Key takeaways

- Fintech is an industry consisting of firms that use technology and innovation to improve and optimize financial services.

- Global fintech adoption is growing and the market volume of fintech companies is expected to grow six-fold by 2030. There’s huge potential in this field.

- To launch a fintech startup, you need to outline the plan, create the design, turn the design into code, test and launch the app, and take care of maintaining and updating your product. Pay attention to marketing and security measures.

- In general, starting a fintech company will cost an estimated $73,700.

What is a fintech company?

Fintech, which stands for financial technology, refers to the field of innovative financial products and services that are offered online. The fintech industry uses cutting-edge technologies to compete with traditional financial service providers.

Fintech solutions range from convenient payment/transfer apps to advanced software for insurance, finance management, financial planning, and much more.

Fintech is not only about convenient and accessible digital payments solutions. Innovation-focused companies improve financial data and security for customers with robust fraud protection measures. All of this helps financial institutions earn the trust of their users. Even now, the fintech sector is expanding, so we are to see many other great features like eco-friendly solutions.

Types of fintech firms

Digital bank — a bank without physical branch offices. Offering fintech services via online platforms, it improves quality, saves time and costs, all while increasing personal data security. Digital banks goes through the rigorous process of obtaining a banking license, so they are much more trustworthy.

Investment apps — apps that help users make investments in the stock market and manage your assets. You can choose securities, metals, commodities, funds, etc.

Crypto apps — apps that allow users to interact with cryptocurrencies. With their help, users can invest, get information about exchange rates, earn from buying and selling assets, store their savings, and even collect unique NFT tokens.

Insurtech — companies that use modern technology in the insurance industry. The most popular is auto insurance, although health, life, real estate, and travel insurance are also in demand. New technologies in this sphere create an ecosystem, so clients can solve all necessary issues in one app.

Personal finance management — a personal finance app allows users to monitor their financial resources. Tracking expenses and allocating income and savings to achieve various goals. Users can also track cash flows and view deadlines for loans and installment payments.

We have listed the simple steps to start a fintech company below. You can click on the relevant heading in the content on the right to skip through the sections. Besides the step-by-step, it’s important to know the context, complexities, trends, market statistics etc. All of these areas are important to consider before starting a project.

What’s special about fintech companies

Fintech organizations have several characteristics that set them apart from their peers in other industries. We’ve outlined the main ways in which they differ.

Modern technologies. Fintech firms are committed to technological advancements. They use new technologies such as artificial intelligence, blockchain, machine learning, and big data analytics, to create innovative tools for the financial sector.

Flexibility. Fintech companies are more dynamic, so they provide services and process financial transactions faster. They adapt quickly to market changes and rapidly develop and introduce new financial products.

A customer-centric approach. Fintech companies put the needs of their customers first. Unlike the apps of traditional banks, fintech apps are more personalized and responsive to individual requirements, making them much more user-friendly.

Financial inclusion. It is estimated that about 1.5 billion adults worldwide are still unbanked, and another 2.8 billion don’t have bank cards.Fintech companies promote financial inclusion and can reach a segment of the population which may not be able to gain full or easy access to financial instruments.

Current fintech market trends

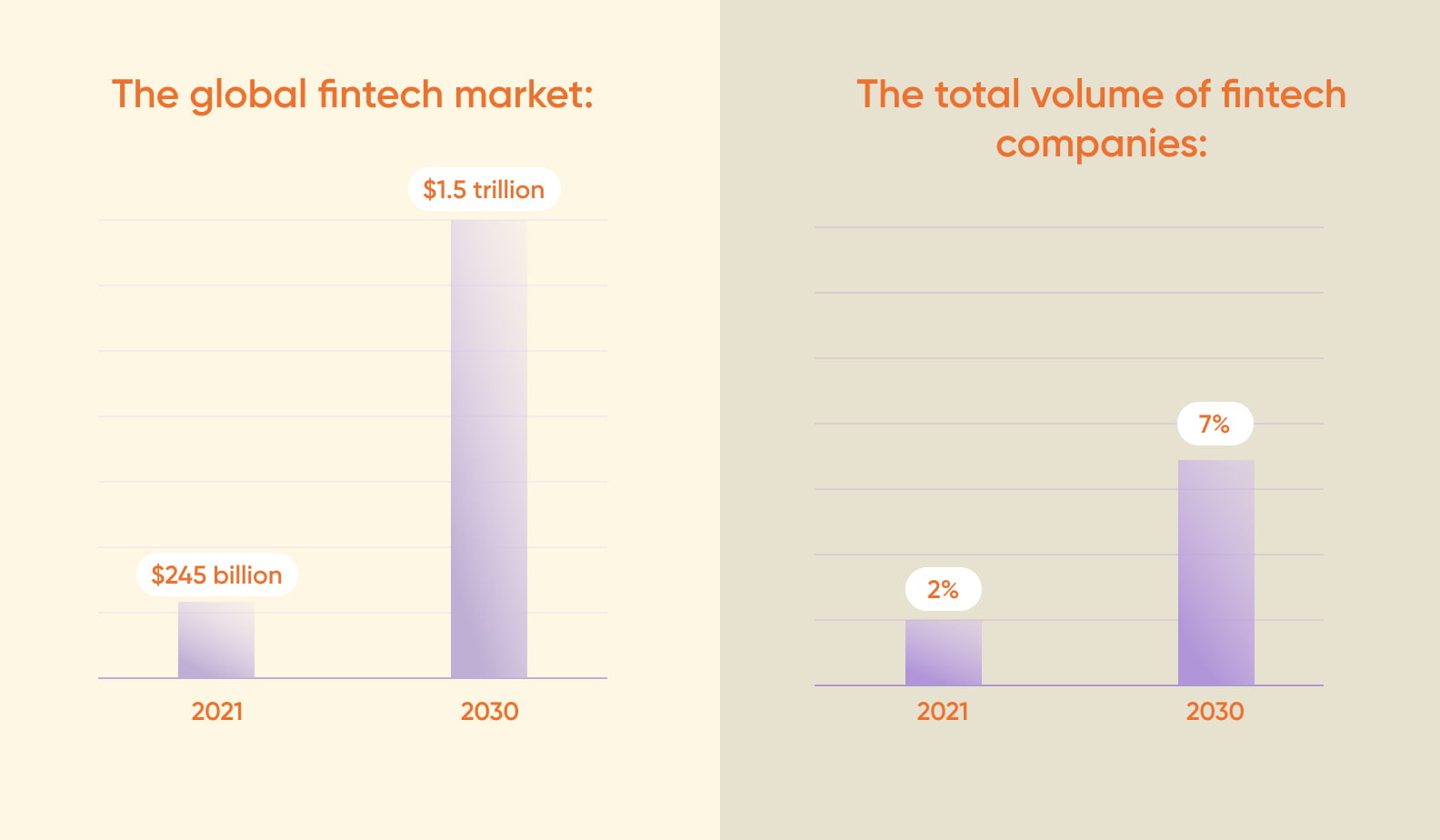

Fintech app development is gaining traction, according to a 2023 report by Boston Consulting Group (BCG) and QED Investors. The global fintech market is projected to grow from $245 billion in 2021 to $1.5 trillion by 2030, a significant six-fold increase.

At BCG, professionals believe that the development of fintech is still at an early stage and that this trend will continue to revolutionize the fintech industry. However, fintech startups still have a long way to go to compete with traditional banks.

Fintech holds great potential with experts suggesting that the total volume of fintech companies in the global financial services industry will grow from 2% in 2021 to 7% in 2030, amounting to $21.9 trillion. Currently, the key fintech market players are North America, the UK, and the EU.

Current fintech market trendsIn January 2023, PayU, an international payment integrator, identified the main trends that will shape the future of fintech:

1. Cross-border payments transformation

Fintech seeks to optimize internal processes and reduce costs. Financial companies are introducing new business models that help make cross-border payments faster and cheaper. This trend is aimed at meeting the needs of people making purchases from international retailers and e-commerce that requires international money transfers is driving this transformation.

2. Payment systems innovations

Fintech is utilizing cutting-edge technologies. One of the trends in fintech in 2023 will be trying to stay relevant among the competition and businesses must embrace modern payment solutions like crypto, to ensure they remain relevant. They will have to create modern payment systems and products with an eye on customers.

The popularity of cryptocurrencies and blockchain systems is growing and you can make the most of these technologies to catch up with the new advanced companies. Keep in mind that not all governments approve crypto payments and seek to regulate this sphere to make it transparent and secure.

3. Consumer and payment security

Digital payments require an additional level of security and online fraud prevention. According to Statista: in 2022, the global e-commerce market lost more than $41 billion to criminals, and in 2023, it risks losing another $48 billion.

As people move away from cash and make more purchases online, companies must take extra care to remain secure, while complying with local laws and using advanced security protocols.

4. Transparency of payments

Fintech institutions want to remain transparent, as this attracts users and increases trust. The trend in 2023 will be not only to maintain the existing level of transparency but also to make loan pricing more clear to consumers.

Credits and lending are popular right now because of the macroeconomic environment, so it’s increasingly important to introduce technology that will protect people from getting into bad debt. Inflation and the cost-of-living crisis are challenges that fintech firms will have to deal with, in order to gain trust they should build upon transparent systems and technologies.

5. Green fintech

Fintech embracing “green” development has grown over the last year, however many analysts still say it won’t be fully formed for another 5 to 10 years. The trend will accelerate if regulators and society demand that ESG (environmental, social, governance) sustainability parameters be used to influence funding decisions.

Governments are increasingly adopting carbon-neutral programs, fintech and banking industries are evolving, and potential investors are attracted by green projects. An example of a green fintech solution we created at Purrweb is a carbon accounting platform for controlling CO2 emissions.

What are the most outstanding fintech companies globally

The modern finance industry is changing the way we manage our money, maybe you use at least one of the fintech apps already. From payment applications to investment platforms, various solutions have made a significant impact globally. Here’s a list of the financial market leaders from different areas such as digital banking, payments, and blockchain technologies.

Each successful fintech app and business model is unique, and their features may not fit your app. Do the research, but don’t feel pressured to cramp your app with features you don’t need. But still, these are the best fintech businesses in 2023.

Stripe — Europe

Stripe is an Irish-American technology company that develops solutions for electronic payment acceptance and processing. The main function of Stripe is to enable businesses to quickly and securely accept payments over the internet.

This paytech company has the following functions:

- financial transactions processing

- international payment processing

- subscription management

- customizable checkout pages

- detailed reporting and analytics

- advanced fraud detection mechanisms

Square — North America

Square is a financial technology company based in the US. It enables small businesses and individuals to accept electronic credit card payments. It offers innovative hardware and software solutions to facilitate financial management.

This is also a paytech firm, featuring:

- payment processing

- peer-to-peer payments

- point-of-sale transactions

- mobile banking services (via Cash App)

- lending service for small businesses

Ant Financial — Asia

This is a technology company that offers modern fintech services and operates primarily in China as a subsidiary of the Alibaba Group, a huge Chinese conglomerate. This fintech company is part of the open banking segment.

It offers:

- digital payment processing

- investment options

- cloud computing services

- insurance services

- web and mobile banking services (deposits, loans, and cross-border payments)

Nubank — South America

Nubank is a Brazilian fintech company that offers digital banking and financial services. This is a “challenger bank”, a small retail bank that competes with the longer-established banks to deliver services online. Nubank is one of the leading fintech companies in Brazil.

There, you can find:

- digital banking (bank accounts)

- peer-to-peer payments

- investment options

- credit cards (available in the mobile app)

- B2B banking solutions

- financial management tools

- loyalty programs

Polygon — Asia

Polygon is an Indian blockchain company that provides solutions for developing decentralized applications (dApps). It solves the scalability problems of blockchain networks with a focus on the Ethereum network, in particular. Interestingly, Polygon is carbon-neutral, which is a great green initiative.

Polygon’s digital payments solutions comprise:

- the transfer of assets

- a crypto wallet

- deposits and withdrawals between networks

- decentralization of the network

- the ability to create dApps

- a software development kit

Why you should launch a fintech startup

There are many benefits financial technology companies bring to society. B, but what about the company owner? Here, we’ve compiled the top advantages a fintech startup has to offer.

| Advantage | Explanation |

|---|---|

| 🏠 You can start your business from home | You don’t have to have a physical storefront or office space to start your business. You can do everything from home, at least at first. However, you may need to set up a call center and plastic card delivery service as you grow. |

| 📈 Scalability | You can grow and expand, and there will always be new features, products, and services that you can add. What’s more, a fintech startup can be turned into an entire ecosystem over time. Use several business models and pricing tiers to reach all types of customers. |

| 💰 High margins | Gross margin is a financial metric that measures the percentage of revenue your business has after paying the cost of goods sold. A high gross margin means that your business is making a lot of profit. |

| 📇 Readily available information | When you start your fintech startup, you will have a wealth of information available online. Search for insights on professional forums, watch YouTube videos, and check financial news. This will help eliminate questions, doubts, or concerns you may have. |

| 💵 Unlimited income | When starting a fintech startup, there is no limit to the size of your income. It all depends on how many customers you attract and how good your marketing is. The stronger your business skills are and the more time you invest, the more you can earn. |

What you should know before starting a fintech company

Before you start a fintech company, it’s important to learn about the common pitfalls and challenges presented in fintech. The more you learn about this field in advance, the higher the chances are for your startup’s success.

| Challenge | Explanation |

| 😈 High competition | The finance industry has been actively developing in recent years and there are already many big names. Rivals could be more successful and popular. You will face high startup competition, but if you choose the right target audience, you can carve your own niche and get new clients consistently. |

| 🆘 Need for constant maintenance | With a fintech startup, you’ll have to protect yourself from cyber threats and hacking, implement security protocols, and constantly keep the site up and running. Find top app developers who will help you. You’ll also have to devote time to promoting your blog and advertising to stay in sight of those searching for you on the web. |

| 👫 Difficult to build trust with customers | Digital products cut out personal interaction with customers and tangible products. This can make it harder to build trust. It will take careful work with each customer and plenty of personalization to win over the target audience. |

Another industry-specific factor to keep in mind is legislation. You have to comply with all local and federal requirements in order to get a business permit.

Laws regulating the fintech industry include:

- The General Data Protection Regulation (GDPR)

- The Payment Card Industry Data Security Standard (PCI DSS)

- Anti-Money Laundering Policy (AML)

- Know Your Customer (KYC) verification policies

How to start a fintech company in 6 steps

When you decide to start a fintech startup and create your fintech app, we recommend starting with an MVP. A minimum viable product is a version of the product that includes only the core functions, which is perfect for launching a functional product quickly and within a limited budget. It’s the best option if you want to test your idea on the market with low risk.

Step 1. Analyze the target market and draw a plan

To launch a successful startup, you need to analyze the current market. Keep an eye on what your competitors are up to. Think about the features you would like to have in your minimum viable product: from simple ones to advanced ones like a chatbot with artificial intelligence. Choose the essentials and don’t overload the first version of the app.

Step 2. Create a design

You need to create a clear, modern design. Research your competitors and decide what you like and dislike. Next is to ensure the designers make your app functional and easy to use. At Purrweb, we first create mind maps and wireframes to make sure the design fits your needs and then turn them into live clickable prototypes.

Step 3. Develop the app

After the designers finish their work, they pass the prototypes on to the developers. Programmers write the logic of your app using the top tech stack and then code the server side and the user side. For a financial application, you’ll need to integrate APIs and a payment gateway, which will also appear at this stage.

Step 4. Test the app

No matter how experienced your team is or what tech stack you use, set some time aside to test your app. Quality assurance will help you fix bugs and deal with potential issues. Once tested, your application will run smoothly and users will have a better experience. As professional app developers, we believe that it’s better to start testing your app in parallel with the development process to remove bugs early on.

Step 5. Release the app and collect user feedback

When you are done with all the previous steps, you can release the app. Put it out in the App Store and Google Play and engage your target audience. Collect feedback from your first users to make adjustments. Think about improving your customer acquisition strategy to keep up with competitors.

Step 6. Maintain the app

The release is not the final stage, as the application needs to be maintained, updated, and fixed as needed. You may also decide to add new features as you grow. Our team will always help support the product after launch.

How much does it cost to start a fintech company

Now that you know all about the development process, let’s look at the costs. To build a successful fintech startup, you’ll need to find experienced financial app developers. At Purrweb, we have more than 9 years experience creating MVPs, check out our portfolio to learn more.

To show you a real-world example, we’ve decided to evaluate the MVP with features like that of Stripe, a paytech app. Here’s how our software development team estimates the cost and timing of each stage of app creation.

| Stage | Estimation in hours | Estimation in weeks | Approximate costs |

| Business process project analysis | 40 hours | 1 week | $1 200 |

| UI/UX design | 150 hours | 5 weeks | $7 500 |

| App development stage | 950 hours | 6 weeks | $47 500 |

| QA Testing | 380 hours | In parallel with the development | $7 600 |

| Project management | during the whole project | during the whole project | $9 900 |

Overall, fintech app development will cost you approximately $73 700. To get an individual offer, contact our development team. If you are interested specifically in personal finance management app costs, check out our guide.

How we launch fintech startups: Purrweb’s cases

Our team has experience in creating functional MVPs for financial companies. In this section, we will tell you about our best web and mobile apps.

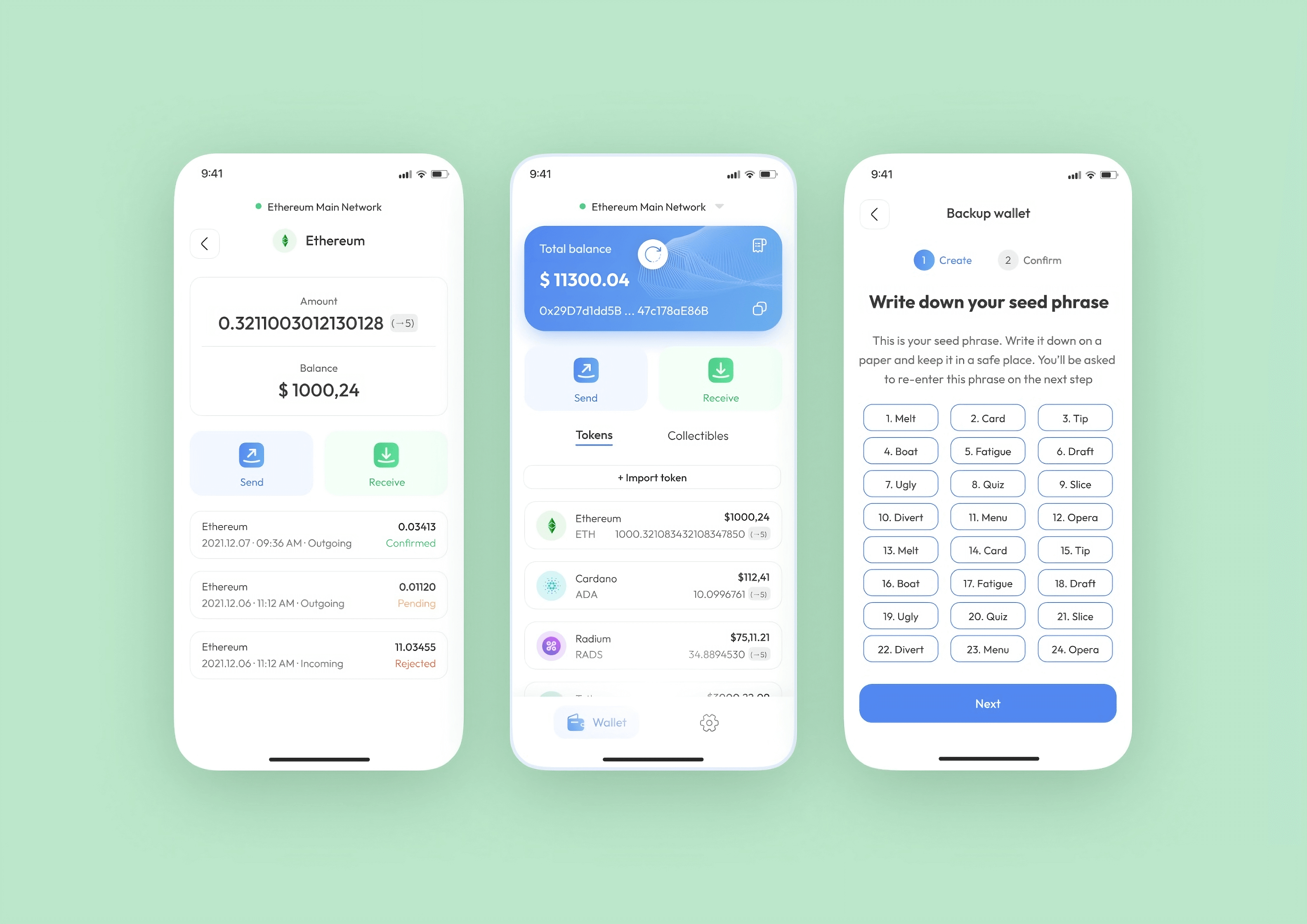

A mobile crypto wallet

Our development team can handle complex tasks involving advanced technology. We created a crypto wallet for storing, exchanging, and converting cryptocurrencies. On the main screen, the user finds their total balance and a list of their tokens, they can also quickly send and receive tokens.

This fintech app supports financial transactions and has advanced security protocols to keep the user’s funds safe. Learn how we made a mobile multicurrency crypto wallet.

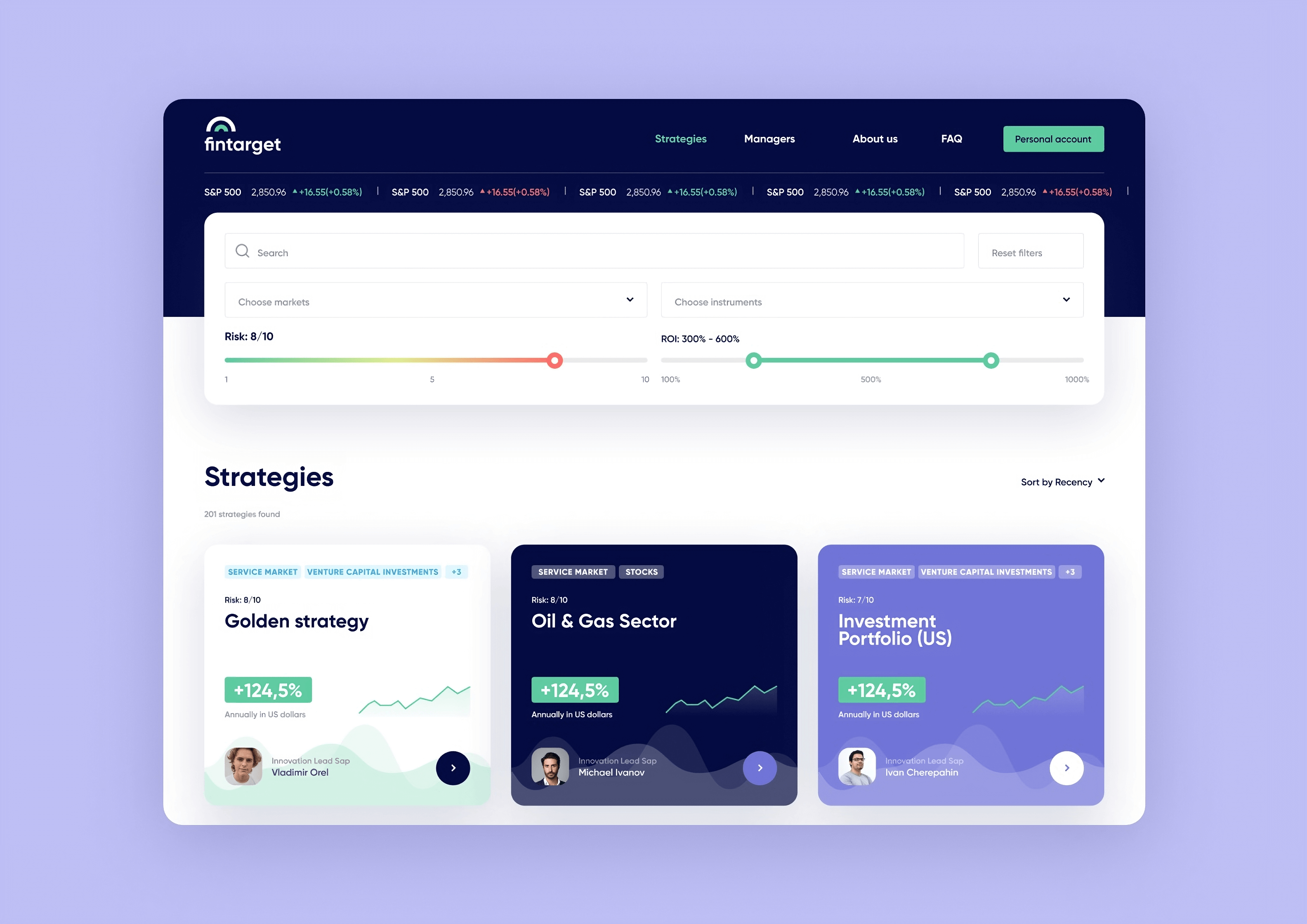

A trading platform

Fintarget is a platform for brokers and investors, which provides tools for searching and placing investment strategies and allows users to generate passive income.

In this app, you can find an investment account, financial transactions feature, a dashboard with statistics, and a knowledge base. Here’s how Purrweb’s development team launched an investment strategies app.

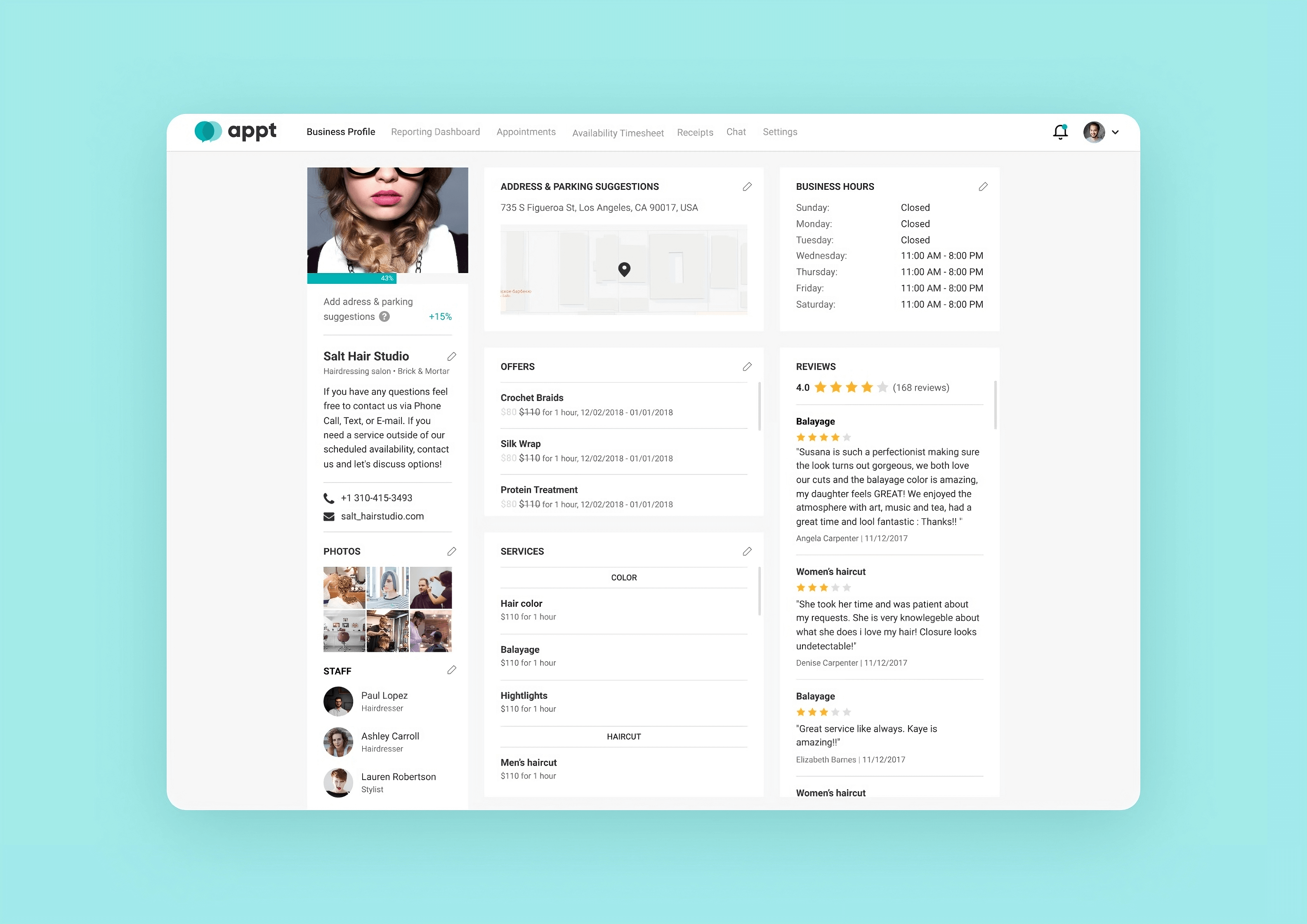

A business profile platform

We created a smart business tool called APPT. APPT is a smartly designed fintech web app tailored to cater to the needs of individuals and expanding companies. It facilitates the efficient organization of their online presence and streamlines lead generation.

We added onboarding, a business profile, a reporting dashboard, appointment scheduling, and much more. Now entrepreneurs and businesses can establish their professional websites, showcase a range of services they offer, and let clients conveniently book service providers online.

If you like this app type, we can build a similar platform for you. Fill out the form below!

How to raise venture capital to finance your fintech company

When the idea is ready and there are plans to create an app, fintech entrepreneurs face a common challenge of funding the project. This is where they look to raise venture capital or seek strategic financing to start a fintech company.

Venture capital for fintech business is a popular option, as venture investors are usually willing to take more risk in exchange for potentially high returns on investment. However, in recent years, alternative funding sources for fintech startups have emerged, providing business people with a range of options for financing their companies. Let’s go over what some of these are.

Crowdfunding. The popularity of crowdfunding in financing the fintech business has increased dramatically. Crowdfunding is a method of raising funds for a project by collecting small amounts of money from many people, typically online. Allowing companies to reach out to a wide audience and ask for financial support to start a fintech startup.

Angel investors. Another viable option for fintech startups is angel investors, who not only provide financial support but also bring valuable experience and mentorship. Like the TV show Shark Tank in the US or Dragons Den in the UK.

Debt financing. You can also use debt financing, although it involves interest payments and collateral requirements. Still, it may be a less risky choice compared to equity financing for companies with a stable revenue stream.

Equity financing. This remains the traditional method of raising capital for fintech companies, allowing investors to receive an ownership stake in exchange for financing.

Seed funding. This is a common form of equity financing, done through family, angel or crowd funding. Allowing early-stage companies to obtain the necessary funds for initial operations.

Bootstrapping. This is a way to finance a company using personal savings or income generated from the business itself. While this method may be slow, it gives founders more freedom, control and flexibility.

Build a fintech startup with Purrweb

We are a team of professionals ready to help business enthusiasts from all over the world to develop web and mobile applications. Our goal is to help startups validate business hypotheses quickly and efficiently. You can test any idea in the market by creating an MVP, the very first version of a product.

We develop fintech apps that bring convenience and transparency to financial systems of all sizes. From home budget monitoring and wallets to banking apps, ERP systems, and trading platforms. Read more about our previous projects and check clients’ reviews to get to know us better.

Benefits of developing a financial app with us:

- Industry expertise

- Customer-centric approach

- Full-cycle development

- Professional MVP development

- Two-week sprints that increase flexibility

- Transparent and well-established communication

- Constant client support

- Post-release product maintenance

Start a fintech startup with Purrweb to take a major step towards becoming a unicorn. Fill in the form and get a quote today.