A banking app is no longer just a nice-to-have, it’s a must-have. For many, it replaces in-person visits, ATMs, and even desktop banking. In this article, we’re going to break down the core principles of banking app design, check out some of the best practices, and even try to look into the future of fintech UX.

Banking apps in 2026 are smarter, faster, and more user-focused than ever. Aside from clean design and a wallet, your product has to have features users actually need. Here are six banking design trends you can’t afford to skip.

Users don’t want ten different banking apps to manage money. They want one hub where they can check balances, trade crypto, pay bills, and book insurance — all in a few taps. The best banking apps are going full-stack, with embedded features from budgeting tools to investment dashboards.

A super app is basically a step towards a financial ecosystem: it’s one platform for multiple services. In the western markets, a good example is Revolut: what started as a travel card with great exchange rates is now a full-fledged neobank.

However, not everything needs to be a super app. You have to be confident that the users actually need all of the features you’re going to offer, or you risk losing lots of money on an app nobody’s looking for. In this case, starting with an MVP and a discovery phase is always a good idea.

<div class="post_divider"></div>

⭐ Our experience

A client once approached us with an idea for a Muslim super app that would help Islamic users with their everyday religious needs: reading the Quran, checking time for the prayer, or fasting during Ramadan.

But developing super apps is difficult and expensive, which is why we decided to launch the product discovery first.

We identified user needs and pains using the JTBD framework. By the way, our research helped discover a hidden user pain: many Muslims have problems with finding halal products in their cities in small secular cities. This turned out to be a perfect backup idea for an app.

But what about the super app that was planned? Well, qualitative and quantitative research made it clear that only 18-40% of the main segment needed a single application for their religious needs. This wasn’t enough to invest into a super app — even though the app’s economy would be strong, it risked not attracting users with additional value.

However, the discovery phase helped bring forward the hidden pain we mentioned with the halal products. Additionally, the client learned a lot about his potential audience and saved thousands of dollars on developing a super app no one needed.

<div class="post_divider"></div>

Typing passwords is over. Users now expect Face ID, fingerprint login, and even passive authentication (like behavior-based patterns). It’s not just about speed with banking apps, but a much-needed response to the surge of fraud: passwords are simply not enough for real security.

Banking apps are getting smarter. AI is being used to personalize dashboards, suggest savings goals, predict expenses, and even flag risky transactions, all in real time. If you want to keep up with the trends, it will be hard to escape AI.

Nobody wants to “wait 1–3 business days.” In 2026, instant transfers are the standard across accounts, banks, and even borders. Your banking app UX should reflect that with real-time feedback, status indicators, and instant notifications.

Money is social — people split bills, send gifts, or crowdfund together. Integrating contacts, P2P payments, or even payment sharing links into your mobile banking app creates smoother flows and keeps users inside your app.

<div class="post_divider"></div>

⭐ Our experience

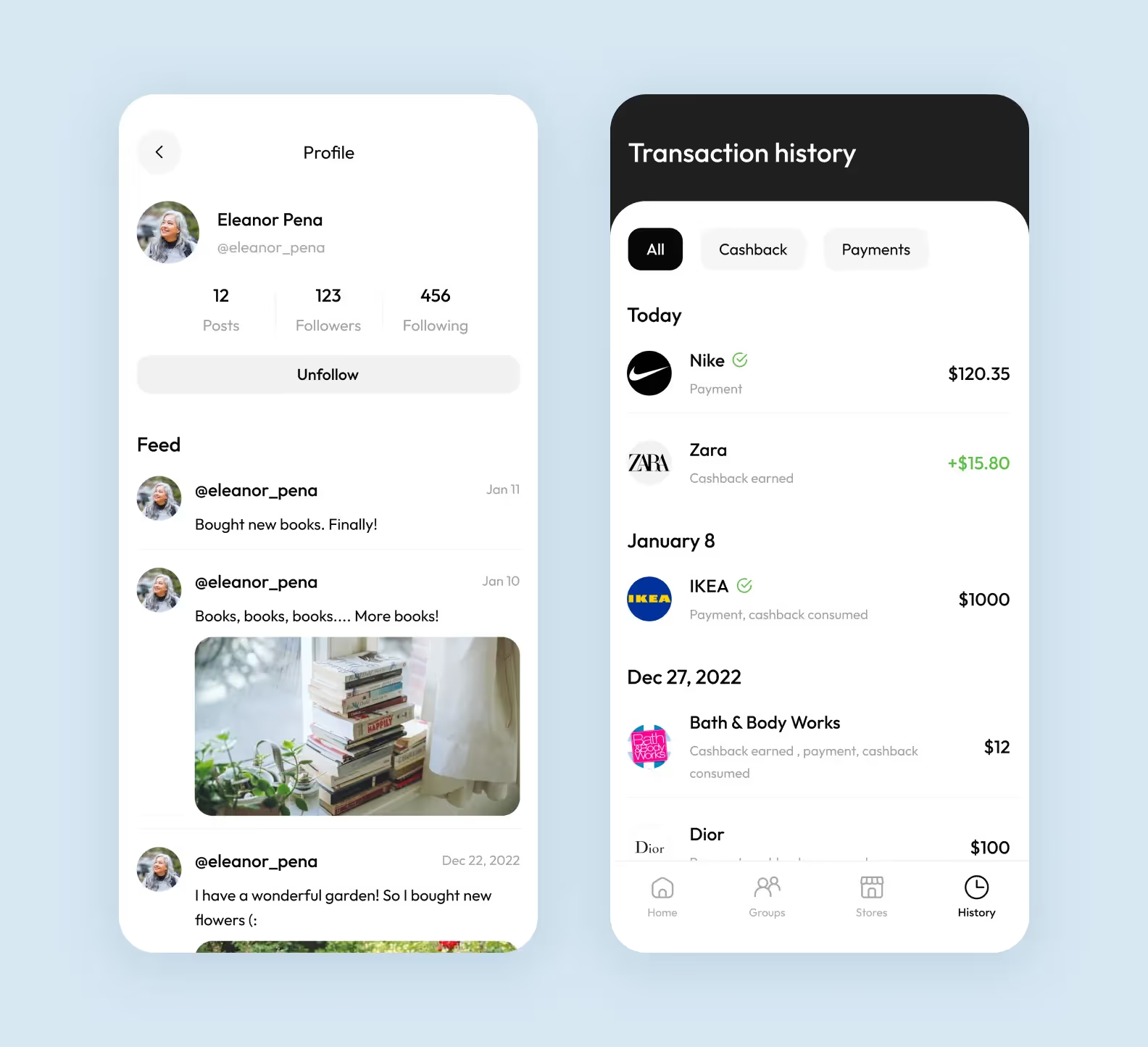

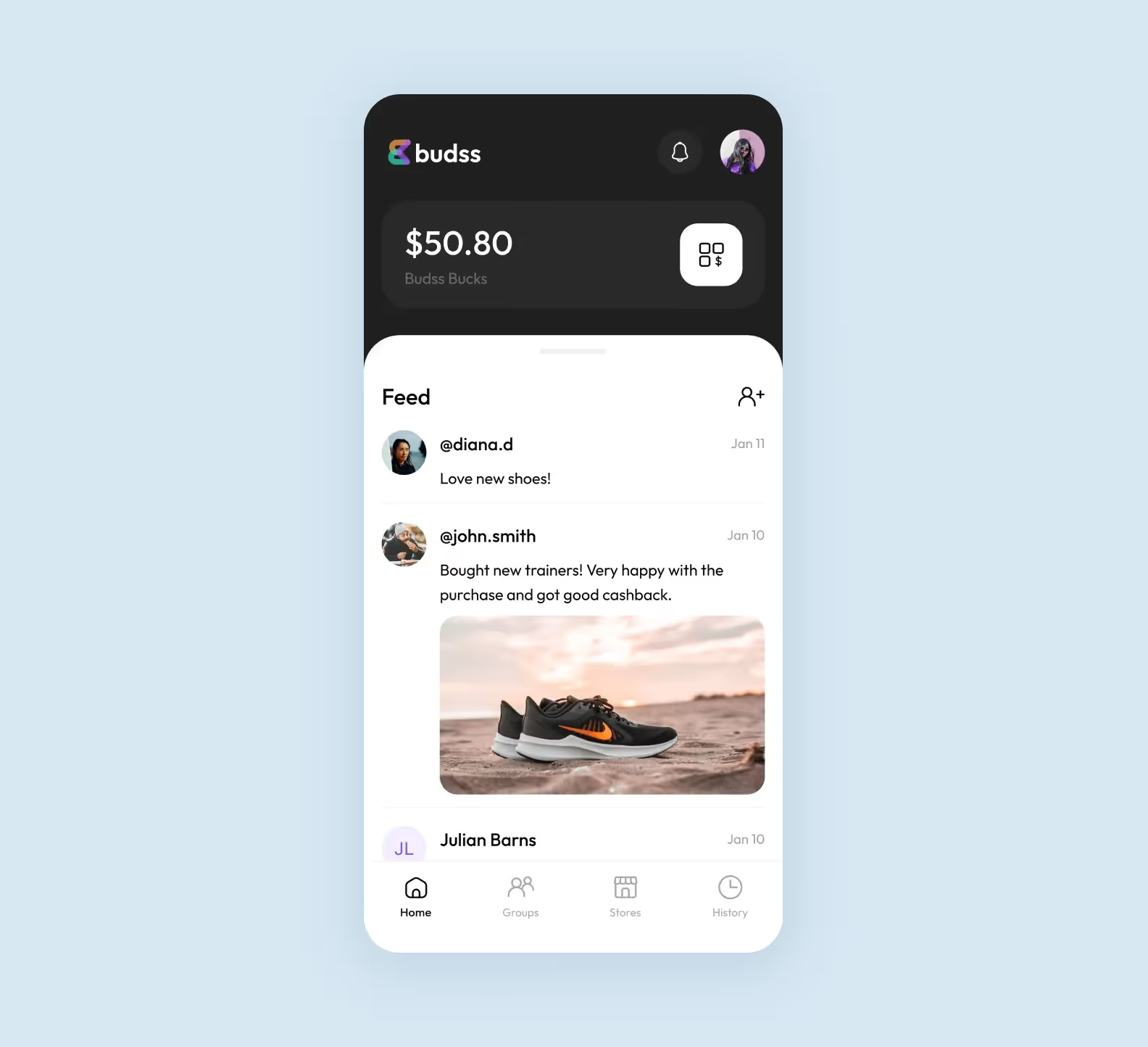

We did a UX/UI audit for Budss — a cashback platform that granted cashback for payments made in the app. To increase their cashback, users need to invite friends or make them on the app. Basically, it’s a merge of a fintech app and a social network.

The service was already up and running, but the conversion rates were pretty low. Our task was to find out why, based on the platform’s UX and UI design.

We discovered the following issues with the previous design:

We decided to create a new, sleek design using black-and-white along with some green and purple accents. The new interface didn’t just look clean and modern but also aligned with Apple’s guidelines.

The color accents helped visually separate all functions of the app: black is for all things cashback, white is for social networking, and the purple button is the CTA that allows you to create a group that helps increase cashback. That’s why it’s in the middle.

The social networking element doesn’t interfere with the main functions of the app: payments and cashback management. But if users want to delve into networking, they can expand their feed to full-screen mode.

We managed to deliver the final design in just 1 month! Our client’s only grievance was that he didn’t find out about us earlier 😉

<div class="post_divider"></div>

Nobody’s saying you need coins and confetti everywhere. But adding light gamification like savings streaks, level-ups, or progress bars can motivate users to build better habits and come back more often.

<div class="post_divider"></div>

⭐ Our experience

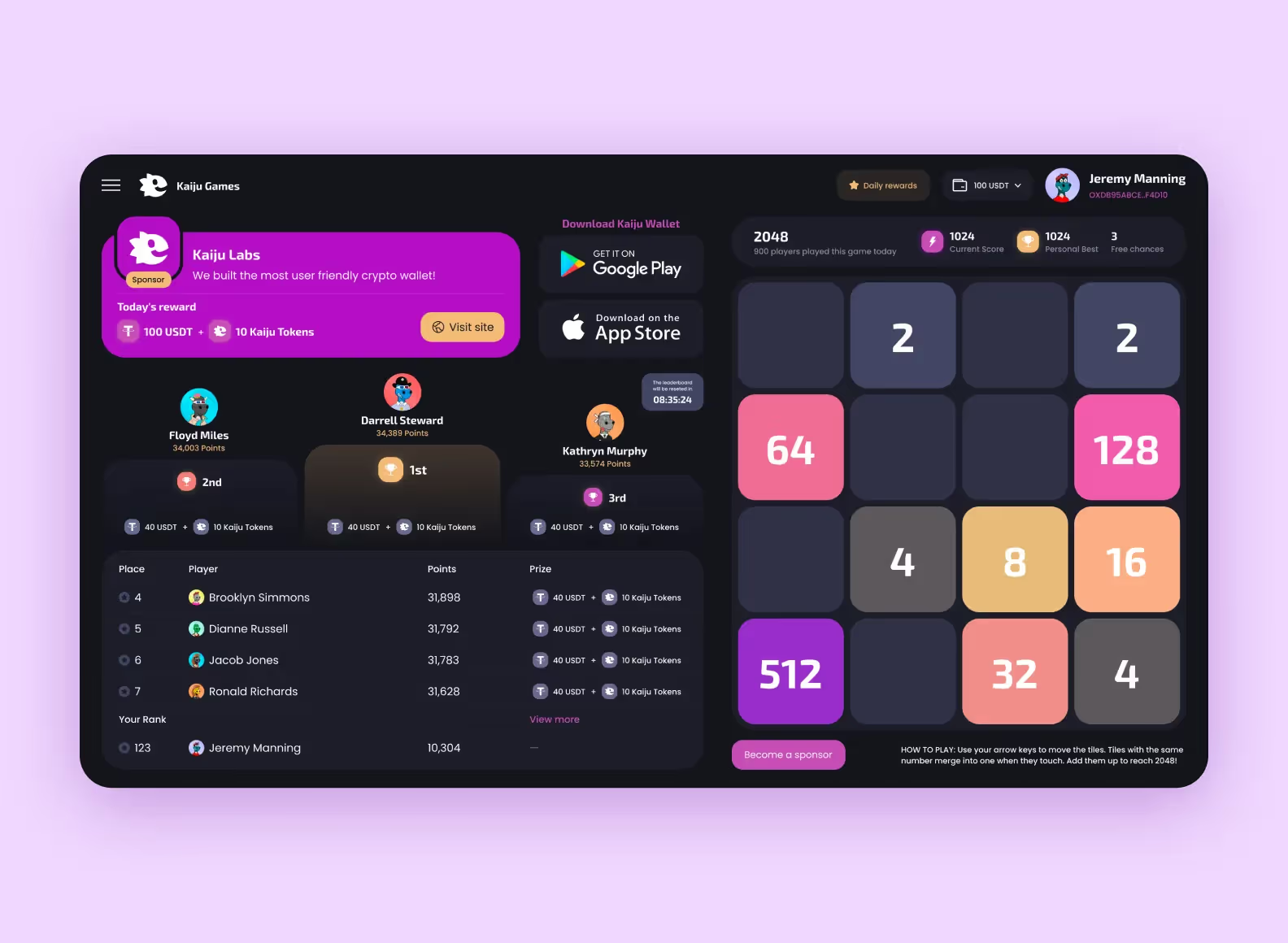

We designed a cryptocurrency wallet and a game for Kaiju — a Singaporean project that already had their low-code builder for decentralized games and needed experienced designers. Luckily, there we were!

Our task was to design a wallet, a game, and a logo. A wallet needed several cool features:

The goal was to provide effortless onboarding even for those without crypto expertise.

To promote the wallet, the client came up with a simple puzzle game, “2048,” that gave rewards in the form of crypto tokens.

The entire process of signing up for the wallet is connected to the game, which makes the entire process effortless and exciting. Besides, the leadership mechanic that allows the best player to get more prizes is an additional conversion booster.

Aside from that, we needed to design a logo as well as the entire visual style for the platform. We were inspired by Discord and Lucky Wheel.

The entire project took us 2 months and cost our client $8,000. The product has been launched and already received investments and attracted first users.

<div class="post_divider"></div>

Trendy features are great — but without a strong UX foundation, your banking app won’t stick. These 8 principles are what actually make an app usable, scalable, and loved by users.

Nobody wants to decode a dashboard. Good banking UX means less clutter, fewer choices per screen, and crystal-clear labels. The goal is to let users complete tasks in seconds, not minutes.

If your app lags, your users leave. Smooth animations, quick transactions, and responsive screens build trust. Especially when people are checking balances or sending money on the go.

Security is non-negotiable, but it shouldn't slow users down. Combine visible trust signals (like biometric login and 2FA) with invisible protection (behavioral tracking and fraud alerts) to keep both peace of mind and performance.

Let users shape their experience. Whether it’s pinning favorite actions, setting spending limits, or adjusting notifications, customization creates ownership and boosts retention.

Users should be able to open your app, register, verify their identity, and start using it fast. No 12-step forms or confusing screens.

Design for everyone — not just the tech-savvy. That means high contrast, readable fonts, screen reader support, and tap targets that actually work on small screens.

Don’t hide fees, limits, or processes. Users appreciate clear breakdowns of what’s happening, especially when money is involved.

Your app isn’t finished at launch. Collect user feedback, analyze behavior, and release updates that actually solve pain points.

We’ve already established that banking app users expect more than basic transactions. They want fast, smart, and human-like experiences. Some banking apps manage to deliver even more than what’s expected. Let’s look at 4 UX/UI features that are not necessarily must-haves in each banking app, but would definitely elevate your product to a whole new level.

Users want a home screen that actually works for them — not a generic list of accounts. A smart dashboard should surface recent activity, upcoming bills, spending trends, and personalized tips. Bonus points if users can customize what they see.

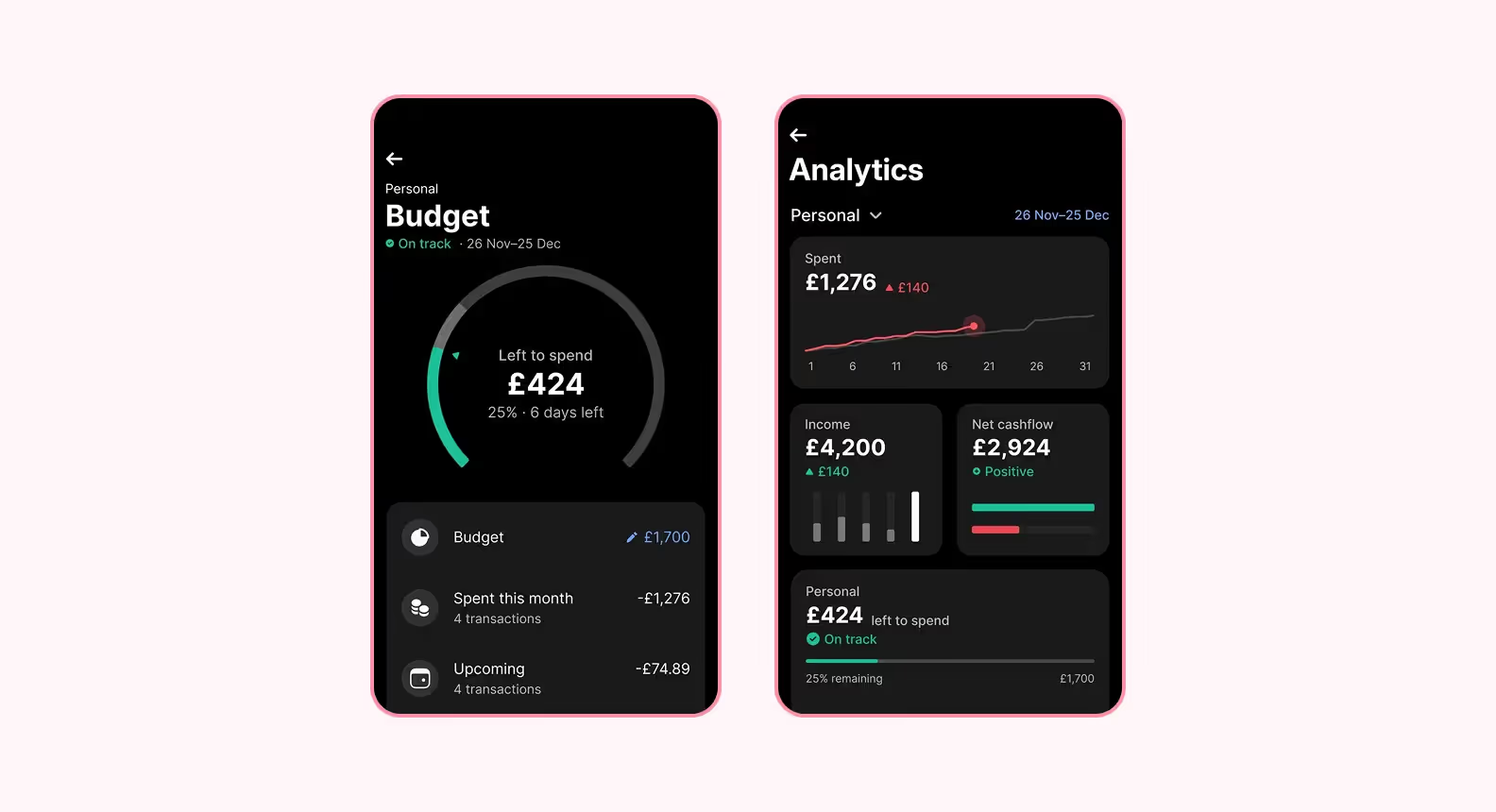

Revolut does this well — the dashboard highlights real-time balances, budget insights, and recent transactions, all personalized based on user behavior.

Typing in a search bar is fine, but talking to your bank and getting instant help like you’re Tony Stark giving Jarvis instructions is way better. Users now expect AI chatbots that handle transfers, explain fees, and answer questions — all in plain language.

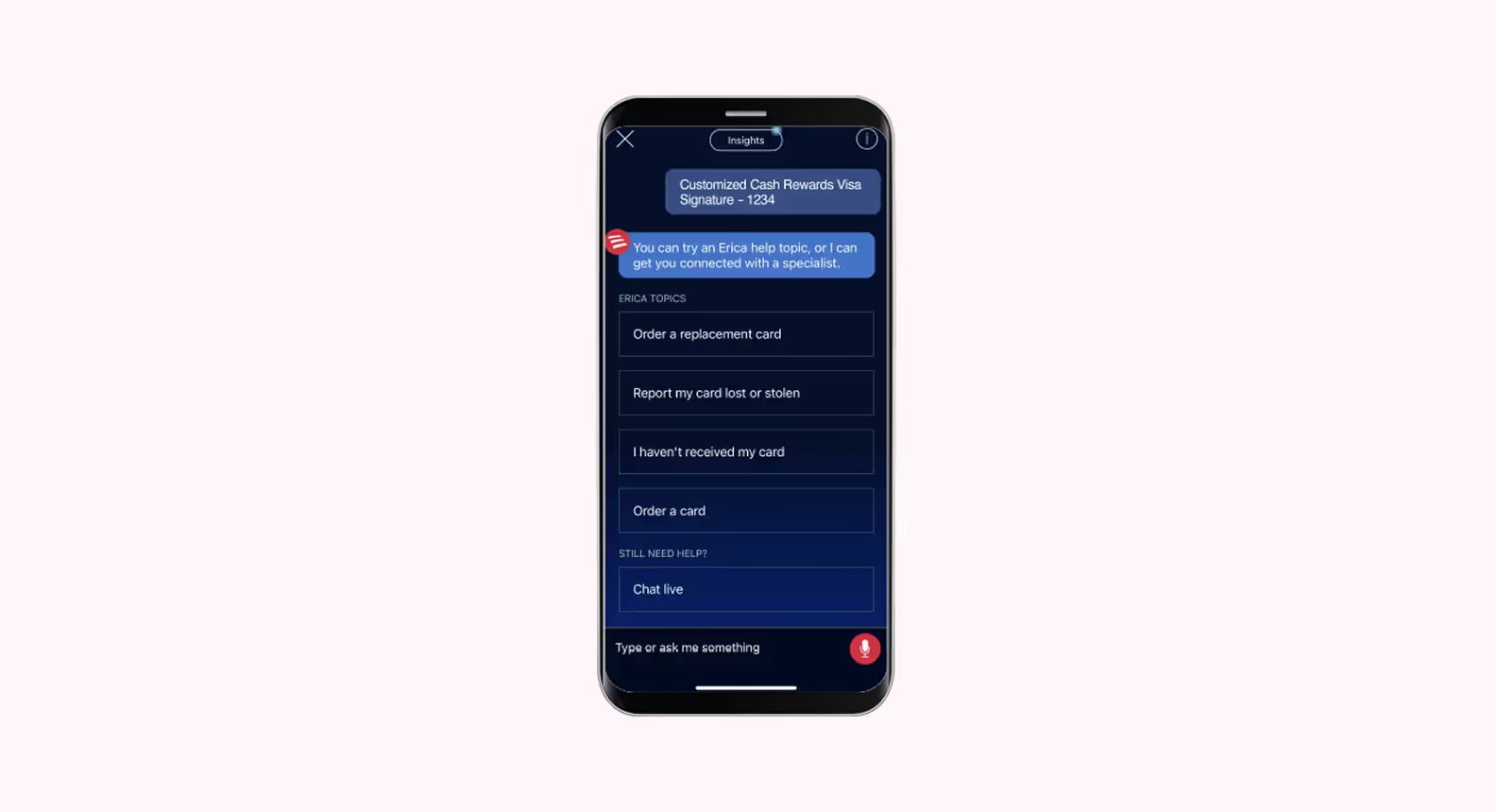

Erica by Bank of America is one of the best in class. Users can ask things like “How much did I spend on food last month?” or ask for help with issuing a card — and the digital assistant will get it done.

Users don’t want five apps to manage money, crypto, insurance, and loans. They want one financial command center where they can invest, borrow, budget, and track everything — without switching tabs.

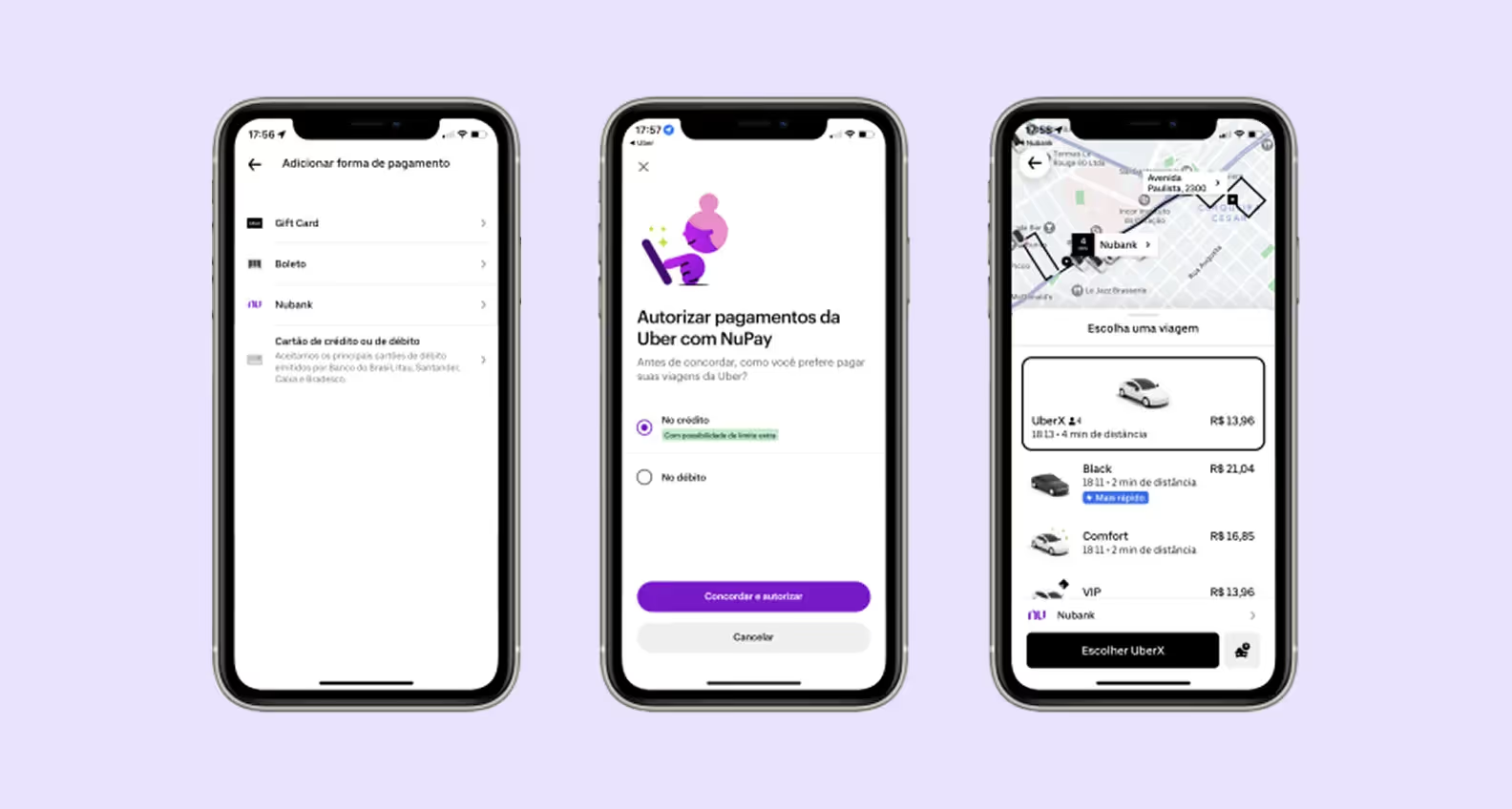

One of the examples is Brazilian neobank Nubank. Aside from basic features like managing your insurance and loans, the bank offers in-app subscriptions and even its own payment system. For instance, NuPay is an exclusive paying service that is directly integrated with Uber and allows one-click payments.

Security can’t just happen in the background. Users want to see that their money is protected — with alerts, instant card freezes, and real-time risk detection.

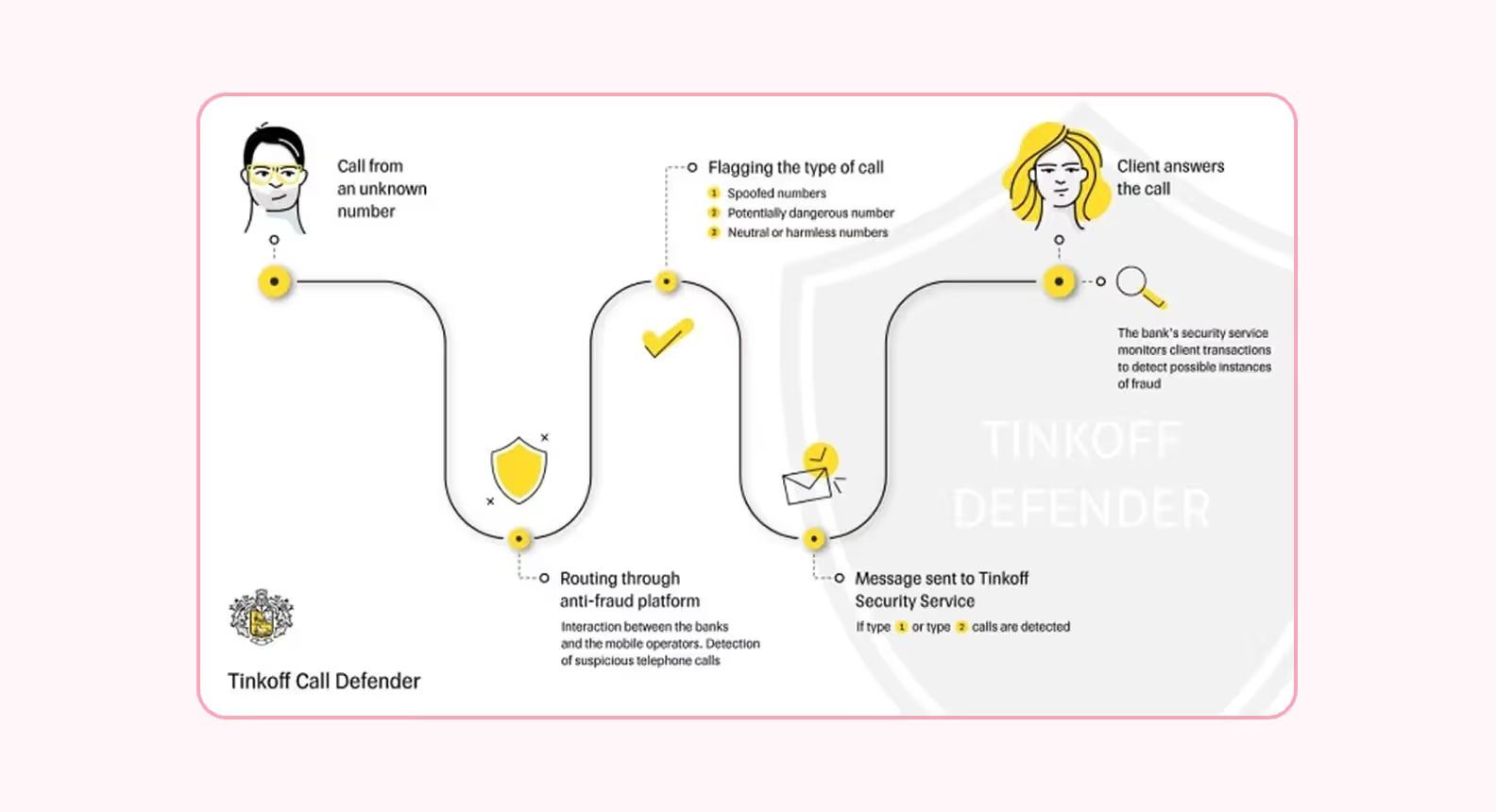

For example, Russian bank T-bank launched an entire call defender system to protect users from suspicious calls. Today, its anti-fraud platform even offers a fraud roulette where you can request to be connected with a scammer and waste their time so they don’t reach other, less aware users.

Great UX isn’t just about good-looking screens — it’s about guiding users through complex financial tasks with zero friction. These 4 fintech UX practices make banking apps more intuitive, engaging, and habit-forming.

People love a sense of progress. We already mentioned that adding light gamification in banking makes financial tasks more rewarding. It taps into motivation without overwhelming users with “gamey” elements.

Among such elements can be awards for certain spending types (for example, those who spend more on eating out can get a “Foodie” label in their wallet) or even full-fledged games woven into the app (like Wordle).

Done right, pop-ups can guide users at the exact moment they need help — during onboarding, a new feature rollout, or when they’re about to make a costly mistake. The trick is to make them contextual, not intrusive.

Tiny animations, haptic responses, or visual cues (like a bounce or color change) tell users that the app is responding. These microinteractions build trust and clarity, especially during sensitive actions like sending money or updating security settings.

Don’t dump everything on the screen at once. Show users only what they need at the moment — and reveal more as they dive deeper. This reduces cognitive load and helps beginners feel more confident using your app.

Even the best-looking app can fail if the UX isn't solid. In fintech, one mistake can cost you users — or worse, trust. Here are five common UX pitfalls that banking apps still make but your platform would want to avoid.

Regulatory requirements aren’t just checkboxes — they shape the user journey. If your KYC flow is confusing or your data handling isn’t up to spec, you risk both legal trouble and user frustration.

<div class="post_divider"></div>

⭐ Our experience

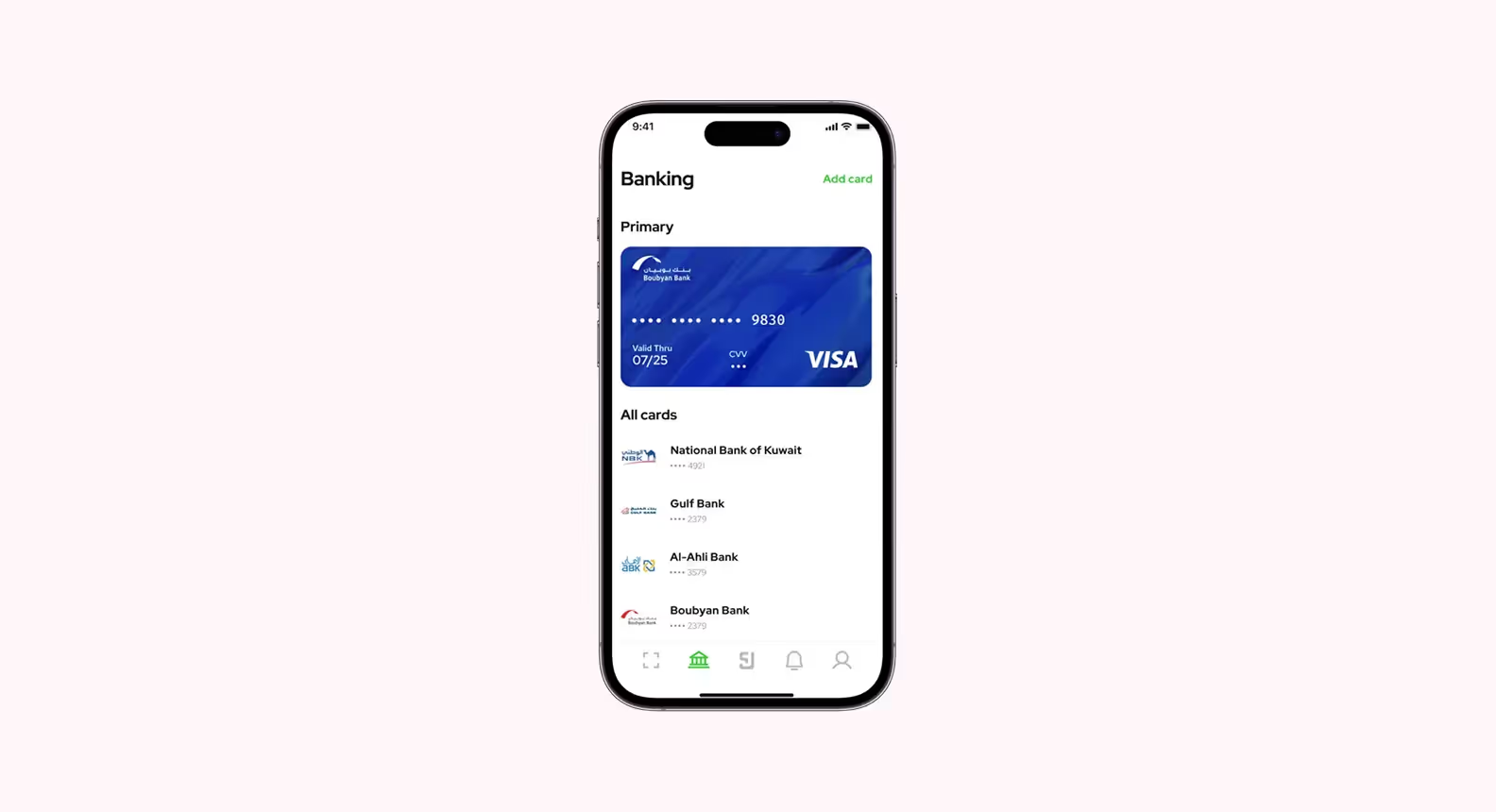

We made KEM — a P2P payment platform in Kuwait, where not everyone has access to online banking services.

It works pretty much like a social network that allows users to transfer money to other people in their contact list — or request such transfers from them.

However, working with banks comes with challenges. One such challenge is gaining access to APIs — apps cannot make transactions without it. Banks have a closed API because of sensitive financial information.

That’s why we developed the entire backend with imaginary data so that the clients could have an MVP to show to banks.

And it worked! The team managed to gain access to local bank APIs, but with one condition — the entire technical team had to be located in Kuwait. The country’s banks do not allow developers from outside to work with the API.

To comply, KEM started to assemble an in-house team. At Purrweb, we work in a way that allows seamless handover to another team. We got on call with the customers, handed over the code and the accesses, and stayed in touch for a month to answer the CTO’s questions.

After the handover, the in-house team wrote a backend with real APIs and rebranded it, making it possible for KEM to successfully enter the market. In the seed funding round, KEM raised $1 million! Now, the founders plan to expand to Saudi Arabia and launch an app-based neobank.

<div class="post_divider"></div>

If users can’t tell that your app is secure, they’ll assume it isn’t. Missing trust signals (like biometric login, transaction alerts, or fraud detection) make users feel exposed — especially when their money’s involved.

Too many buttons, colors, or data points on one screen leads to user overload the mobile banking app design. Just because your app can do everything doesn’t mean it should show everything at once. This mistake is especially tough to avoid when you’re aiming for a super app.

Long, clunky sign-up flows are a guaranteed drop-off point. Fintech onboarding needs to feel fast, frictionless, and mobile-first — with as few screens and steps as possible. If you’re having trouble with users leaving the app, check your onboarding process first.

Too many alerts? Users will mute or uninstall. Too few? They miss key updates. Bad timing or irrelevant content just makes it worse. For a banking app, it’s important to find that balance between being relatable and fun but also reliable and on-point. Turning a fintech platform into a meme account on social media would be a breakout strategy, but a risky one.

The fintech space is evolving fast — and users expect apps to keep up. The next wave of UX will (hopefully) be about creating smarter, more connected experiences that adapt to how people live and manage money. Here’s what may be coming next for mobile banking design — see you right here in a couple of years to find out if we were right 😉

The days of single-purpose banking apps are over. With users now striving for a one-stop hub that combines savings, loans, investments, insurance, and even travel and lifestyle services under one roof, financial ecosystems may evolve even further.

From a UX perspective, this means designing for flexibility: modular components, scalable navigation, and flows that can adapt as more services plug in.

As financial data gets more complex, users need better ways to understand it. That’s where AR and visual banking app UX step in. Think spending heat maps on your desk or budget progress rings floating in your living room.

It may sound futuristic, but it’s already starting to happen — and the goal is simple: make money feel more visible, interactive, and intuitive.

Crypto and DeFi aren’t just for techies anymore. Mainstream users are jumping in, but they need interfaces that make complex blockchain features simple, safe, and understandable. Today, blockchain feels pretty complicated (and scary) for the majority of people, but in the future, the technology may integrate with our day-to-day banking processes even further.

<div class="post_divider"></div>

⭐ Our experience

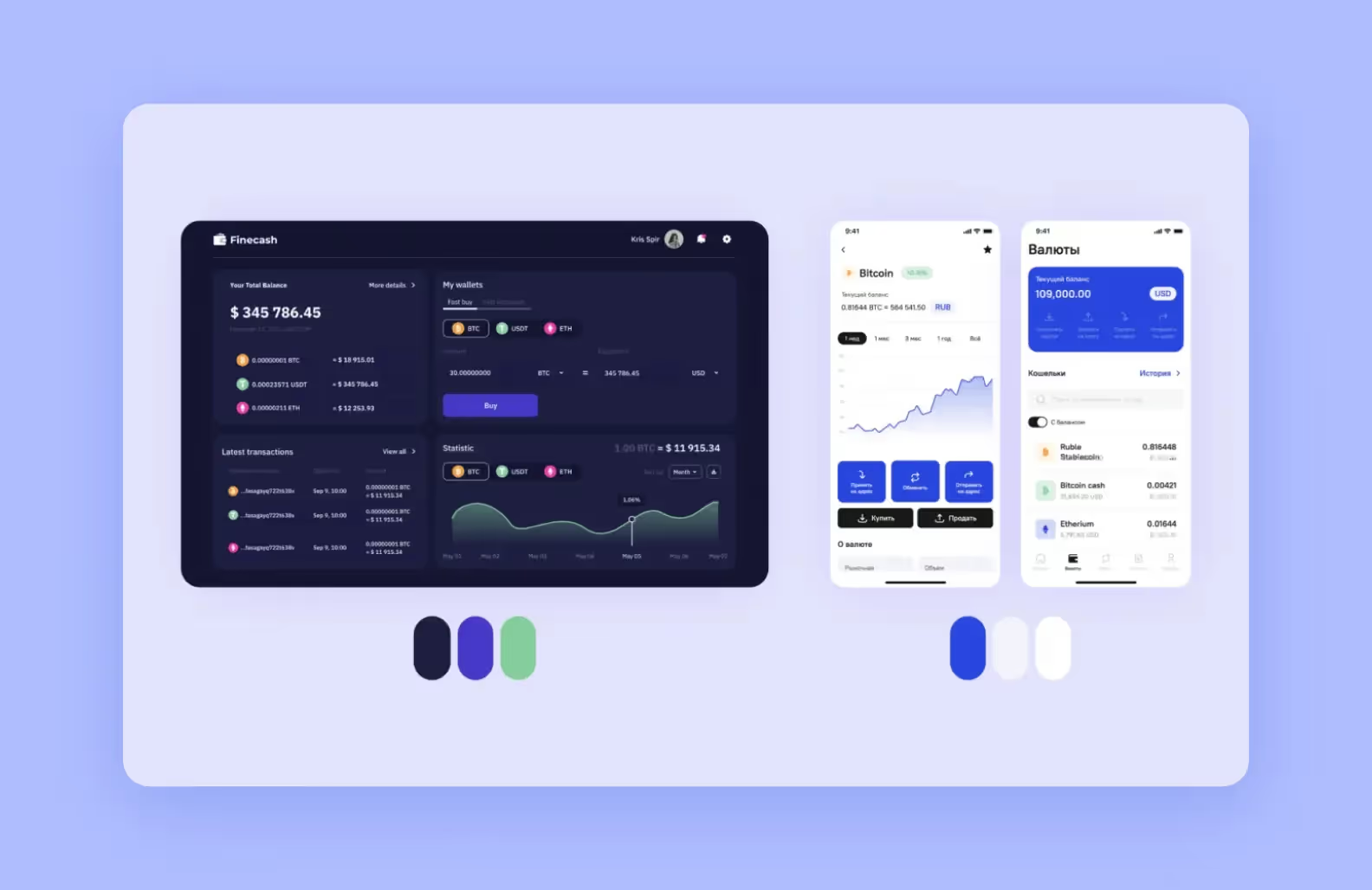

When we developed Broex — a crypto wallet app — we were just tipping our toes into cryptocurrencies and did not have as much experience as we do today.

Broex’s mission as a European-licensed multi-currency was to help newbies by offering the world’s most user-friendly wallet, the fastest verification, and the option to hold crypto money.

The clients came to us with a task to develop a cross-platform mobile app from scratch while dealing with a backend that we didn’t write.

To do that, we had to delve into crypto and the logic behind it. But the users didn’t need to know any of that — for them, it was only important to enter, exchange, and withdraw at a minimal cost without fearing that they’re doing something wrong.

To make Broex more user-friendly, we refused to go with crypto-associated stereotypical cyberpunk design and chose a classic and clean design banking apps usually use.

We also:

When the first version was released, users were able to sign up, set up security measures in their profile, view a list of assets and their details, as well as explore and add assets to favorites.

We kept making improvements, and the latest release included biometrics (via Face ID and Touch ID). Now, we provide ongoing support for Broex.

<div class="post_divider"></div>

Banking apps are full-scale financial platforms that users rely on daily. Nailing the UX means delivering clarity, speed, trust, and relevance at every step.

From personalization and security to emerging tech like AR and blockchain, the best apps are built on real user needs — and smart design decisions behind the scenes.

➡️ If you’re building or revamping a fintech product, now’s the time to think strategically about UX. Ready to design and develop your perfect banking app? <a class="blog-modal_opener">Contact us</a> and get a free project estimation in 48 hours.