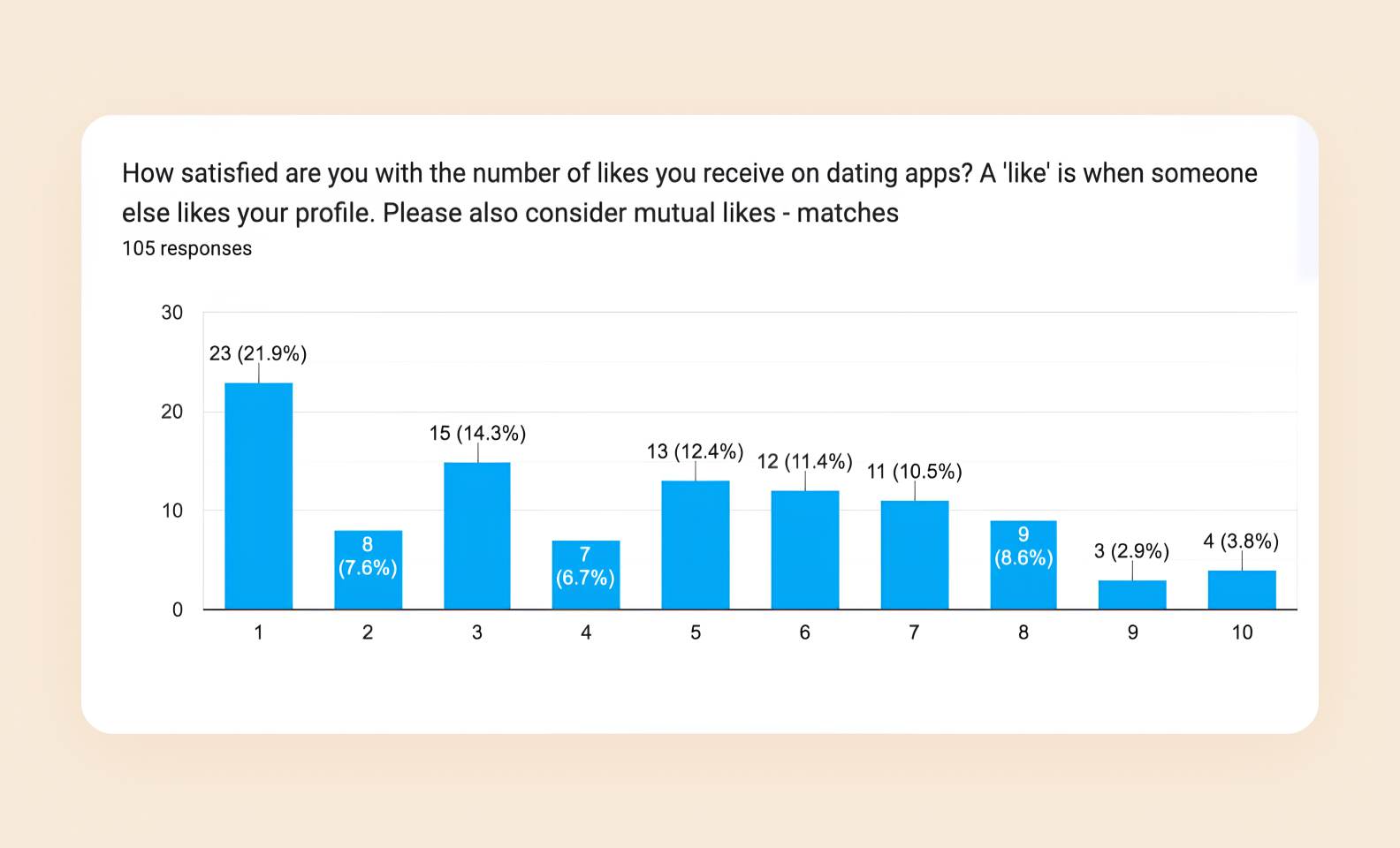

We asked them to rate, on a scale of one to ten, how satisfied they were with the number of likes and matches in dating apps. Most respondents were dissatisfied with their numbers.

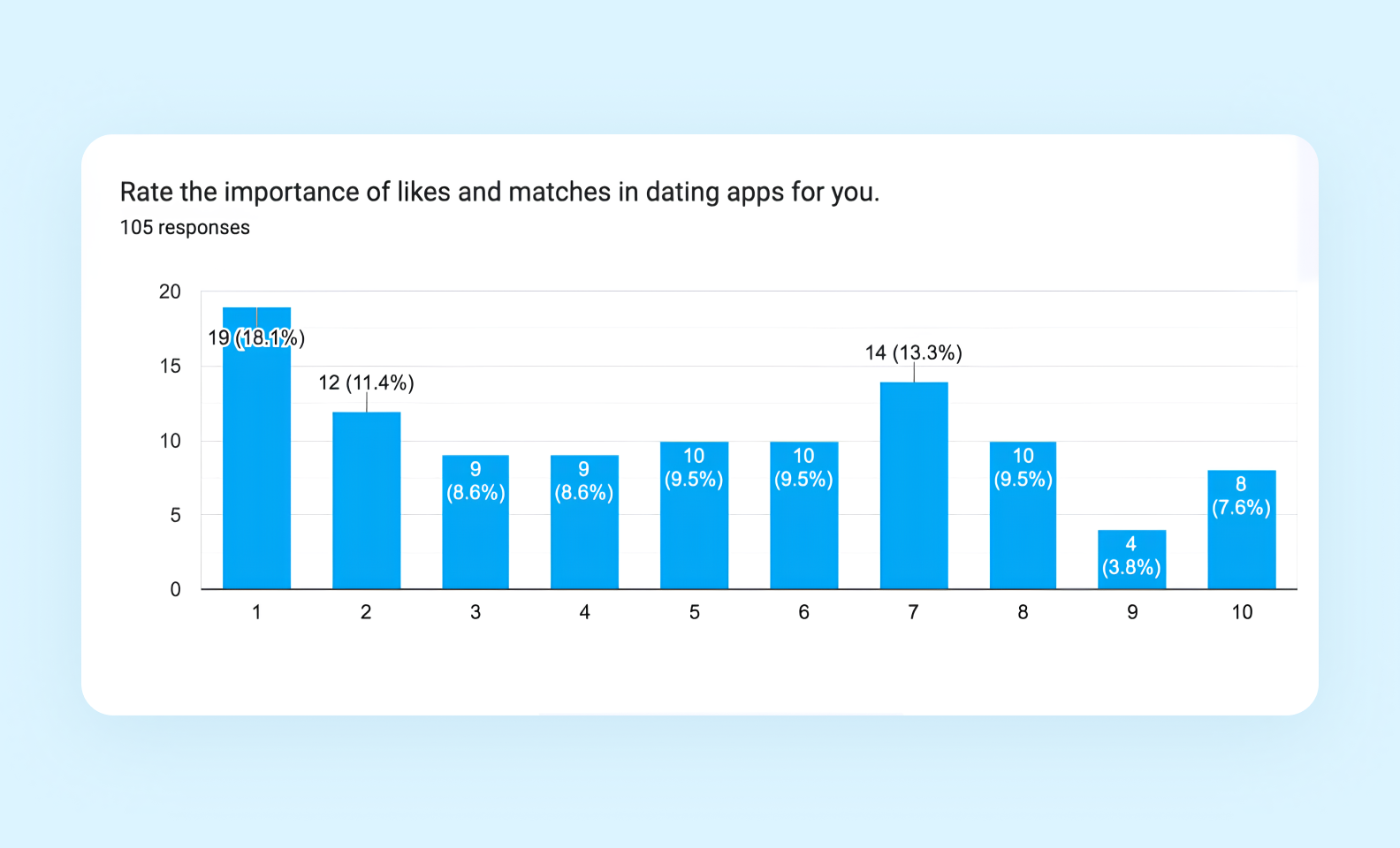

Then, we asked them to rate how important it is for them to get likes and matches. Opinions were divided, but overall, users do not place much importance on likes and matches — only 7.6% of respondents said it was important to them.

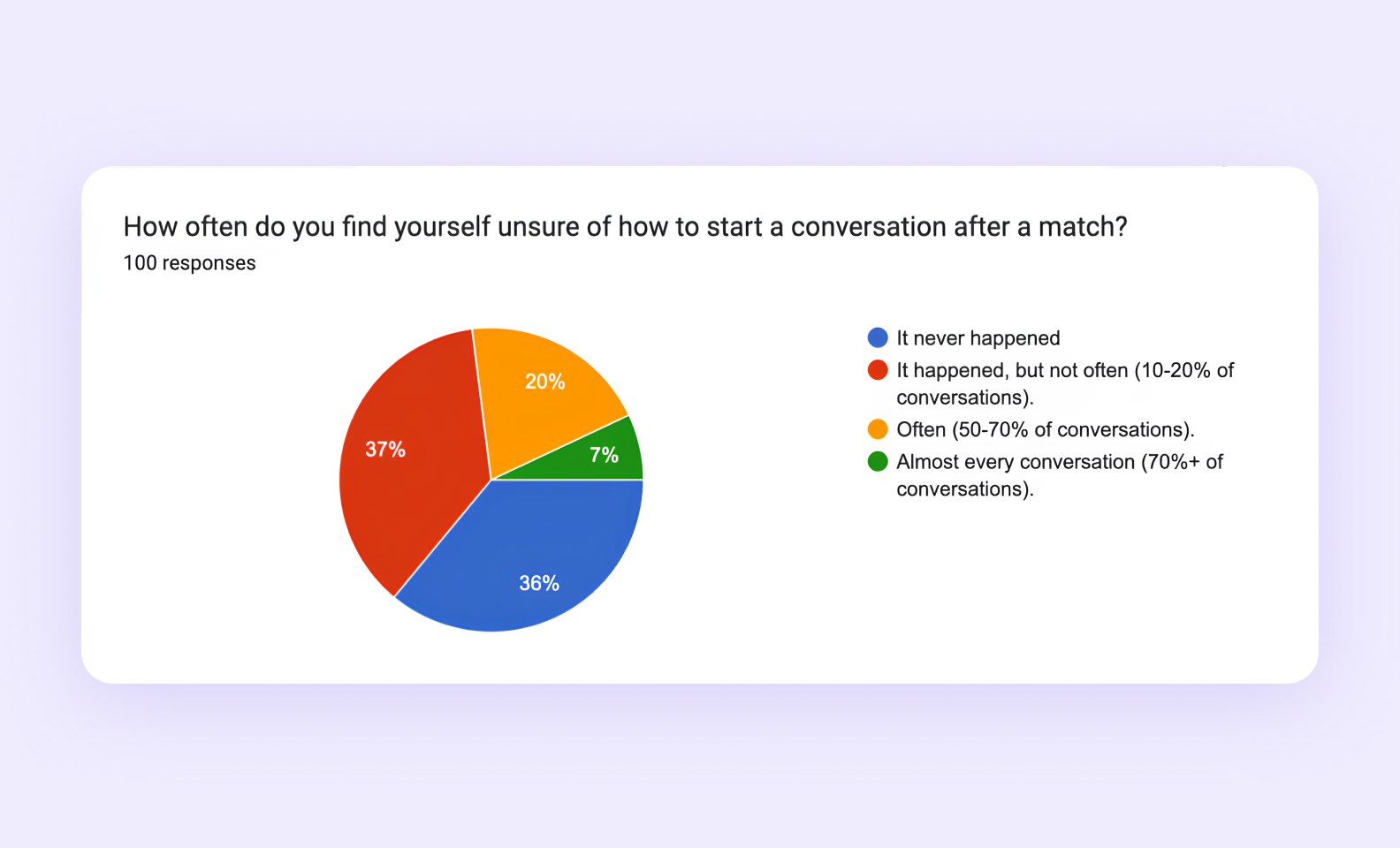

We asked how often respondents didn’t know what to write on the first message after a match. They rarely encounter this situation.

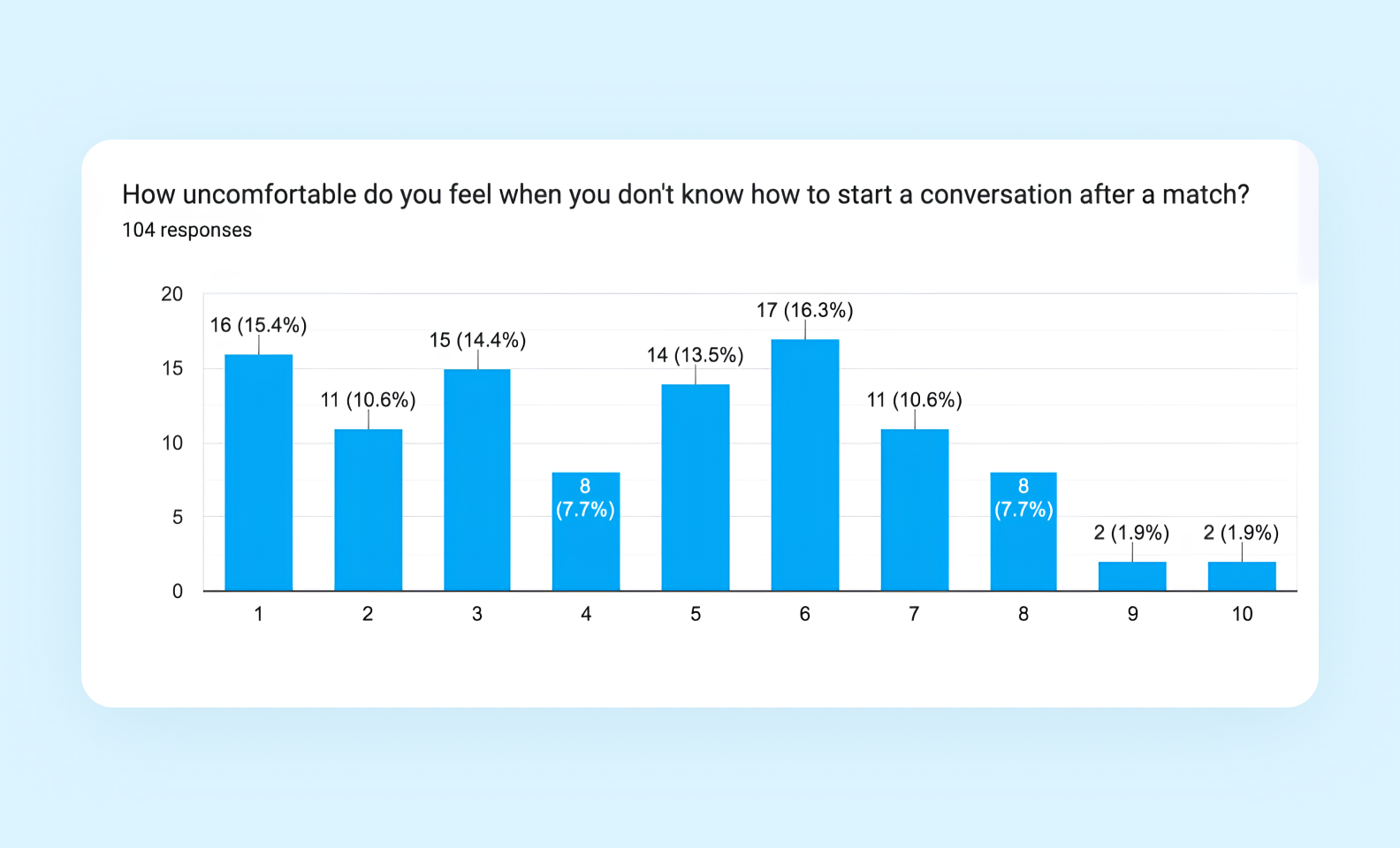

We also asked how uncomfortable they felt when they didn’t know how to start a conversation after a match. Respondents generally handle these situations calmly.

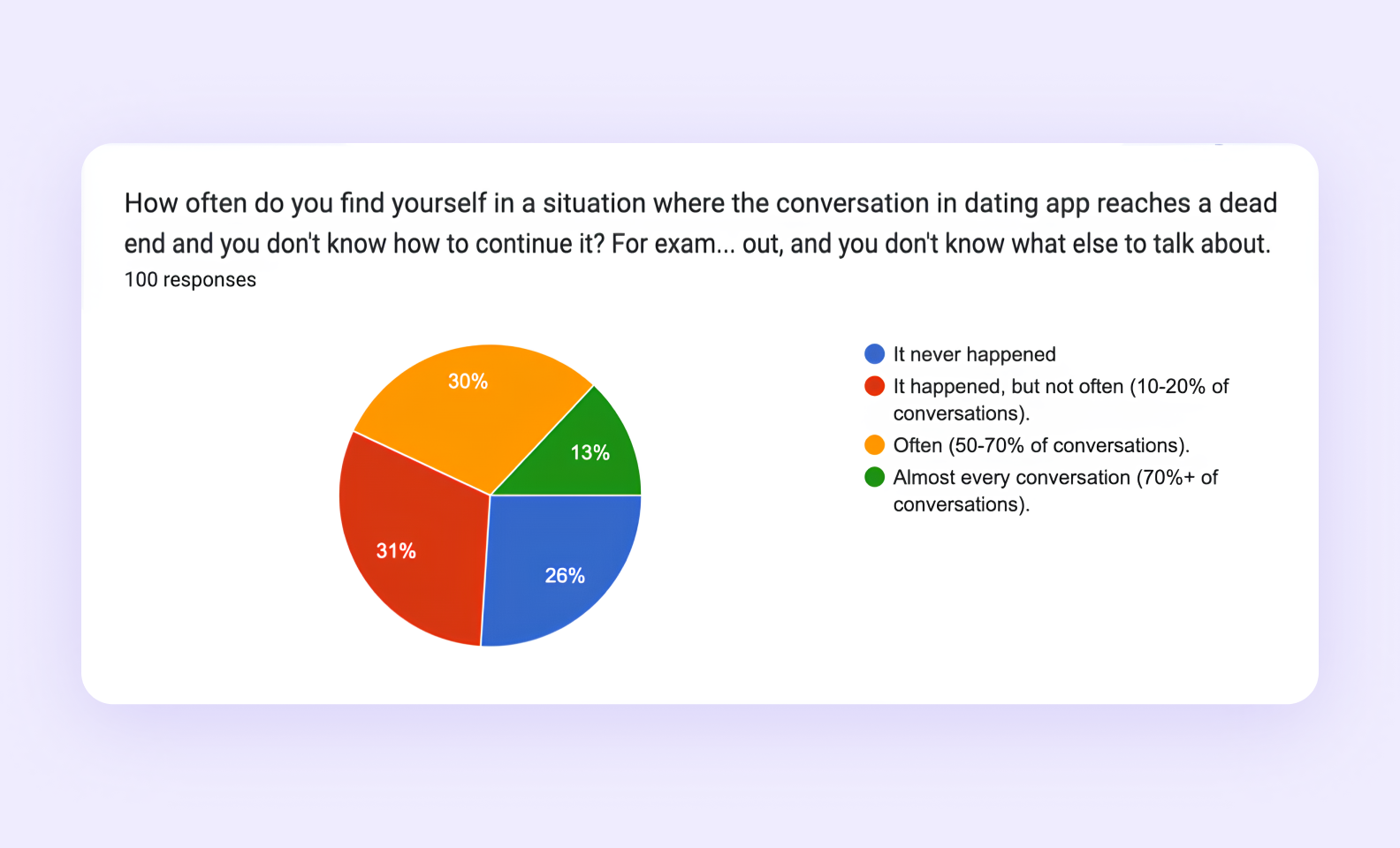

We asked how often conversations on dating apps hit a dead end, and respondents couldn’t find topics to talk about. These situations do occur, but not for all respondents.

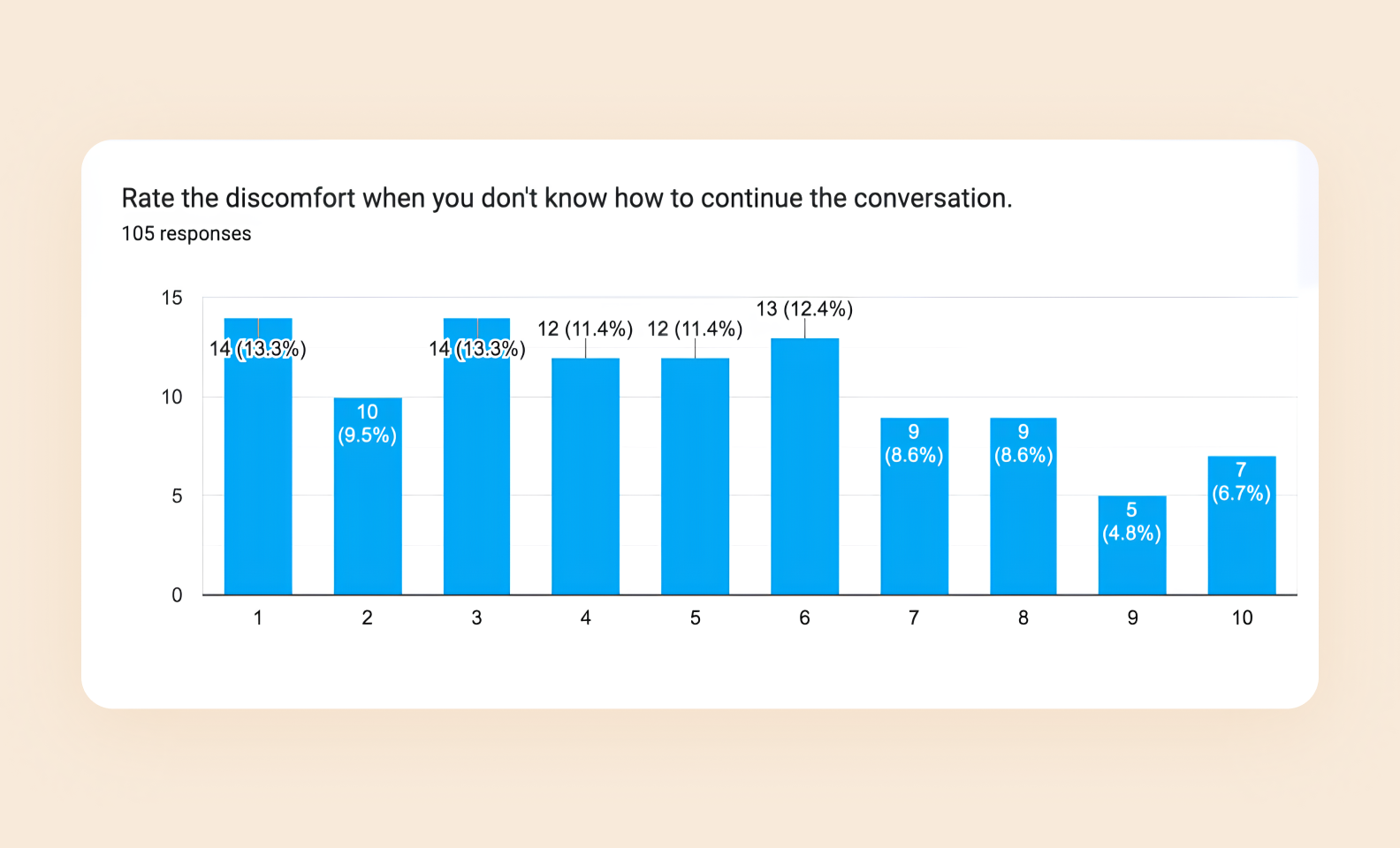

We asked them to rate, on a scale of one to ten, how uncomfortable they felt when they didn’t know how to continue the conversation. Overall, participants rated their level of discomfort as low.

The survey showed that users of dating apps do experience difficulties. However, most respondents do not place much importance on these issues.

We calculated unit economics

Now, we move on to the most serious section — money and monetization. Just numbers and no romance!

The client planned to monetize the product through subscriptions. From his marketing experience, he knew that the average subscription lifespan is 3-4 months. This is enough time for a user to meet someone, so this monetization model made sense.

We thought there was a risk: subscriptions work well for products with high return rates. But in this case, the audience consists of people who use the service temporarily while they are looking for a partner.

Therefore, we decided to test the client’s subscription idea by proposing four options, as well as an alternative monetization method — a pay-per-use model.

Subscription models

| Subscription cost (per month) | Conversion rate | Maximum cost per lead |

| $30 | 1% | no more than $0.25 |

| $15 | 1% | no more than $0.14 |

| $10 | 1% | no more than $0.09 |

| $5 | 1% | no more than $0.05 |

For all options, we assumed a 1% lead-to-customer conversion rate — a feasible figure even for a new product if the value is clearly communicated to the user.

The marketing budget range of $0.25 -$0.05 sets strict limits. It is necessary to have a deep understanding of the target audience’s needs so that advertising hits their pain points and pays off.

With the subscription model, cohorts will be formed — these are groups of users who renew their subscriptions and bring in money, although no budget needs to be spent to acquire them. We modeled cohorts with a second purchase conversion of 60%, a third purchase conversion of 30%, and so on. We found that they could potentially start generating up to $2,000 by the third month.

Cohorts are beneficial to any economy, but only if users can be retained for as long as possible. This needs to be worked on, for example, by sending push notifications and offering discounts and promo codes if the user hasn’t paid for the product yet.

Pay-per-use model

We assumed that a user might not need to buy a subscription if they wanted to perform a one-time action: generate text or review a profile. So, we modeled micropayments for each of these actions and looked at the potential benefits.

With a per-use payment of $1 and six purchases per month, users can be attracted to $0.25. This monetization model should be used as a backup.

The conversion to purchase with this model should be 5-6% — it will be higher than with the subscription model as it’s psychologically easier for a user to pay $1-2 than $5-30.

Both models look realistic: with the subscription option, all figures seem achievable, and the pay-per-use model can be tested through an A/B test.

Result

We tested all hypotheses and found no demand for a dating service with artificial intelligence. The pain points that the product was supposed to address, according to the concept, simply did not exist for the audience.

Users like their current solutions, and the initial assumption that they experience strong negative emotions due to rejections in online dating was not confirmed.

The client realized that the audience has no interest in the features he wanted to implement in the product.

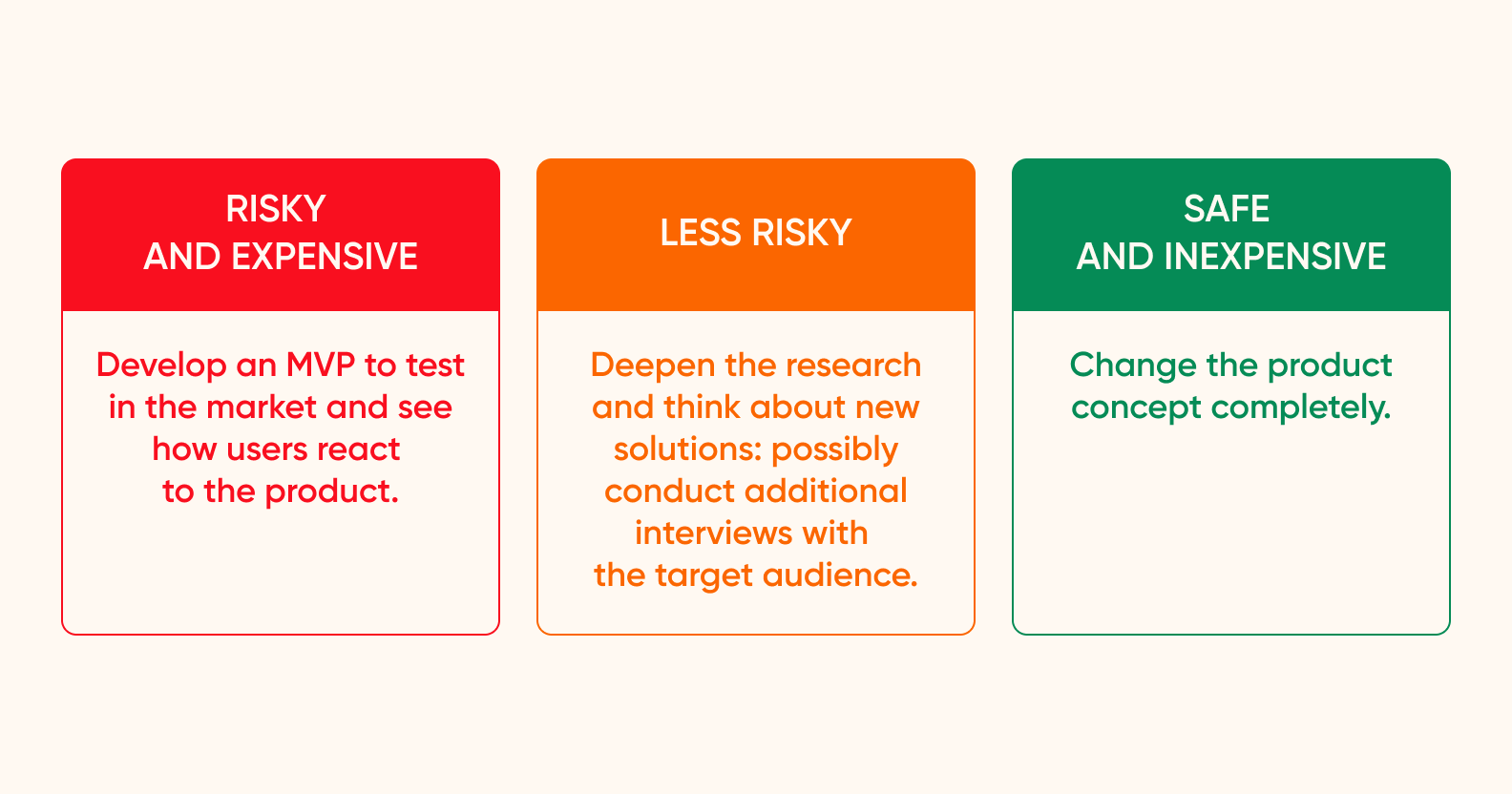

If the hypothesis is not confirmed, is it a failure? No! The purpose of Product Discovery is not to give the client the green light to develop the product, but to show whether the product will be truly interesting to the audience.

The client could have started developing the service right away and lost money, but thanks to the research, he saved the budget, gained valuable insights, and now understands the real needs of users much better.

He remembered a similar product with communication recommendations in dating apps that was unsuccessful. Our research explained why this happened.

Of course, we could not leave the client without any solution and offered three options for further action.

From the interviews, we learned that people value live communication, but the conversion from chatting to offline dating is not high, and many users are concerned about this. We suggested that the client think about a solution that could address this need if he is interested in continuing to work in the dating app market. He took a pause to study competitors and existing products.

If you want to test your project idea, fill out the form to contact us. We will listen to you carefully, share our experience, and estimate costs and timelines.