What is a neobank?

Neobank is a financial organization that operates entirely online. These alternative FinTech startups communicate with clients and provide online banking services without physical offices.

Usually, neobanks are licensed financial organizations that conduct financial transactions and perform offline banks’ functions independently. But, in rare cases, neobanks are also intermediary organizations that cooperate with offline financial institutions to provide their services remotely.

What’s the difference between the neobank and the bank?

The first banks appeared about 2,500 years ago, and, despite the centuries-old changes, the bank’s functions have remained the same: they lend, store, and transfer money. We can say that the digitalization of the economic environment has added convenience to the entire system of traditional banking services. Today coming to the bank office on any issues is customary, but not necessary! There is no problem paying a bill and transferring money to another person in the bank application. Even getting a card, issuing cash, filing a fraud complaint, or consulting is possible via apps, online consultants, and ATMs.

Here come neobanks — a new step in the finance sector and a potential booster for the growth of banking. How are they different from regular banks? Firstly, the trend towards switching to online is clear: neobanks do not have offices, but there are ATMs where people can independently receive services, withdraw or deposit money.

Secondly, unlike conventional banks, neobanks can be specialized. It is an important reason for the neobank building because they can both be habitual and render regular online banking services, or narrowly focused, for example, to serve entrepreneurs, to lend only to organizations, and so on.

Thirdly, the government models differ. To be more specific, the Central Bank or the Fed is the governing body of a conventional bank, whereas a neobank can use business models that differ from traditional ones because it does not need to comply with strict state banking rules. As a result, neobanks differ in their offerings and structure from conventional banks.

Lastly, digital-only neobanks raise the accessibility of financial services. People that for some reason cannot receive a bank card in the office, gain a golden opportunity to open an account remotely.

Why should you start a neobank?

If you are planning to launch a FinTech application and consider neobank as one of the options, you will most likely have to weigh the pros and cons. We have compiled the current market statistics and advantages of neobanks, so it will be easier for you to make a decision.

In short, the key takeaway is as follows: if you have identified the unique banking needs of a particular group of people, for example, freelancers or e-commerce marketplace owners, feel free to launch your neobank from scratch. You will find your clients even without a physical office. The main aim is to create a high-quality application that meets the requirements and needs of a potential customer base and then advertise it correctly.

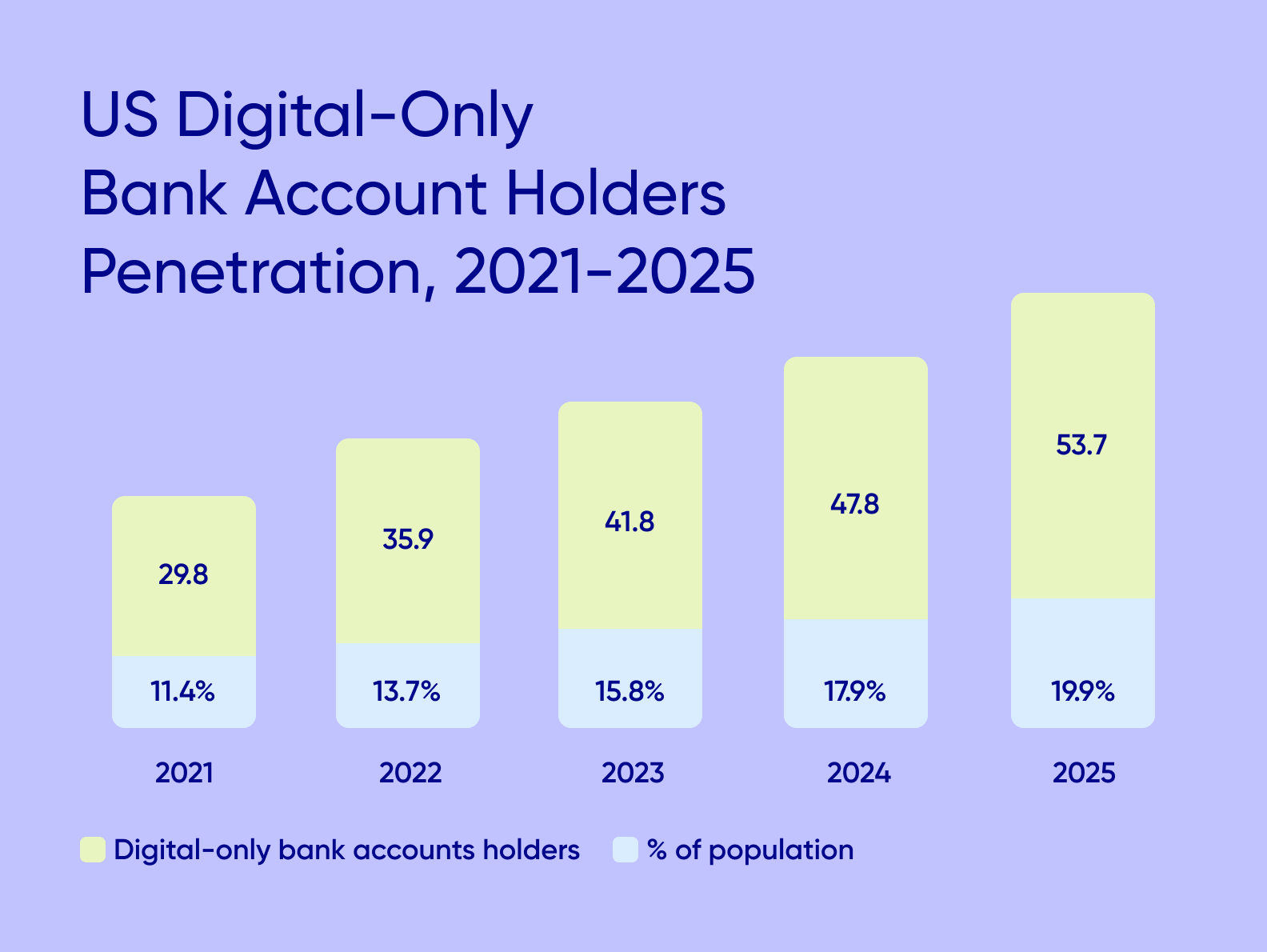

Today, more and more people tend to use digital-only banks. For example, the number of such bank account holders in the USA is already 13.7% of the population, and it’s forecast to reach 20% by the year 2025.

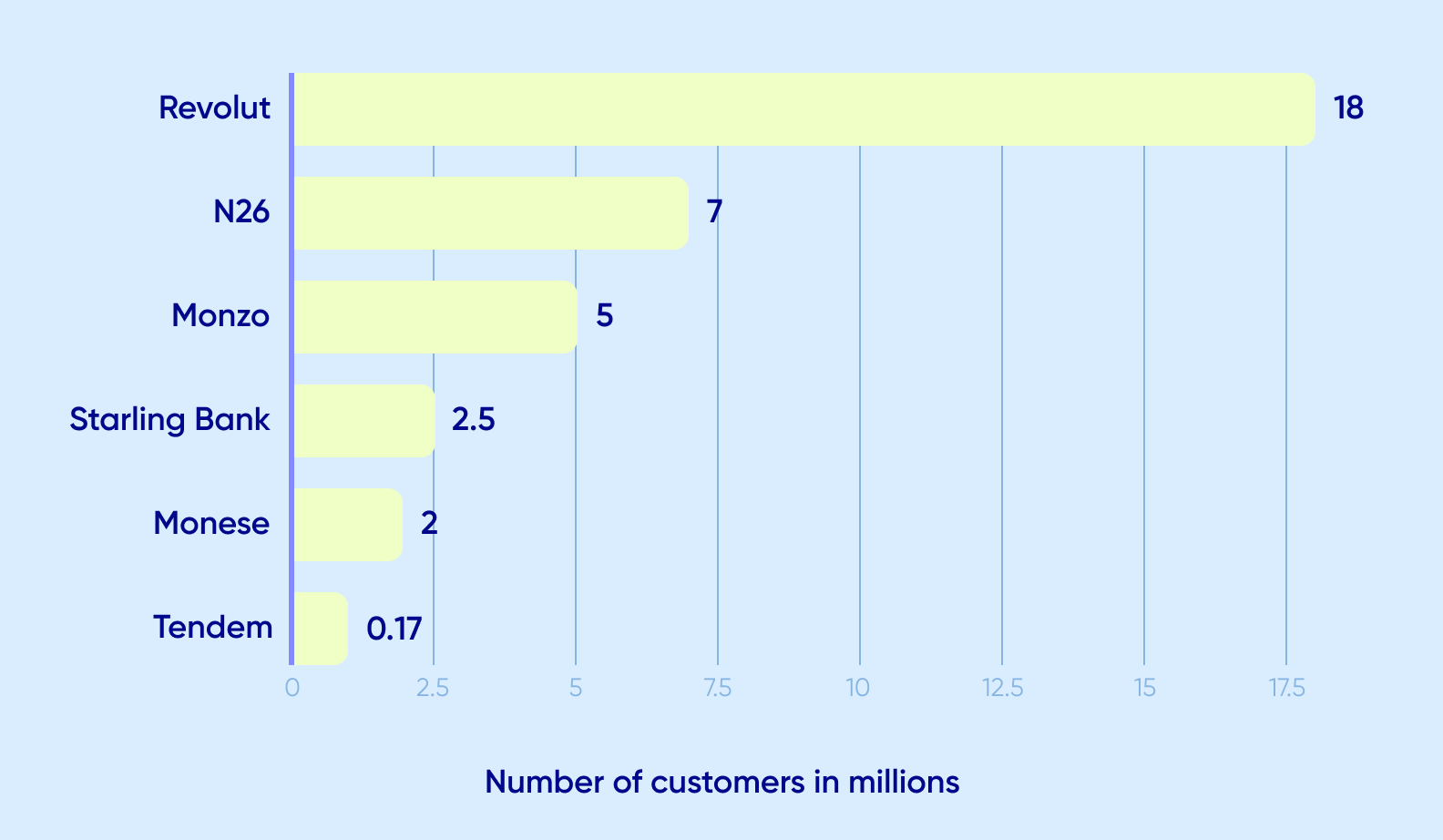

Thanks to neobanks, the acceptability of banking services represented in the number of bank accounts being opened online is surging, and consumers are focused on digital technologies. For example, in Europe if you opt for a digital bank, it’s possible to complete the signup process from anywhere with a solid Wi-Fi connection. A client just needs to prepare an ID, a residency document, and proof of employment or school enrollment. As of 2022, the current number of customers in the largest European banks operating only online is as follows:

If you are still not convinced that neobanks are the solution of the future, let’s look closer at the peculiarities of a strong and popular US neobank.

A successful digital-only bank example: Chime

The increased consumer interest in financial services apps is driving competition globally. Consumers value convenience, speed of transactions, simple problem-solving, and exclusive offers. So, neobanks introduce noteworthy features, such as overdraft protection and registration of incentives. We want to tell you more about an encouraging example of neobank.

Let’s take Chime, the most popular neobank in the US. Chime is a FinTech company that provides digital banking services and issues debit cards. The Bancorp Bank and Central National Bank partner with it. There are two features that make this neobank popular. Chime offers a $200 overdraft and access to more than 60,000 ATMs for free. It has over 13 million customers, over half of which have Chime as their primary banking service app. And, as we mentioned, this bank has found its niche: Chime is only available in the USA, and there is no information on whether it plans to expand to other countries.

The benefit of creating a digital bank is obvious. It is reasonable to transfer the entire business to the internet, save on renting premises, hiring staff and buying equipment, and still be in demand. But keep in mind that you need to identify the market needs before launching. Overall, if you develop a neobank app today, you are highly likely to find your clients while taking advantage of staying online.

How neobanks make a profit?

Perhaps you have a logical question that sounds like: Okay, I can create a neobank from scratch, it will have users and popularity. But how to make money on it?

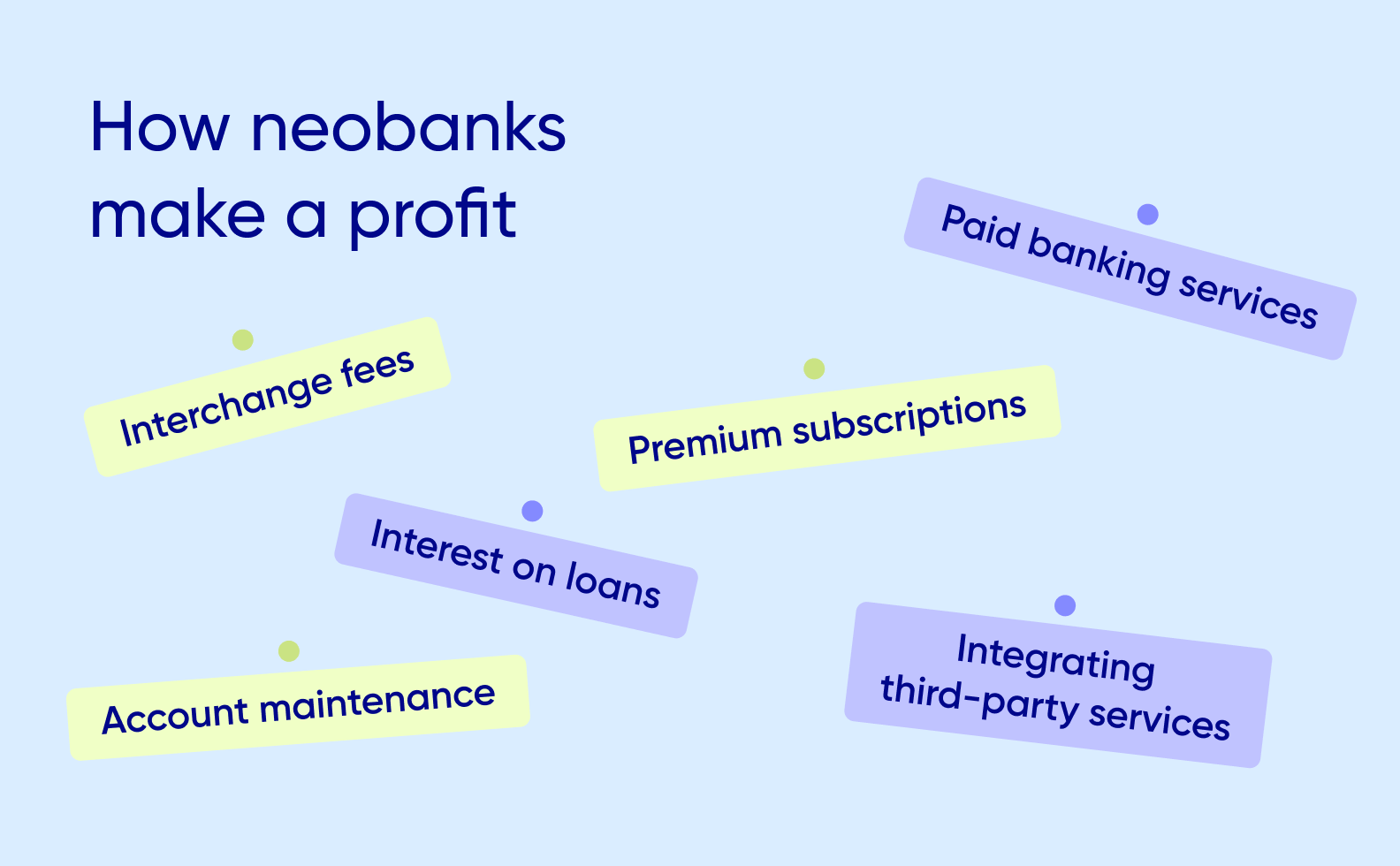

Generally, neobanks receive a large share of their profits from interchange fees paid to the company whenever a customer makes a purchase using a debit or credit card of the neobank. For example, the aforementioned Chime generated $950 million as revenue in 2021, mostly through this process. The 1.5% of the interchange fee paid by merchants to Visa for each transaction goes to the service provider.

Moreover, you can make a profit from accruing interest on loans, account maintenance, paid banking services, premium subscriptions, integrating third-party services in your mobile app, etc. Additionally, neobanks also profit from the interest earned on ATM fees.

Must-have neobank features in 2022

Now neobanks have both unique functions for the target audience and attractive solutions for the layman. If you are interested in how to start a neobank, check out its core functions that you will need to implement in the application.

Secure transactions and data storage

The number one thing you need to take care of when it comes to finances is security. Your application must protect customer data from fraudsters, potential hacks and data leakage. You also need to secure your server, where all customer information is stored.

Sometimes, neobanks are not protected in the same way as conventional banks, for example, they are not included in the guaranteed insurance fund, but they can establish a high level of cybersecurity, for example, using biometric verification and data encryption. If a digital organization is independent, it also must meet such requirements as ensuring the protection of user accounts, insuring clients’ money, and not using clients’ funds in business turnover.

If you use payment gateways that connect you to Visa or Mastercard, make sure everything is trustworthy and verified. Financial flows also need to be encrypted, here the 3-D secure protocol will help you. The overall sign-in flow should be simple, but safe. For your users, create an additional layer of protection by offering them to set a PIN-code to log into the neobank application.

Opening an account

Creating an account and getting a card is a must-have for any neobank application. It is the main product of the financial app. Through the account, the user interacts with financial flows, receives and withdraws money. Additionally, in the Current neobank, you can not only open a virtual account, but also receive a plastic debit or credit card. Such cards are already used by more than 4 million people in the US.

Basic financial operations

The most basic financial operations are money transactions, payment of bills and taxes, and debiting and crediting funds to the account. You can add currency conversion and additional banking products, such as savings accounts and deposits or an investment account.

Push notifications

Push notifications are a great tool to inform the user about their debits and credits or other actions with their account. Via push notifications users can also receive messages from the neobank itself about news and offers.

Nice-to-have neobank features

A useful banking application can be built only with basic functions. However, if you add optional but convenient and innovative solutions, it will help you stand out from the competition. Here are some popular additional features.

Personalization and use of AI algorithms

Companies are expanding the use of adaptive machine learning and artificial intelligence technologies. Machine learning and AI are real tools that select offers for each client individually and give them an accurate answer in a chat to reduce the time of contacting the bank during servicing. Personalization includes the ability to transfer money to a frequently used number, use a regularly needed service, and view up-to-date spending analytics. Ultimately, these instruments are supposed to increase conversion and bring you more customers.

Payment by QR code

QR code is one of the fastest payment methods. To boost the user experience, many companies already accept payments made using QR-scanner in the banking app. The buyer just needs to click a QR code button in the app interface. While China was the first to implement QR codes, the United States will catch up very soon. Going forward, QR codes use in the US will likely increase.

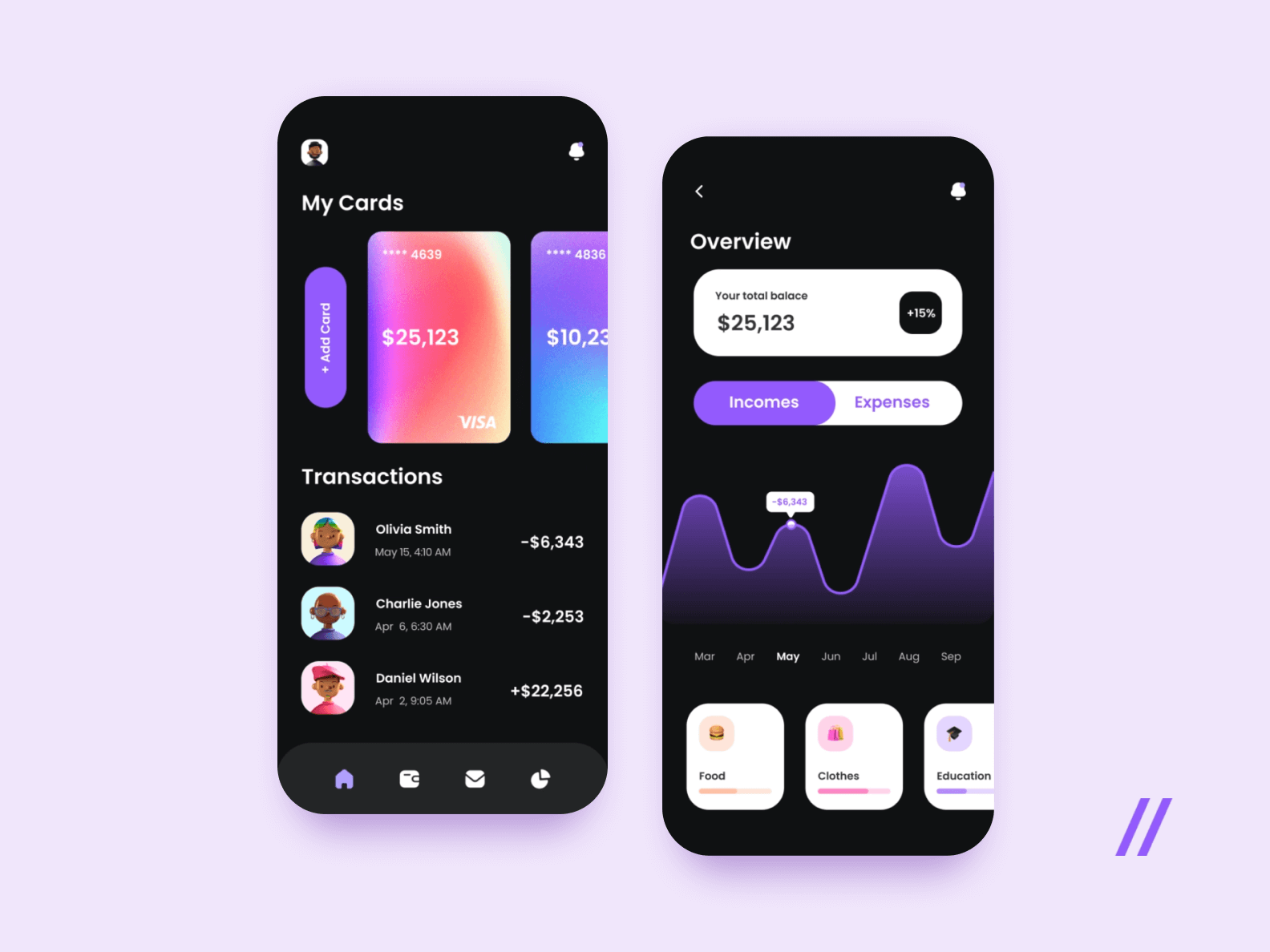

Dashboards and information boards

In the app, specially designated information panels can store user information. This can be an analysis of recent income or the most popular categories of expenses. Make sure that everything your neobank users may need is available on the dashboard without any unnecessary data or advertising.

What to consider before opening a neobank

Neobank is a FinTech company app, therefore, it interacts with money and must comply with the requirements and international standards. There are many laws regulating the industry, Including:

- Anti-Money Laundering Policy (AML),

- Payment Card Industry Data Security Standard (PCI DSS),

- Know Your Customer (KYC)

- General Data Protection Regulation (GDPR).

One more point to consider is a banking license. This is not a mandatory requirement, but an important signal that the bank has been verified by government authorities and can be trusted. The license gives the right to attract funds for deposits, payments via open bank accounts, and currency transactions.

Also, ensure that:

- Your banking services comply with the norms of the banking industry;

- Your app is protected from fraudsters and can run under high load;

- You use a suitable interoperable technical stack.

Define the set of programming languages, software development kits and frameworks that will fit your app, for example, use React Native for cross-platform development to make an app for both Android and iOS at once.

5 steps to start a neobank from scratch

Digital banking software development is not much different from other app development processes. To start a neobank, you need to go through several vital steps. Mind that it is always better to go for creating a neobank with an experienced team. It is also worth noting that it is rational to start with MVP (Minimum Viable Product). We’ll look at the steps of MVP development below.

Step 1: Define the project’s idea

You should start by choosing a niche and determining a target audience that potentially needs your services. Perhaps you should consider opening your neobank with the help of a partner bank. Think over the ideas, the concept, and the logic of the work. If you have any questions at this stage, contact experts who will help you with market analytics and estimation of the potential costs and time frames.

Step 2: Create a design

When developing an application, you need to think about the user experience. Find several references that the design team will use to create the best interface for the application. Take the time to analyze competitors’ solutions and user reviews about app convenience. Create a mindmap to make your design process easier. Then develop your neobank application together with the UI/UX team.

Step 3: Develop the app

Your next step is to build a neobank application. Our experienced team has identified the most convenient tools, but there are other options. To develop a desktop application, we recommend an Electron.js framework, for the web version — React.js and Node.js JavaScript libraries, and for the mobile app, React Native will suit you best. Don’t forget to take into account the subtleties of the banking industry, as they are strictly regulated.

Step 4: Test the app

After many years of experience, we realized that the ideal approach is to test the application in parallel with development. So, errors can be detected early, and not after the hard and time-consuming work stages. QA (Quality Assurance) will help to remove all bugs so that your application works efficiently.

Step 5: Release the app and get feedback

At this stage, your application is completely ready, and you need to open it to users. Ask the first of them to evaluate your application and rate some aspects of its operation. Offer your clients to leave comments and suggestions. Thanks to the feedback, you will have ideas about what can be fixed and improved.

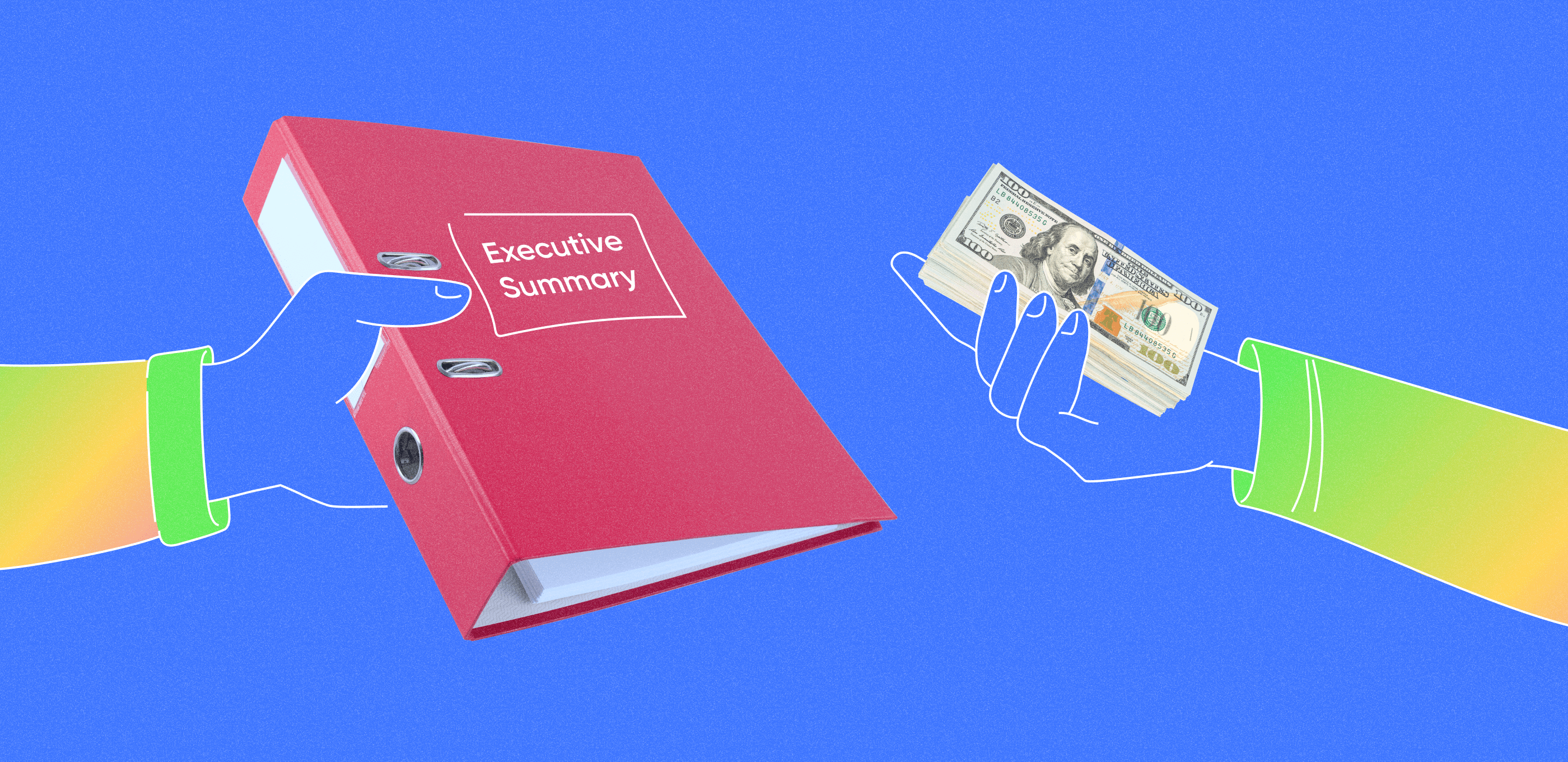

How much does neobank development cost

At Purrweb, we can help you estimate your project cost and timeframes of the development. Our team will design and develop your neobank app taking into account all your wishes. If you’re going to build a neobank app, take a look at how we estimated the pace and cost of developing an application with a basic set of functions:

| Stage | Estimation in hours | Estimation in weeks | Approximate costs |

| Project analysis | 8 hours | 1 week | $0 |

| UI/UX design | 185 hours | 7 weeks | $8 325 |

| App development stage | 900 hours | 10 weeks | $54 000 |

| QA Testing | 450 hours | In parallel with the development | $9 000 |

| Project management | during the whole project | during the whole project | $7 500 |

Overall, the neobank development will cost you $77 625.

To get a more accurate estimate, please contact us, and we will provide you with a personalized offer.

Summary

Now that you’ve read our guide, you know what to do if you want to start a neobank app. When creating a neobank, you are not constrained by the strict limits of the traditional banking industry, so you have more opportunities to find solutions that the younger generation needs. You do not need to spend money on offices and staff, so the initial investment will be significantly less.

If you are interested in more detailed information or an individual consultation, fill out the form and the Purrweb team will contact you.