Key takeaways

-

- A banking app allows you to send and receive money, view previous transactions, make deposits, and pay bills from your smartphone or laptop.

- The main types of banking apps include: apps for peer-to-peer transactions, apps for banks with physical branches, and online banks.

- Must-have banking app features: current balance dashboard, transaction history, secure payments and transfers, customer support, and two-factor authentication.

- Banking app development will cost you about $86 750 and take around four months.

What is a banking app?

A banking app is a platform that allows you to access your bank account from a smartphone or laptop, send and receive money, view previous transactions, make deposits, and pay bills. Users of the banking app are clients across various regions and ages.

There are three types of banking applications:

-

- for peer-to-peer transactions only (PayPal, Venmo),

- for old-school banks with physical branches (Bank of America, Citibank),

- for online banks with no branches (Ally Bank, Chime).

In this article, we will focus on cross-platform app development that is suitable for all types.

Types of mobile apps for banking

Today, there are many types of mobile banking services out there, each serving a different type of client. To help you build a mobile banking product, we’ll go over the most popular types of mobile banking apps:

Retail banking apps

These are the most standard banking apps developed by commercial banks like Citibank or Wells Fargo. They allow both individual clients and businesses to manage their bank accounts and make money transfers.

Banking apps for business accounting

Business accounting apps provide businesses with a convenient way to manage their funds. Applications like Xero and Wave offer a complete set of features for expense control, reporting, and general bookkeeping.

Investment apps

One of the more recent types of mobile banking apps, investment apps are meant to help investors manage their portfolios and learn about new investing techniques. Apps like Stash and Betterment offer smart investment recommendations based on current market conditions.

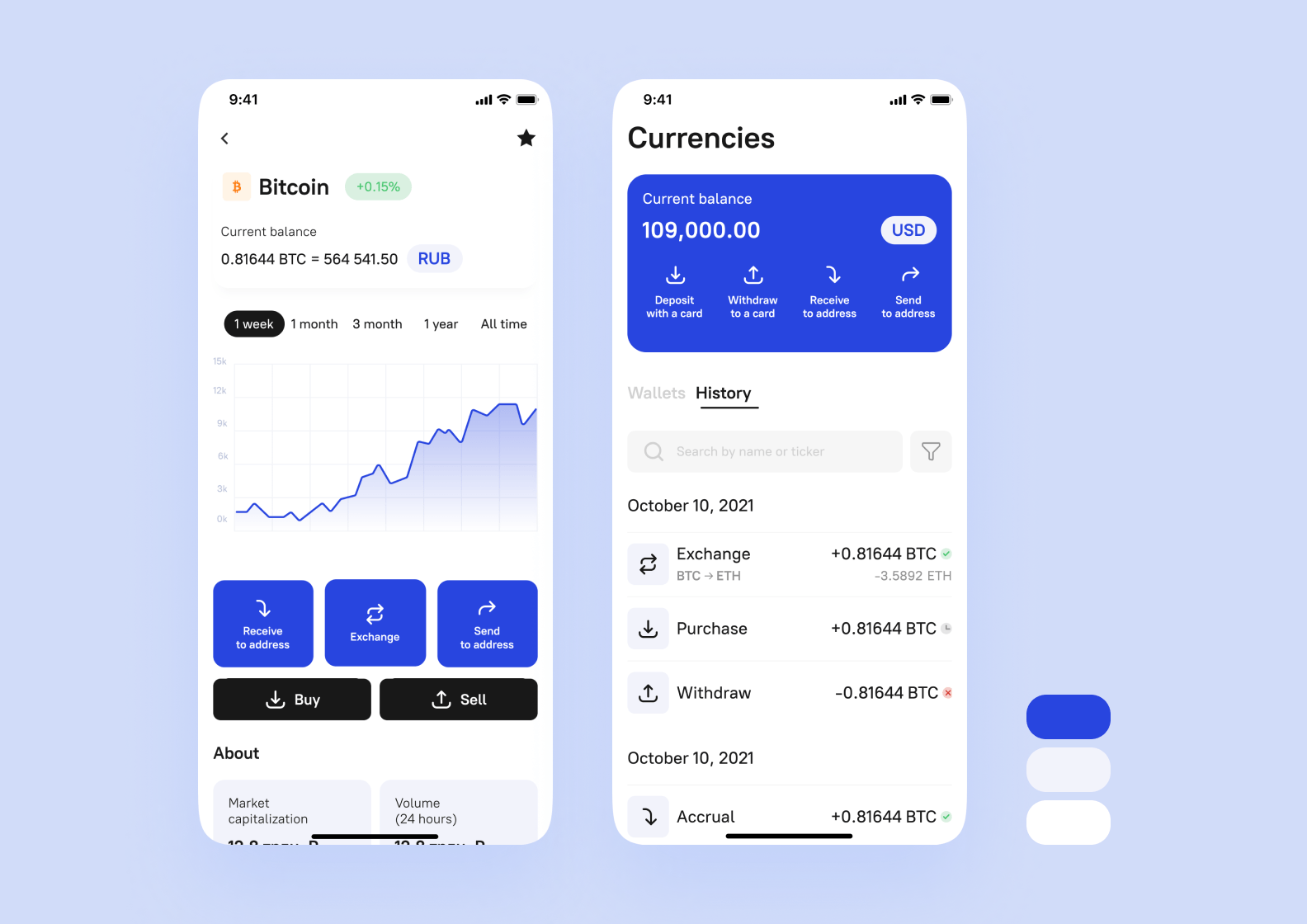

Cryptocurrency trading apps

These apps allow users to purchase and sell cryptocurrencies like Bitcoin and Ethereum. Prominent crypto exchange platforms such as Coinbase and Kraken have built engaging mobile apps offering numerous features for managing crypto assets.

Expense tracking and budget planning apps

Applications of this type are designed for managing personal finances and tracking daily expenses. Among the most popular are Mint and YNAB (You Need A Budget).

Digital payment apps

These apps allow individuals and businesses to send money transfers and pay bills. Platforms like PayPal are more focused on individual clients, while services like Stripe help businesses handle online payments.

Apps for peer-to-peer transactions

Built for quick peer-to-peer money transfers, mobile apps like Cash App and Wise are popular for their user-friendly design and convenient features.

Loan management apps

While not as widespread as other mobile banking services, these apps allow users to get personal loans and view their credit scores. Some of the best examples include Upstart and Fundbox.

An overview of the mobile banking market

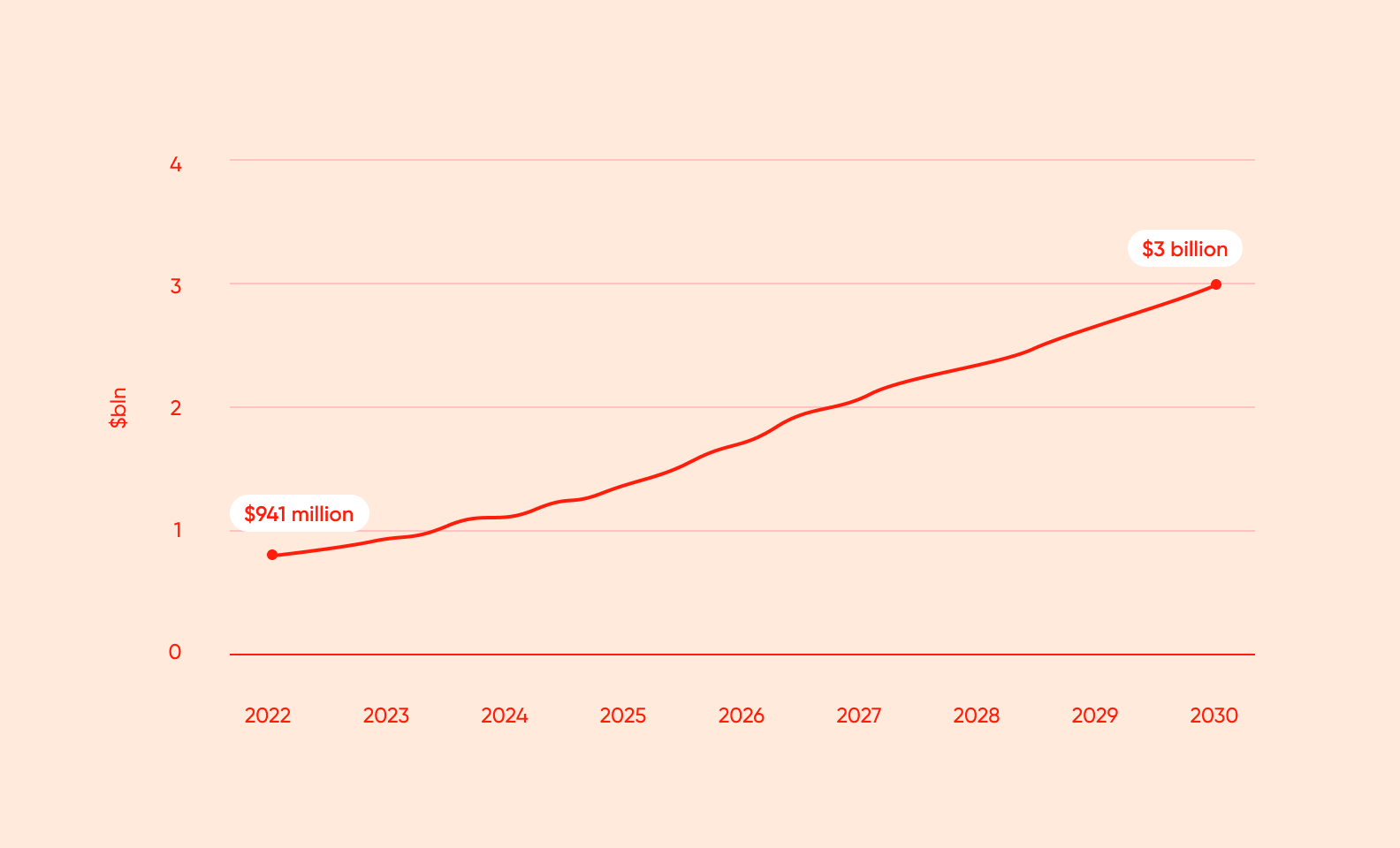

Mobile banking is on the rise. Valued at $941 million in 2022, the market is expected to reach more than $3 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 15% — which is staggering for a niche that appeared less than 20 years ago. The main factors that drive the demand for custom banking apps are the rapid spread of available smartphones, the increasing popularity of digital services all over the world, and the digitalization of financial institutions.

Current trends in mobile banking

If you aim to enter the mobile banking market, it’s crucial to understand the direction in which the industry is going. Let’s take a look at the 8 most important trends in this segment.

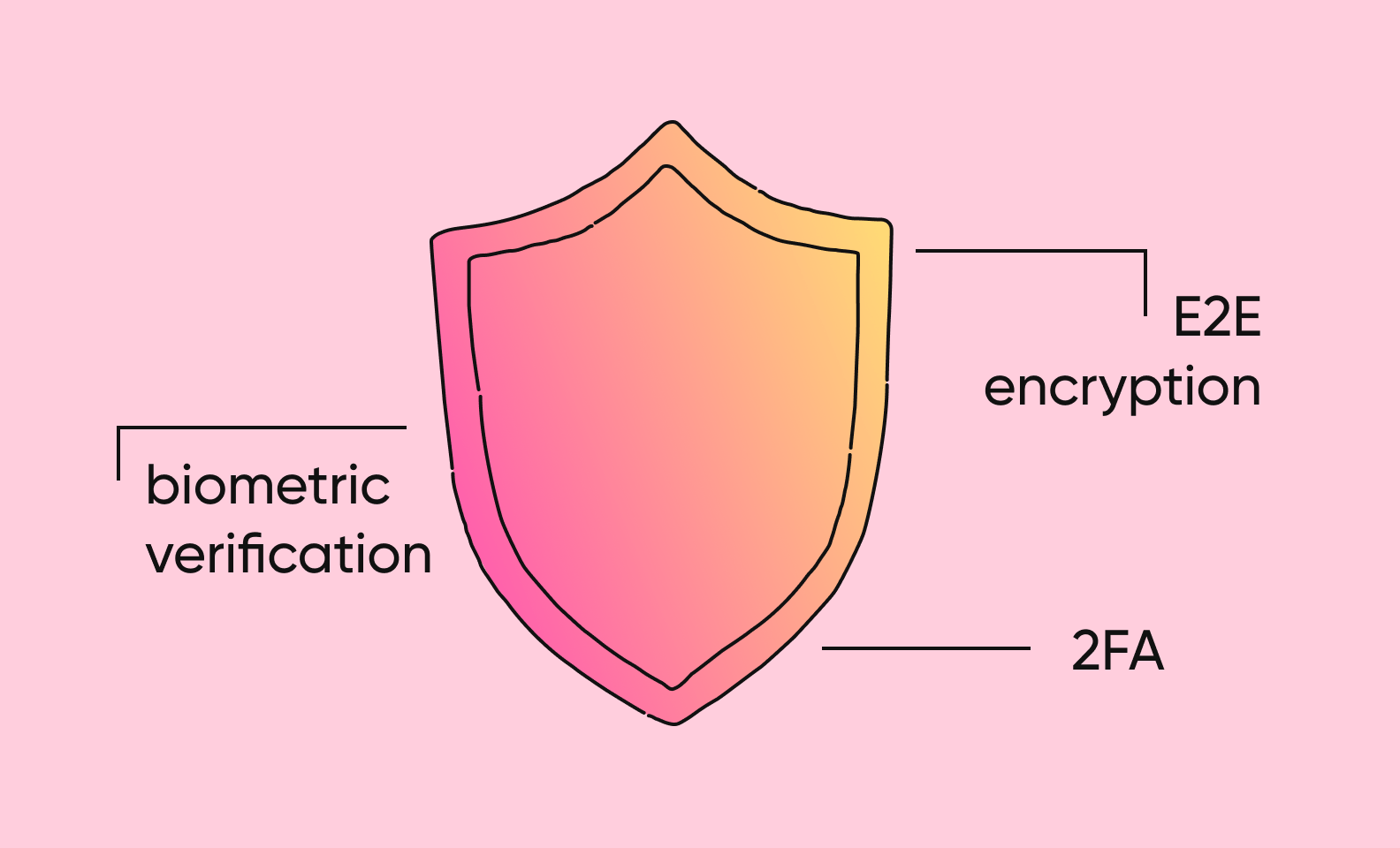

1. Advanced security measures

When running a mobile banking app, you routinely deal with highly sensitive information pertaining to your customers — card numbers, phone numbers, addresses, etc. Any breach will result in major reputational damage and financial reparations, so robust security is a must. You can use end-to-end encryption, two-factor authentication, biometric verification, and multiple other security measures to ensure that no data falls into the wrong hands.

2. Big data analytics

Your mobile banking app will inevitably generate colossal amounts of information, and you’ll benefit hugely from finding the right use for it. By analyzing consumer behavior and preferences, you’ll be able to improve your service across all platforms, offer a more personalized experience, and reveal any problematic places in the user journey. It will also help you fight fraud, as machine learning models can identify patterns associated with fraudulent behavior.

3. International transfers

We live in an increasingly interconnected world. Traveling is as accessible as ever, digital nomads roam the planet, and big businesses form complex supply chains that span dozens of countries. This means that people often have financial ties across multiple borders, be it with their families, employers, or anyone else. Mobile banking solutions such as international transfers allow customers to easily move funds between different countries, thus giving you a great competitive advantage.

4. Blockchain integration

Blockchain is a revolutionary technology that powers Bitcoin, Ethereum, and other cryptocurrencies. However, it actually has much wider applications beyond crypto networks: with blockchain, you can facilitate digital transactions, securely store sensitive data, and audit transaction history to prevent money laundering and fraud.

5. Personalization

Personalization is the defining trend, not only in internet banking but also in the entire segment of digital services. By offering targeted recommendations, offers, and promotions, you foster trust and loyalty among your audience — the more attention you pay to your customers, the more competitive edge you gain.

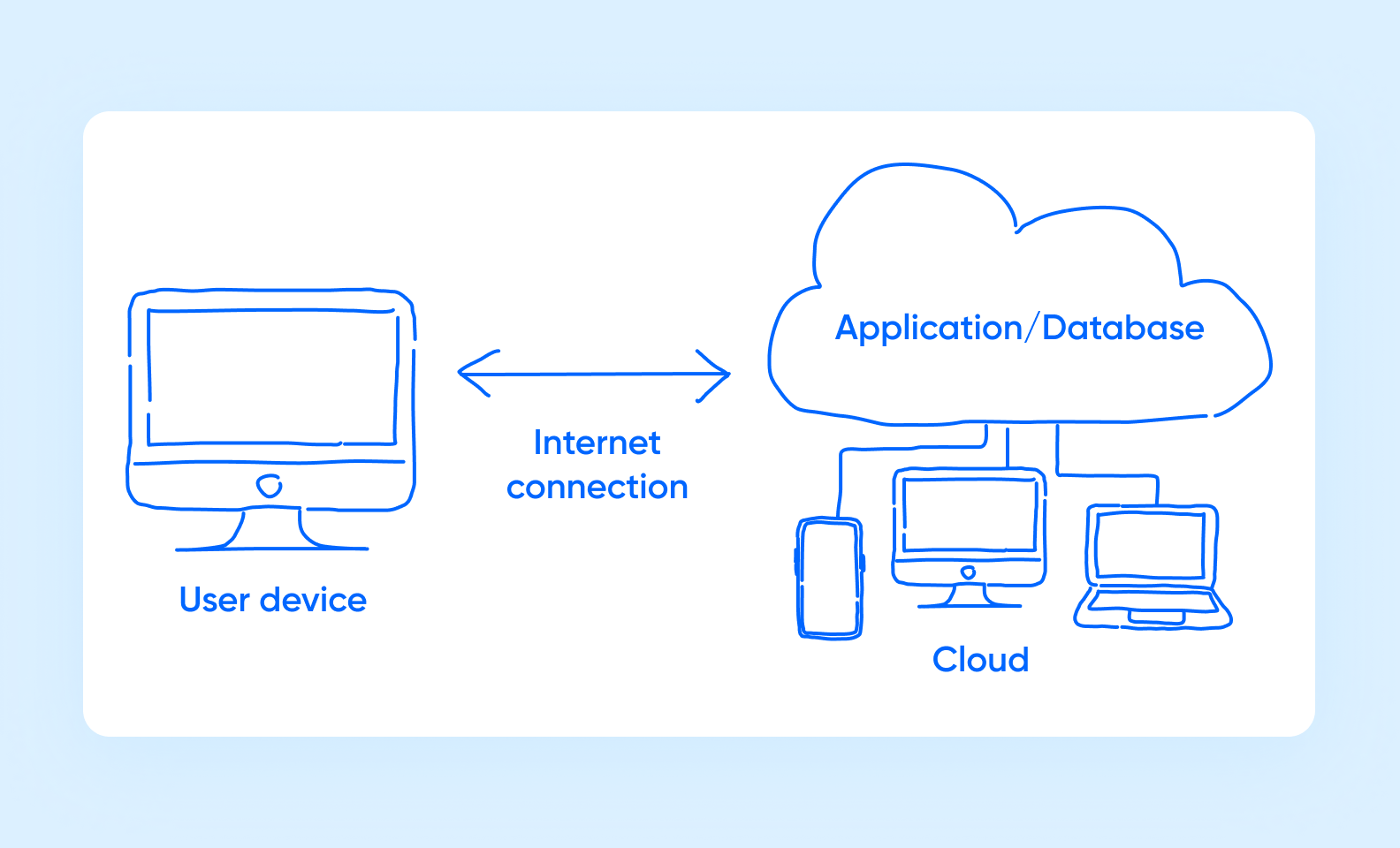

6. Cloud computing

With cloud computing, banks can store and manage various data on remote servers. Such mobile banking solutions replace cumbersome on-premise infrastructure, thus greatly reducing both capital expenditures and ongoing operational costs. Cloud platforms also provide the opportunity to rapidly develop, test, and implement new features, making the business much more flexible.

7. Sustainability

Like any other digital service, mobile banking operations rely on data centers that consume massive amounts of electric energy. By adopting sustainable practices, banks can reduce their carbon footprint, minimize electronic waste, and contribute to global efforts against climate change — all the while boosting their reputation and receiving positive media coverage.

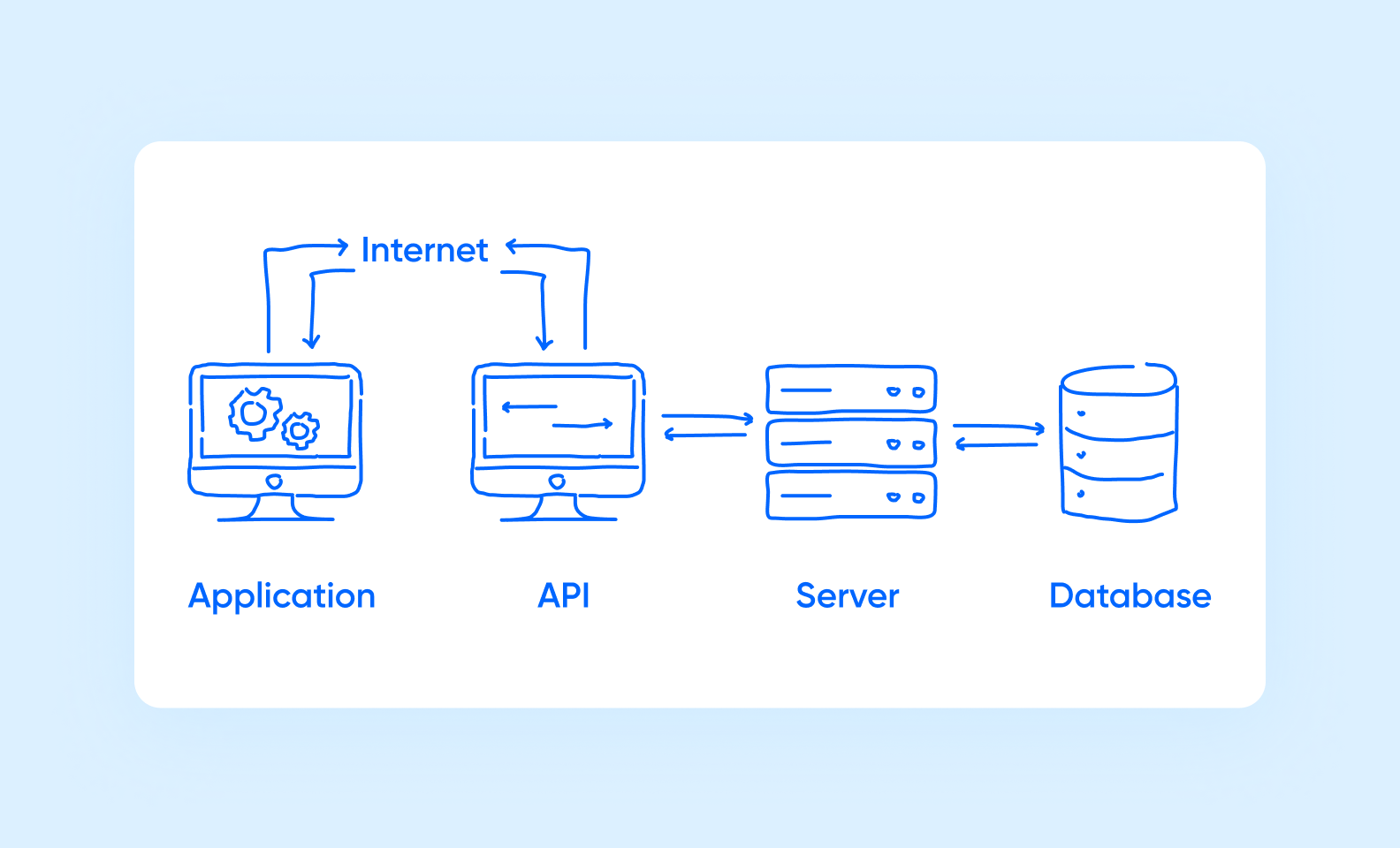

8. Open APIs

On a basic level, application programming interfaces (APIs) enable two or more computer programs to communicate with each other. With open APIs, banks can collaborate with their partners to offer personalized and specialized solutions that cater to specific customer needs. You can also use APIs to create financial ecosystems by seamlessly integrating multiple services under your brand.

Why should you go for launching a banking app?

The fintech market for mobile banking applications is large, with a growing customer base and opportunities for new products to appear and expand. Many people turn to digital banking for convenience and lack of extra hassle.

76% of Americans have used an app of their bank in the last 12 months. Most of them are millennials (21–34 years old) and Generation X (35–49 years old).

Also, mobile banking apps are used in most countries. The most tech-savvy market is Asia, with China and South Korea being leaders in digital secure payments usage. Followed by the United States, Denmark, India, and Sweden. Therefore, if you decide to create a mobile banking platform, global opportunities and audiences will open for your startup.

Last but not least, you can target user engagement and create an effective banking app with minimum features. Statistics show that the majority of the customers use such platforms for three reasons. To deposit checks, to transfer money between accounts, and to view statements and current balances. Therefore, if you are considering starting the mobile banking development process, we recommend focusing on these three services.

If you want your mobile banking app to appeal to the widest audience, make sure to implement these features

Can a banking app make money?

The answer is yes! Like regular banks, mobile banking apps charge fees and commissions. For example, a $10 per month service fee, a $25 commission for international transfers, or 3% for exchanging currency. Also, they earn an interest rate for clients’ deposits and investments.

Let’s look at the revenue of some of the big players on the market. In 2021, Brazilian-based app NuBank made $963 million, while Chime ended the year at $600 million. They were followed by Revolut and Tinkoff, earning $361 million and $160 million accordingly.

So, considering the scale of growth, mobile banking development is an appealing industry for both investors and customers.

3 successful examples of banking apps

Before you decide to create a banking app and hire a team of developers, it is worth closely looking at the market leaders and their business models. How they approached banking mobile app development and what makes them stand out. We picked three outstanding banking products from different regions: the United States, Russia, and Germany.

Chime

Chime is an American fintech company that started in 2014 and rapidly became one of the main players in neobank app development. About themselves, the startup says: “Chime is a financial technology company, not a bank.” It is because banking services, mobile payment tools, and debit cards are provided not by Chime directly, but by partners: real banks and fintech corporations.

On the banking app Chime, users can open fee-free debit cards and savings accounts with a couple of clicks. Since services are provided by trusted banks, all accounts have FDIC insurance so the money is safe. For regular users, the mobile banking solution is free — Chime makes money by charging retailers and merchants a small commission for banking transactions.

The banking app quickly became famous because of its user-friendly UI/UX design, straightforward copywriting, and minimalistic set of offered services. Now, it serves as a role model for many mobile banking projects.

Chime grew rapidly. Last year, it reached 13 million active customers, which made it the most popular mobile banking platform in the United States.

Revolut

Revolut is a global neobank that offers an extensive array of financial services. Founded in 2015 in a fintech incubator, it quickly garnered the attention of influential investors and became a unicorn. The company was breaking even by 2020. In 2021, Revolut was rated the UK’s biggest fintech company with a valuation of more than $33 billion.

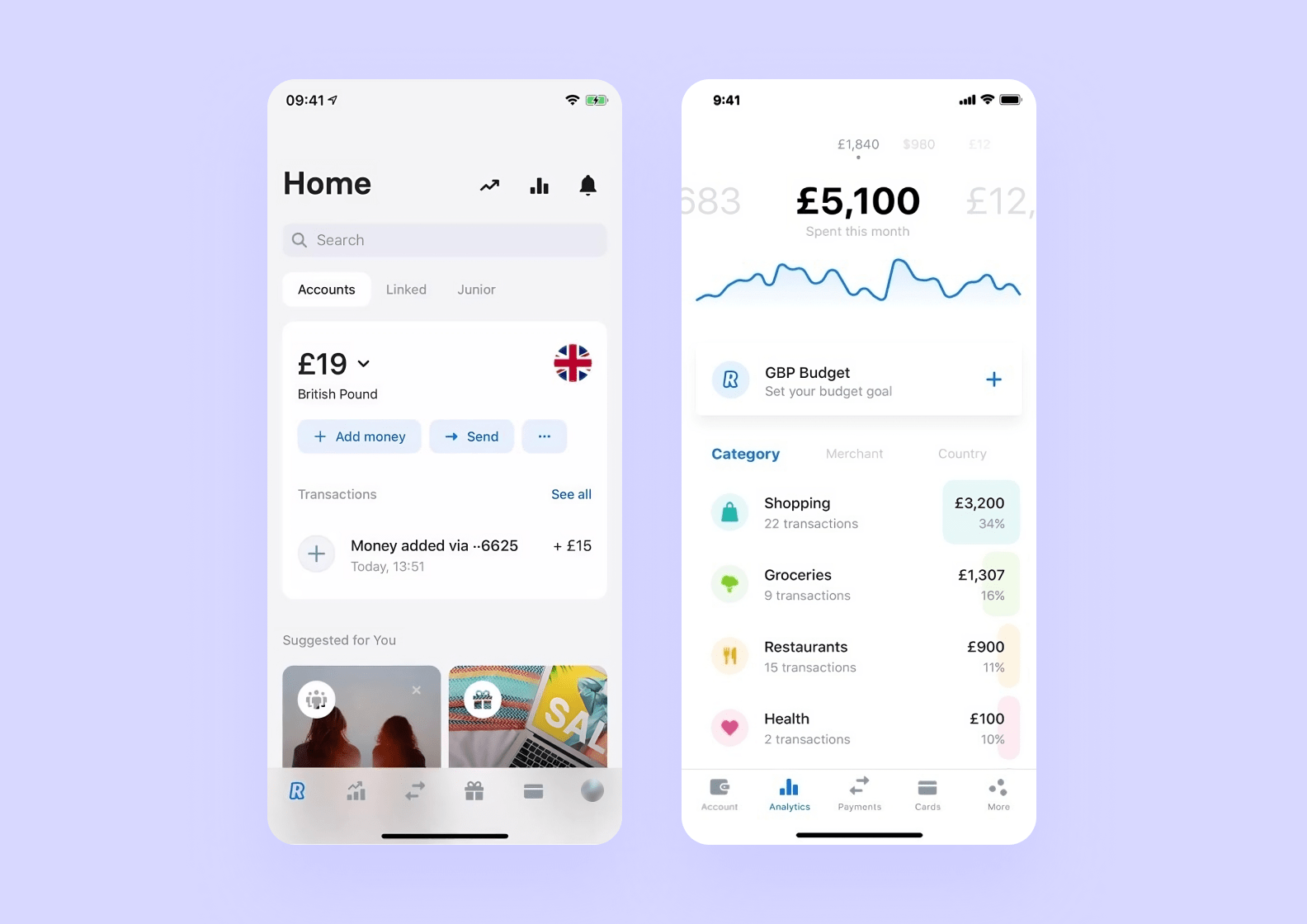

With Revolut, mobile banking users can make international mobile payments, generate virtual cards, invest in the stock market, and use multiple tools for better budget management. The platform also provides access to various cryptocurrencies such as Bitcoin, Ethereum, and Cardana, offering exchanges with 25 fiat currencies.

Revolut operates on a freemium model: users can access all the primary features for free, but the more advanced functionality becomes available only to those who purchase a subscription. There are multiple plans on offer with a list of perks ranging from fancy plastic cards to stock trading privileges.

Featuring an “all-in-one” approach, Revolut offers instant P2P transactions and a plethora of other online banking services

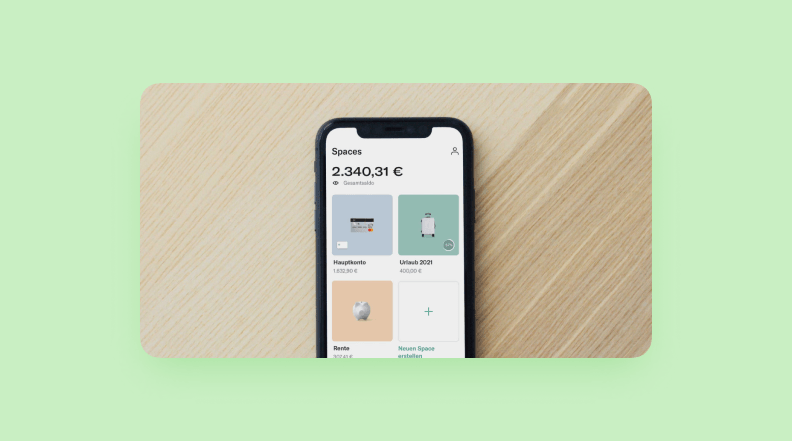

N26

N26 is a banking app based in Berlin, Germany that operates in 24 European countries. Functioning mainly as a wallet app, it provides users with a fee-free debit card to make purchases and transfer money. For a small monthly fee, users can access premium features, including overdrafts and investments. The main advantage of the product is that it is 100% online. A user can do secure mobile banking without having to go to a branch or ever getting letters in the mail.

N26 has quickly become a strong competitor to traditional banks, getting over 7 million users in 2021 and being valued at $9 billion the same year.

The interface has a very clean and simple UI, featuring brand-new typography. With the design, N26 went for a minimalistic, modern typeface for the logo and ample negative space to create a feeling of a luxurious company. N26 took everything to the next level, and we definitely recommend researching them before your own project.

What makes a good mobile banking app?

All popular banking applications on the market have two things in common: a clean look and top-tier security.

📲 Modern and transparent UI/UX design. There is a reason people don’t like traditional banks: everything is slow, old, and complicated. Digital banking changed the game and showed that taking care of your financials can be simple and pleasant. Clean and consistent UI design makes a product easier to use and visually appealing. Also, it contributes to a positive user experience.

🔐 Cybersecurity. When dealing with people’s money, protecting data is a must for good mobile banking app development. Potential leaks and breaches will turn people away from your mobile banking application. Make sure you work with reliable developers who have experience in cybersecurity to make a shielded banking app.

5 must-have mobile banking app features

To make your app stand out among competitors and meet your customer’s needs, you need to think about the key features way in advance before mobile app development even starts. With a convenient user interface, simple navigation, and effective design, your mobile banking software will win over the hearts of your potential users.

In a nutshell, a good mobile banking features list includes these five items:

1. Dashboard with the current balance

The main goal of a dashboard is to quickly and efficiently communicate information. Immediate access to critical data is essential for a positive user experience. For example, the first thing users should see when they enter a mobile banking app is how much money is left in the bank account.

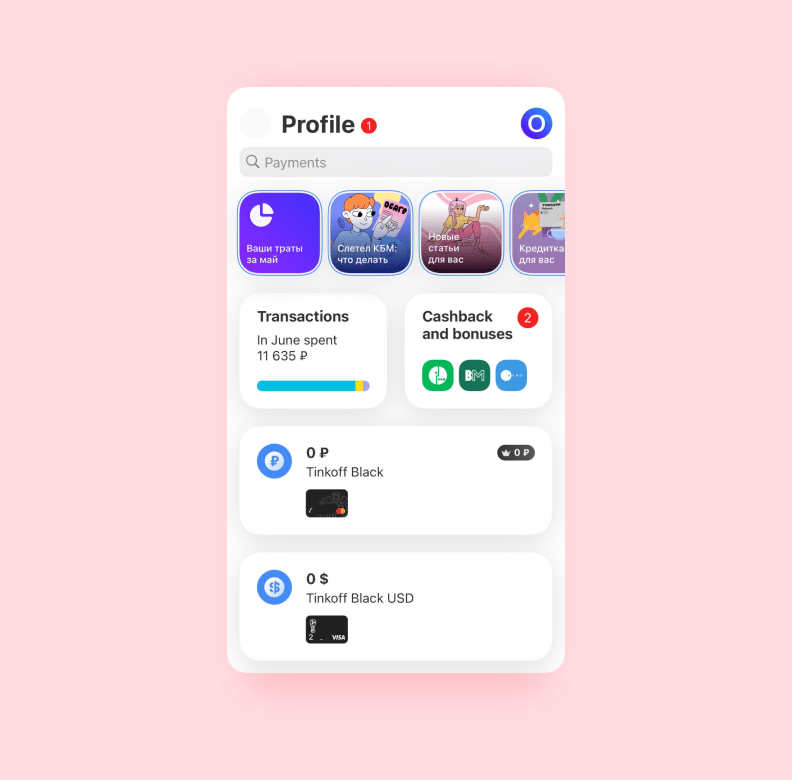

On the main screen, Tinkoff displays current balances, monthly spending, and Stories with useful content.

Сreating a dashboard with a bunch of numbers is not easy. For your banking app, you need to strategically think about the layout, color scheme, important widgets, and interactive elements. Ask your developer in advance if they have experience with dashboards and know best practices for data display.

2. History of transactions

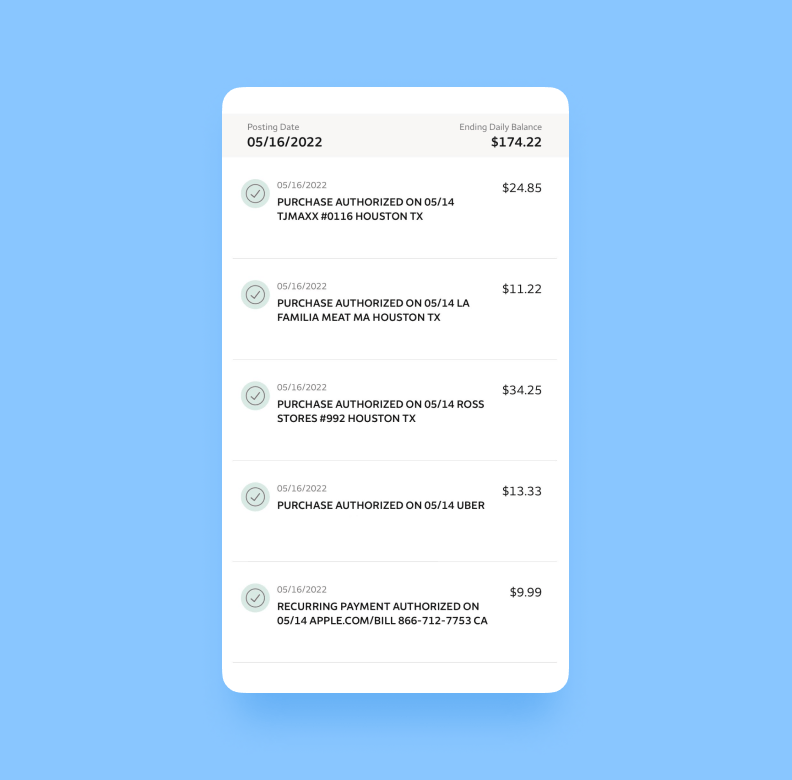

When it comes to money, users demand banking applications to be transparent. They need to know where they spend money and be able to easily find past transactions. Therefore, reviewing details should be effortless and the page has to be easy to navigate around. Don’t overlook previous transactions when you decide on mobile banking app features.

The Wells Fargo bank shows the transactions chronologically, with ending daily balance and details for each date.

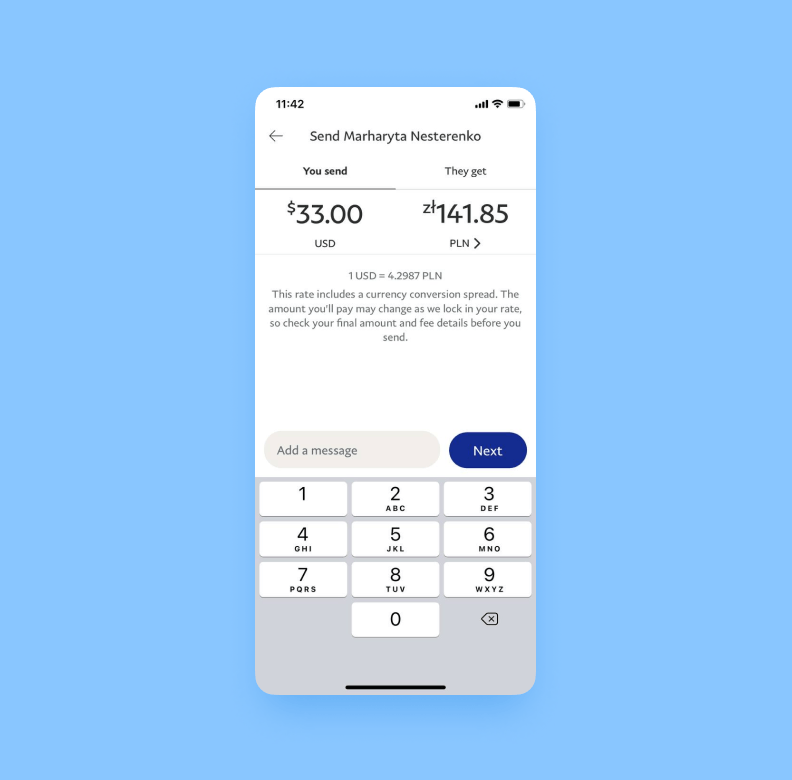

3. Secure payments and transfers

According to statistics, almost a third of all users utilize digital banking for transferring money to their peers (P2P) and paying for bills. Keep in mind this fact during your banking app development. Typically, to send a secure mobile payment within the platform, you need another user’s email address, phone number, or account handle. For wire transfers, users need more details about the recipient, their bank, and their account. You can also set up push notifications to keep the user informed about every transaction.

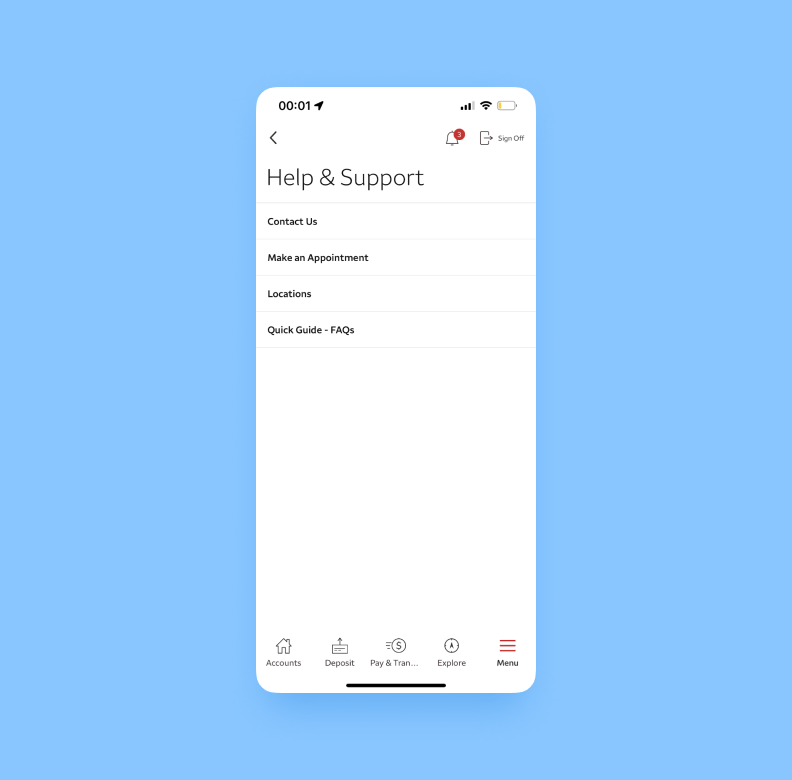

4. Customer support

Most of the financial problems can’t wait. Imagine, you noticed a suspicious payment in your history that you didn’t make. You would probably want to resolve it as soon as possible and make sure no one steals your money while you’re waiting in line to talk to a bank representative.

That’s why providing top-notch and friendly support on a banking app is essential to building trust and making users feel valued and secure. This feature should be carefully planned during mobile banking application development. In addition to FAQ, consider developing an in-app chat support and creating a simple chatbot that can answer basic questions about products.

On the Wells Fargo bank app, users can contact support, read FAQs, or make an appointment at a branch.

5. Two-factor authentication

Two-factor or multi-factor authentication is a technology that helps identify and verify a person entering the mobile banking app. For example, using a password or FaceID with a six-digit code from a text message or email.

2FA in mobile banking apps helps secure accounts and makes it tougher to steal users’ data. That is the reason why most digital banks encourage customers to turn on technology to protect their money. Discuss the best options for your app during the mobile banking application development process.

The most efficient tech stack for mobile banking app development

To create a mobile banking app that will engage users, it’s important to assemble a professional team of financial app developers experienced in both frontend and backend languages. But how do you actually choose which elements to include in the mobile banking app development tech stack? To help you decide, we’ll give you an overview of the best development tools that you can use to build a mobile banking app today.

React Native

A powerful frontend framework is the foundation of any tech stack for mobile banking app development. React Native is an open-source framework that makes it possible to create user-friendly apps for multiple platforms at once.

The main advantage of React Native is its unified codebase, which allows programmers to work on multiple app versions at the same time and reuse code. This feature enables mobile banking app developers to build complex cross-platform apps within a short time, which helps lower development costs. With React Native’s cross-platform functionality, you can save as much as 30% of your development budget. All in all, React Native can be indispensable if you want to quickly launch an MVP without breaking the bank.

NestJS

No mobile banking development project can succeed without a solid backend foundation. After all, to be successful, your banking app will need to process massive amounts of information quickly and efficiently. Powerful backend frameworks such as NestJS are sure to get the job done, as they’re designed to handle complex operations and high user traffic. The main strength of NestJS lies in its ability to process data asynchronously. This feature will allow you to simultaneously create a mobile banking app capable of handling hundreds of user requests simultaneously. All in all, NestJS is a great tool for improving the user experience of your app, making it more accessible and engaging.

NestJS comes with an impressive set of advantages like scalability and modularity that can help you build a mobile banking app

AWS

Building a backend infrastructure for mobile banking development will also require a reliable cloud platform. AWS, or Amazon Web Services, provides a wide range of solutions for building, launching, and maintaining apps and websites. AWS is an all-in-one platform for renting IT services. It allows you to rent virtual servers and take advantage of high-performance computing to create a mobile banking app with high scalability potential. Financial app developers value the AWS platform for its impressive selection of services and high security. It’s an essential component.

PostgreSQL

An effective mobile banking app development tech stack also needs a database that will manage data storage and ensure the security of your app. Mobile banking app developers know how important it is to implement the proper security measures to protect financial data. With PostgreSQL, you can protect your app and reduce the response time of your service through enhanced indexing functionality. This will improve the performance of your app, making your product more engaging. Due to the ability of PostgreSQL to handle massive amounts of data, it’s considered one of the best databases for building complex and resource-intensive apps.

Now that we’ve talked about each development tool, here’s a quick summary of our mobile banking tech stack:

| Frontend | Backend | Cloud services | Database |

| React Native

A cross-platform powerhouse |

NestJS

A foundation for the infrastructure of your app |

AWS

A cloud platform for building scalable apps |

PostgreSQL

A database that will manage and protect your data |

How to choose a developer for a mobile banking app?

If you decide to enter a fintech market and conquer mobile banking development, employing reliable and experienced banking app developers is a must.

And, of course, it’s always better to stick with developers who have worked on relevant projects in mobile banking

At Purrweb, we had experience with both cross-platform and native app development, creating the cryptocurrency e-wallet with a complex dashboard and widgets. We know how to build and maintain a secure mobile banking app.

⬇️ If you are interested to learn more about our services and products we created, check out our case study for crypto e-wallet Broex. Read about how we chose the right design style and made a custom currency selector.

Developing an online banking application: a step-by-step guide

We believe that the best approach to bringing a new concept to life is to first create a minimum viable product (MVP). An MVP is a bare-bone version of an app designed to showcase its main functionality.

MVP development is perfect for gauging the market, testing the viability of your idea, and raising some funds — a fully-functioning product is much more convincing than a bunch of promises and pretty pictures.

In other words, it’s a perfect fit for any startup, and this is exactly what we start with here at Purrweb. Let’s break down the whole development process into six steps.

Step 1. Analyze the market

Understanding your niche is the key to creating a successful product — so it’s better to start off with market research. Learn about the target audience’s expectations, carefully analyze competitors, and pinpoint the most relevant trends in the field. This information will help you better shape the product.

Step 2. Define the features of your product

Using the results of the market research, choose what functionality you want to implement. Although it can be very tempting, don’t just aim to copy the most in-demand features that are popping up in the banking industry — think about how you can make your app stand out from the competition. In other words, select a unique selling point (USP, a.k.a “killer feature”).

Step 3. Devise the UI/UX design

Start with the logic of the app. You need to come up with a smooth user journey that will gently guide your customers through the sales funnel, and make them eager to return. Once you have that, it’s time to start making things pretty: choose colors and fonts, create icons and illustrations, design UI components, animate stuff, and devise a styleguide to make sure that everything stays consistent in the future.

Step 4. Write the code and launch the first version

Having a proper codebase is crucial, especially when you deal with third-party finances on a daily basis. In this segment, bugs can lead to major reputational damage and hefty fines imposed by the court, so make sure that only professional developers take part in the mobile banking software development process. Testing is also absolutely essential, especially before launch.

Step 5. Release updates

Once the first user feedback starts to flow in, you enter the app support loop. Add other features from the backlog, scale, and simply bring your app to perfection, all the while maintaining proper communication channels with your target audience.

Costs & timeline of developing a mobile banking application

How much does cross-platform app development cost for a banking app? Let’s break down the services and the numbers for a similar project.

🚨Disclaimer: This is our estimation for mobile banking application development. We don’t guarantee other companies have the exact costs or timelines. The following quote is valid only if you decide to develop a product with us.

| Stage | What are we doing | Estimation in hours | Estimation in weeks | Approximate costs |

| Initial meeting | Discuss the idea of your app | 1 day | – | No costs |

| UI/UX design | Map users’ journey, create and present you interface mock-ups | 170 hours | 5 weeks | 7 650$ |

| Development | Work on mobile banking application development | 1400 | 16 weeks | 63 000$ |

| QA Testing | Find and fix bugs | 480 | Alongside the development | 9 600$ |

| Project management | Manage the mobile app development project and solve administrative tasks | – | Alongside the UI/UX design and development | 6 500$ |

Overall, the mobile banking app development services will cost you $86 750 and will take approximately four months.

Factors that affect the cost of development

The final cost depends on six parameters: app complexity, design complexity, the number of staff on the team, means of contracting, the team’s location, and the number of supported platforms. Let’s look at each of them in detail:

The number & complexity of the features

As the number of features increases, developers need more time and resources to design, develop, test, and integrate each component. This leads to higher development costs. The same logic applies to more advanced features that demand longer development cycles and the use of special skills.

The complexity of the design

If you don’t have to settle for a minimalistic mobile banking app design, you can always add unique illustrations, sprinkle the screens with neat animations, and create an intricate color scheme — but this will increase the final cost quite a bit.

The number of staff on the team

The math is really straightforward here: the more banking app developers work for you, the more costly the banking app development process will be. Large teams, however, implement projects much faster, and this can make a huge difference in some situations.

Means of contracting

There are three options available for fintech software development: in-house, freelance, and outsourced. In-house teams of banking app developers offer high flexibility in exchange for additional expenditures such as bonuses and social benefits. With freelance and outsourcing, on the other hand, you only pay for the development and nothing else.

Geography

Geography plays a huge role in determining the team’s hourly rates. Agencies based in the US, Canada, and Western Europe are usually more expensive to hire than their colleagues in Latin America, Eastern Europe, and most of Asia.

Supported platforms

If you want to create a modern banking app that supports both Android and iOS, you basically have to create two separate apps, which means more man-hours. This, in turn, means more money. On the other hand, you can stick with cross-platform development frameworks like React Native to cut some costs.

Wrapping up

Overall, developing a mobile app for banking services is ripe with opportunities for growth and success. However, newcomers to the market can face challenges with meeting the security standards of the field and choosing the right features.

To make sure your mobile banking app will meet customers’ needs and keep their data protected, we advise startup owners to choose experienced developers who have executed similar fintech projects before.

At Purrweb, we work with cross-platform and native app development to provide your users with a seamless and hassle-free digital banking experience.